By Graham Summers, MBA

Friday’s data just obliterated any hope of the Fed stopping its rate hikes.

In case you missed it, on Friday the Institute for Supply Management (ISM) reported that its non-manufacturing PMI hit 55 in January 2023. This is a HUGE deal as the same data point was 49 in December 2022.

Anything below 50 is considered to indicate an economic contraction. So the fact we saw this sharp rebound indicates the economy is still going strong. And this, combined with the fact that the economy added over 500,000 jobs last month, tells us that the Fed has a LOT more room to raise rates going forward.

So if you were betting on a soft landing… or the Fed stopping its rate hikes and cutting rates later this year, you’re in for a rude surprise.

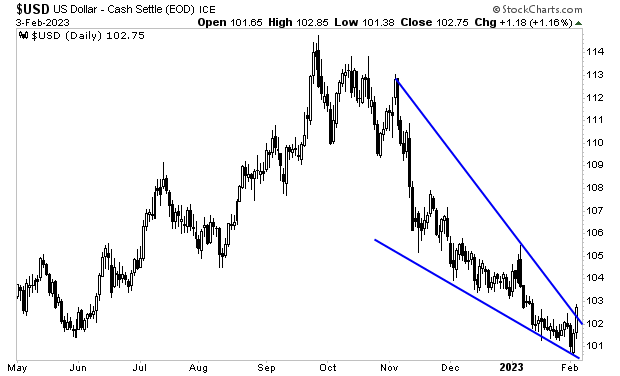

The $USD figured out what’s coming last week. But as usual, stocks are last to “get it.”

In simple terms, the markets are setting up to deal out a load of pain to stock market bulls in the coming weeks.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.Paragraph

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.Paragraph

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html