By Graham Summers, MBA

The Fed has now made what would be its second “career ending” mistake if it operated in the real world.

The first such mistake concerned its ludicrous claim that inflation was “transitory” throughout 2021- 2022. Anyone who bothered doing any real research knew that argument was total nonsense… yet somehow the Fed with its 400 researchers and analysts failed to get it right.

In the real world, someone in a major position (Fed Chair or multiple Fed Presidents) would have been fired for this degree of incompetence. But we’re talking about the Fed here… which exists in some fantasy land in which you can blow up the financial system/ economy and still keep your job.

Which brings us to the Fed’s second “career ending” level mistake… believing that inflation was under control because some highly manipulated data suggested it was.

In December, the official inflation measure, the Consumer Price Index (CPI) recorded a month over month pace of -0.1%. Since October had been 04% and November had been 0.2%, the Fed took this to mean that “disinflation” had arrived. Fed Chair Powell used that word close to a dozen times during the Fed’s February press conference.

The only problem with this was that the CPI is a notoriously AWFUL measure of inflation… and is prone to multiple revisions. I knew that. Most analysts knew it. It is truly staggering that the Fed would NOT know it. And yet, that seems to be the case as the Fed fell for this nonsense and began slowing the speed of its rate hikes down to 0.25% in early 2023.

December’s CPI has since been revised to 0.1%. November and October’s were also revised higher. And January’s clocked in at 0.5% month over month. That’s inflation of 6% on an annualized basis.

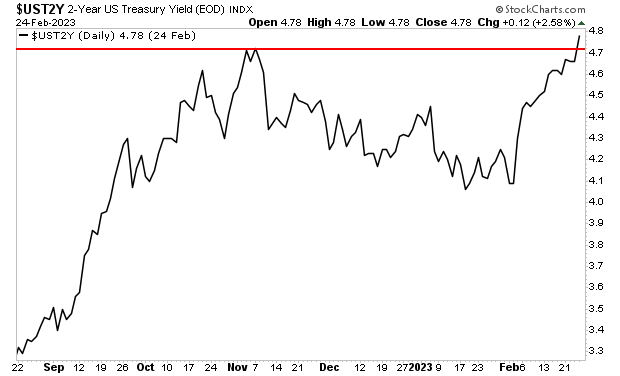

Bonds have woken up to the fact the Fed has lost the plot. The yield on the 2-Year U.S. Treasury has erupted higher taking out its former highs with ease. The Fed will very likely be forced to INCREASE the pace of its rate hikes to 0.5% or even higher in the coming months.

This is the kind of environment in which crashes can happen. The Fed is rapidly losing credibility. And investors have been suckered into believing the “worst” is behind them: they poured $1.5 billion into stocks every day in January. And they did this at a time when my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we have published an exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth.

This report is usually $250, but we’re giving away 100 copies for FREE to those who sign up for our free daily market commentary.

To pick up one of the remaining copies, use the link below…

https://phoenixcapitalmarketing.com/BM2.html