As I keep warning, the global economy is rapidly moving into a recession.

If you don’t believe me, consider that in the last two weeks, the following have been announced…

1) South Korean exports, a critical measure for global growth, recorded a -1.2% drop year over year in December.

2) China’s manufacturing PMI fell into outright contraction below 50. Car sales were negative for the first time in two decades. And Chinese exports fell 4.4% year over year.

3) German Industrial Production fell 1.9% month over month and 4.6% year over year in November: the biggest drop since 2009. Real-time GDP trackers show the largest EU economy is already in a recession.

4) US manufacturing ISM dropped sharply from 59% to 54% (not yet in contraction mode, but rapidly approaching it).

To top if off, we now have numerous companies issuing warnings: Apple, Samsung, LG, Fed Ex, Delta, Skyworks, Tailored Brand, Sherwin-Williams, Lindt, Macy’s, Kohl’s, and American Airlines have all lowered forward guidance.

So we’ve got everything from airlines to big tech to chocolate producers and paint manufacturers warning of a slowdown.

This is the slowdown that stocks began to discount in October.

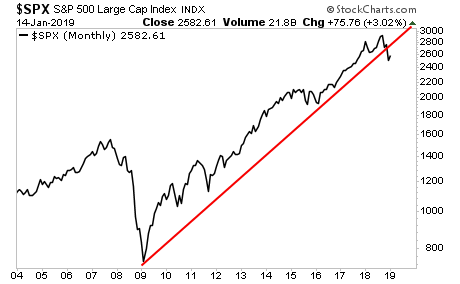

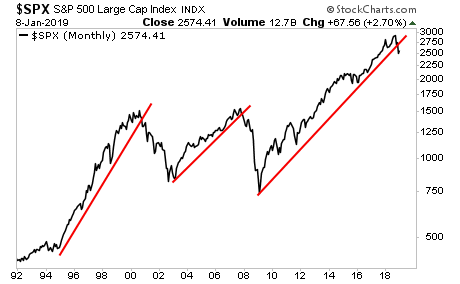

Unfortunately it’s not over either. If you look at the long-term charts, it’s clear the market realizes that the credit cycle has turned and we are moving into a recession/ crisis.

The last two times this happened, a crisis hit within three to six months.

A Crash is coming… and 99% of investors will panic when it hits… but not those who have downloaded our 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on last week’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research