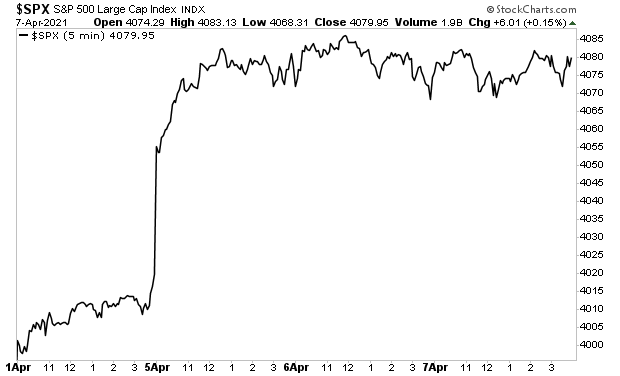

On a day-to-day basis, the market is chopping.

Indeed, the S&P 500 made a large jump over the weekend, but has effectively chopped in a 10 point range ever since.

However, despite the day-to-day gyrations, the BIG PICTURE framework remains the same.

THE FED WANTS INFLATION.

We’ve been tracking the idiotic statements various Fed officials have made concerning inflation in the last few weeks. This week Chicago President Charles Evans made the following jaw-dropping statements.

- It will take some time for price pressures to sustainably hit the central bank’s 2% target.

- The Fed only needs to be concerned if there’s bothersome inflation.

- Inflation up to 2.5% or even 3% would be welcome.

Let’s be clear here, inflation is already well over 2%. I know this. You know this. And I guarantee the Fed knows this.

So, what are these Fed officials yapping about?

The fact is that the Fed is terrified of debt deflation.

You’ve probably heard the word “deflation” mentioned at some point by financial pundits on business TV. Usually, it’s referred to in hushed tones as though it were some kind of unspeakable evil.

This is completely bogus.

Deflation is the process by which something falls in price. It is a perfectly normal development for a healthy economy. In fact, deflation is actually an intrinsic part of technological advancement (for instance, the cell phone you own today is both more sophisticated and cheaper than the original models from a decade ago).

DEBT deflation, on the other hand, is a completely different issue. And it absolutely terrifies Central Bankers like those running the Federal Reserve.

Debt deflation is when the value of a bond begins to drop aggressively, making it more expensive to service (as bond prices FALL, bond yields RISE, making debt payments greater).

With the U.S. sporting a Debt to GDP ratio north of 130%, and on track to add another $3-$5 trillion in debt this year, debt deflation would trigger a systemic crisis worse than 2008.

So, the Fed needs to look for any excuse to continue intervening in the bond markets. And it is clear based on the statements coming out of the Fed, that it has decided that its “inflation target of 2%” is the excuse.

Basically, the Fed is going to continue printing money and buying bonds non-stop until its arbitrary inflation measures (the CPI, which the Fed KNOWS doesn’t accurately measure inflation) hits 2%.

Then as soon as it finally hits 2%, the Fed will say it actually wants inflation to be 2.5%. And when it hits 2.5%, the Fed will say it wants inflation at 3%.

You get the general idea.

The Fed is effectively making up some fantasy “goal” that allows it to print money from now on.

This is the BIG PICTURE for the financial system. And it’s going to result in some of the most spectacular investment opportunities we’ve seen in decades.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

Today is the last day this report will be available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research