As I keep emphasizing, the AI revolution is still in the early stages. And it’s barely in the 1st or 2nd inning for healthcare. So the upside potential is massive.

Previously, we’ve noted that:

- Big pharma is teaming up with companies like NVIDIA for everything from drug development to trial modeling and more.

- Machine learning using AI is proving to be as good if not better than physicians at reading/ diagnosing patients based on data or images (X-rays, MRIs, CT scans).

- AI is being used to map individual genomes to allow for truly tailored care for patients.

Despite the potential here, adoption is slow going: the Elsevier’s Clinician of the Future survey for 2025 noted that less than one in three (32%) of clinicians feel their organizations provided adequate access to AI tools and technologies. And only 16% of them are currently using AI to make clinical decisions!

16%. Less than one in five.

Moreover, patients are proving reticent to trust AI with healthcare decisions. Research by theUniversity of Michigan’s Institute for Healthcare Policy and Innovation found that only 4% of patients have “a lot of trust” in AI-generated information while nearly HALF (47%) have “little to no trust” in it!

So, we have doctors who want to use AI, but don’t have access to it… and patients who don’t trust AI and believe the information it presents isn’t accurate. This is to be expected with new technology. If less than one in five clinicians are even using AI, how on earth can you expect patients to trust it or be familiar with it in a medical setting?!?!

So again, AI adoption in healthcare is in the VERY early stages. But this is where THE BIG money will be made in the coming months and years. AI healthcare spending will grow from $26 billion to over $187 billion in the next five years alone. And frankly I believe these forecasts are underestimating the true scale of demand.

Consider…

The US population over the age of 65 now accounts for 17% of the total US population. In 1920, it was only 5%. Total US healthcare spending is expected to hit $8.6 TRILLION by 2033, up from $5.6 trillion today. At that point healthcare spending will account for 20% of US GDP.

This massive demand is running into shortages. TheElsevier survey mentioned earlier notes that nearly one in three (28%) of clinicians already say they did not have enough time to deliver quality care to each patient!

This is only going to get worse.

The American Hospital Association estimates that the industry will face a shortage of up to 124,000 physicians by 2033, and it will need to hire at least 200,000 nurses a year to meet rising demands.

AI can fix this, but to do it will need widespread adoption… Which means AI healthcare companies making a LOT of money in the future. But as usual, Wall Street is ignoring the potential here.

Healthcare as an investment has been declared DEAD. While the S&P 500 index and NASDAQ have hit all-time highs, the healthcare ETF peaked in 2024 and is effectively in a bear market, down 19% from its peak.

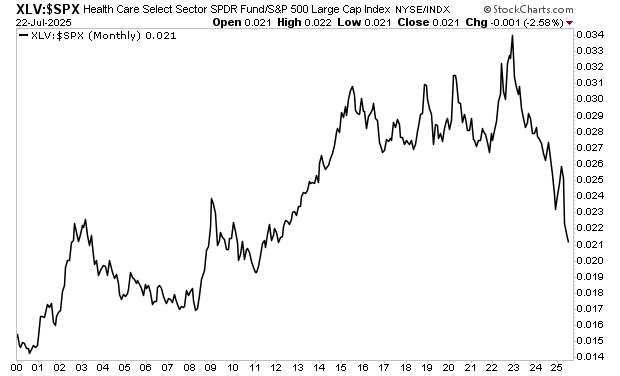

Indeed, the ratio of the healthcare ETF to the overall index (XLV: $SPX) is at trading at levels last seen in 2009! This entire sector of the market has been left for dead.

So, we have growing demand, supply shortages, and an entire sector that has been left for dead… with a revolutionary technology that is in the very early stages of adoption.

This is when BIG money can be made.

So, if you feel you’ve missed out on AI as an investment, you’re very much mistaken. There is tremendous potential (and profits) here. Even a handful of AI-related healthcare plays could generate major returns in the next three to five years.

On that note, we have published a special investment report The AI Plays Your Broker Doesn’t Know About detailing three unique investments designed to profit from the ongoing revolution in AI. Best of all, Wall Street has little to no idea these companies even exist, let alone their potential.

We are making just 99 copies available to the general public. To pick up yours…

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research