By Graham Summers, MBA

Many investors have been getting crushed by the collapse in the inflation trade.

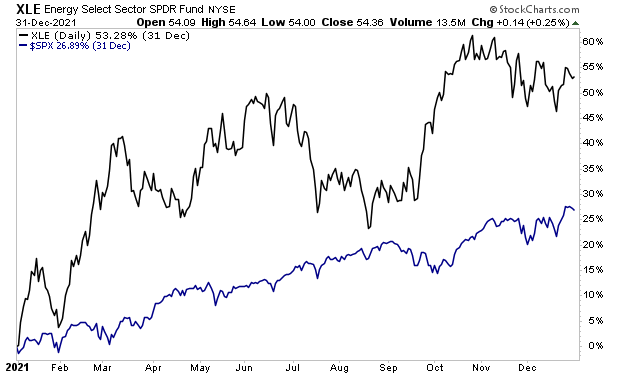

By quick way of review, throughout 2021 and the first quarter of 2022, inflation-based investments dramatically outperformed the broader market. In particular, Energy stocks (XLE) produced outsized gains, more than doubling the performance of the S&P 500 in 2021.

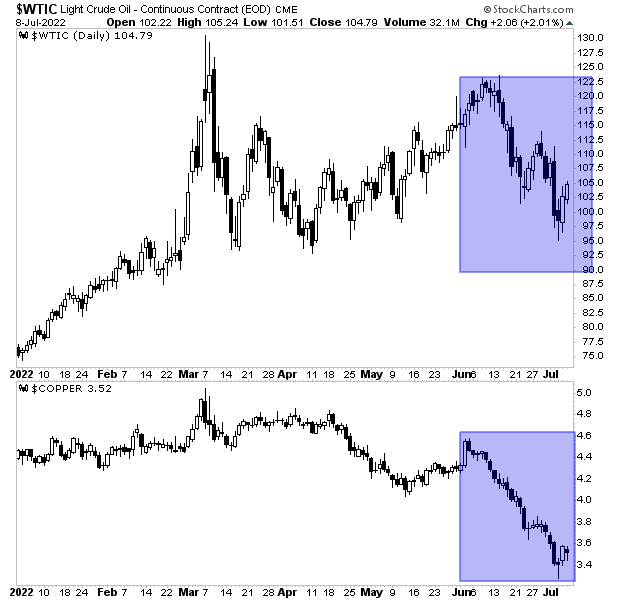

This all changed in June of this year. From that point onward inflation plays like oil, copper and the like have been collapsing. Oil fell 20% peak to trough. Copper is down 30%. Note the blue rectangles in the chart below.

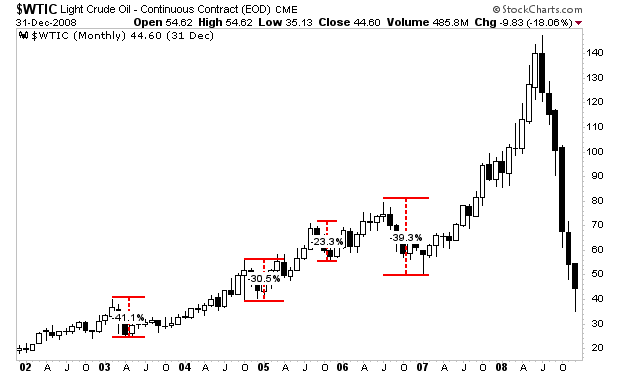

Is the inflation trade over? Not necessarily. Commodities are an extremely volatile asset class: corrections of 20%, 30%, or even 40% are common during major bull markets in commodities.

Case in point, during the last big commodities run from 2002-mid-2008, oil had numerous corrections of 20%-40% before the final blow off top.

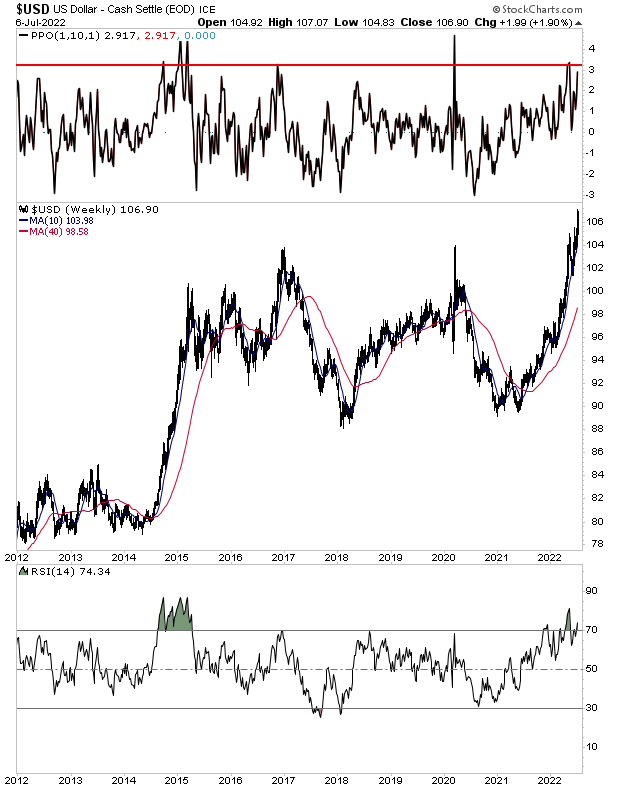

Again, the commodity space is at a critical juncture today. The volatility of the last few weeks is actually quite normal for the space. And the key for determining when the next leg up begins is the $USD.

The $USD has been on a tear as the world is hungry for dollars. Whenever this rally ends and the greenback rolls over again, the commodity space will catch a bid.

As I write this, the greenback’s Relative Strength Index (RSI, located in the bottom box) is overbought. Moreover, the $USD is trading 3% above its 10-week moving average which is also the same as the 50-DMA (see the top box).

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research