By Graham Summers, MBA

All eyes are on the Fed today.

Thus far the bond market doesn’t believe the Fed is serious about tackling inflation. Why would it? The Fed printed another $55 billion after its QE program supposedly ended… and has only raised rates by 0.25%.

Meanwhile inflation is clocking in at 8.5%.

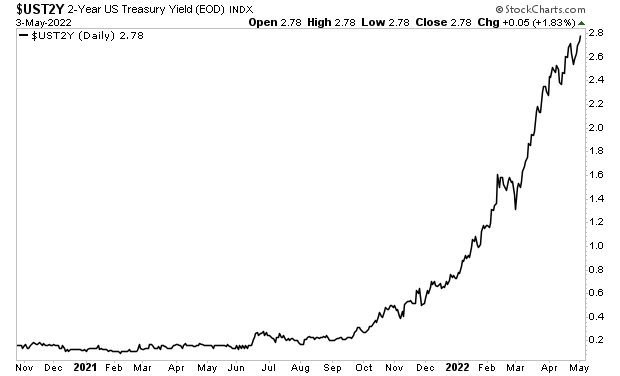

This is why the yield on the 2-year Treasury continues to move higher… the bond market is telling the Fed that it (the Fed) hasn’t done enough. Put another way, the bond market doesn’t think the Fed’s current plan to tackle inflation is credible.

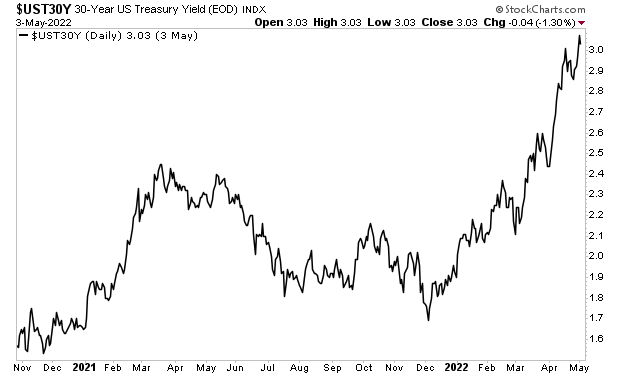

The 30-year Treasury is even more important than the 2-year. This is because bonds of longer duration do a better job of indicating what long-term implications of Fed incompetence.

Put simply, this yield NEEDS to stabilize, otherwise the Fed risks losing control and we enter a bond crisis shortly.

Again, all eyes are on the Fed today. Either the Fed’s strategy is credible and things stabilize… or it’s crisis time. And if it’s crisis time… buckle up, because this current bubble is even larger than the Housing Bubble.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html