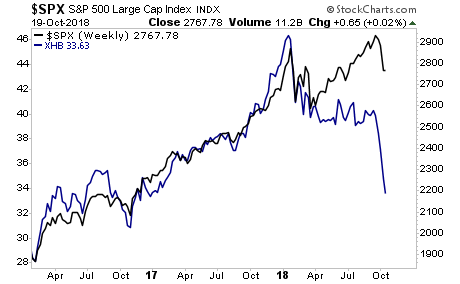

For those who think the Fed is going to “save stocks” think again.

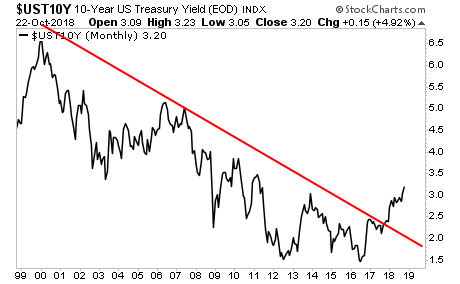

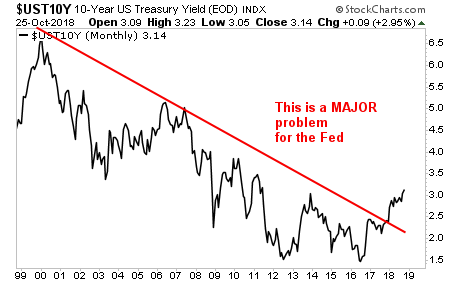

As I repeatedly have warned throughout 2018, the Fed is FAR more concerned about BONDS, than stocks.

When stocks collapse, investors lose money.

When bonds collapse, entire countries go broke.

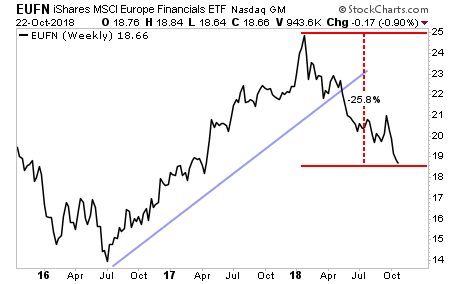

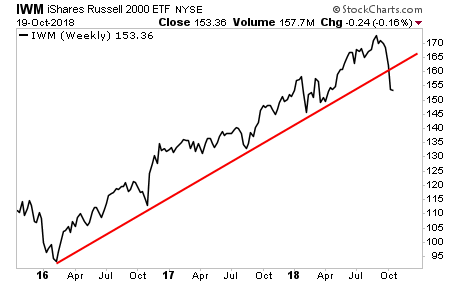

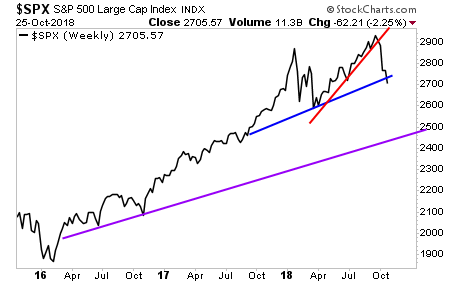

With that in mind, once the US bond market began to collapse, pushing yields above their long-term trendline, it became apparent that the Fed would “sacrifice stocks to save bonds.”

————————————————-

THE CRISIS TRADER turns Crises into HUGE Returns

Back in 2015 I sensed that the financial system was moving towards a multi-year period of increased volatility.

I custom designed an options trading system to profit from it.

It’s called The Crisis Trader and since inception in 2015, it’s produced average annual gains of 41%.

And that’s BEFORE the crisis even hit!

However, I cannot maintain these returns with thousands of traders follwing these trades.

With that in mind, we are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

The reason? Letting stocks collapse will force capital into bonds, thereby forcing yields lower.

That process is now officially underway. And if you think the Fed is close to “stepping in” you’re mistaken. Cleveland Fed President Helen Mester just told CNBC this morning that “the stock market drop is FAR from hurting the US economy.”

This ties in with Fed Chair Jerome Powell’s assertion during a recent Q&A session that the Fed would not step in to prop up the stock market unless it was a sustained collapse that was bad enough to impact the REAL economy, specifically consumer spending.

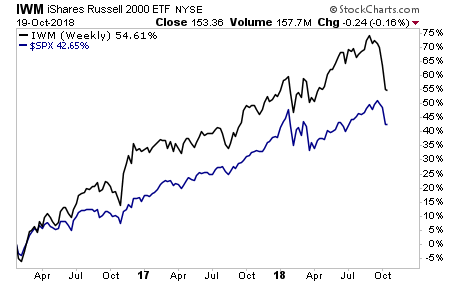

In simple terms… the Fed’s not coming to the rescue this time. And stocks are going to have to drop a LOT further before it does.

Those who prepare to profit from this in advance stand to make literal FORTUNES. Over 99% of traders think the Fed is going to save the day.

It’s not.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

We are giving away just 100 copies for FREE to the public.

Today there are just a handful left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research