Yesterday’s note caught a lot of attention.

In it, we argued that investing in stocks today based on the Fed getting dovish is like buying stocks after the Bear Stearns deal: you’re buying based on a development that reveals the financial system is in serious trouble.

Remember, the Fed didn’t become dovish for no reason… it because dovish because it sees systemic risk on the horizon.

Corporate America is perched atop a debt bomb of $10 trillion, of which roughly 1/3rd is junk… meaning unlikely to be paid back.

Rather than issuing debt to build factories or expand operations, these companies have been issuing debt to buy back shares, resulting in the system being MORE leveraged today than it was in 2007.

Over $700 billion of this debt comes due this year… at a time when 60% of US companies already have NEGATIVE cash flow.

Put another way, the debt is coming due at a time when most companies don’t have the money to pay it back.

Outside of the US, Europe is teetering on the brink of recession, with the latest industrial production numbers showing a year over year decline of 4.2%. This is the largest collapse since 2009, at the depth of the Great Financial Crisis.

Then there’s China, where despite claims to the contrary, the entire system is collapsing. The Central Bank of China just engaged in the largest liquidity pump of all time last month… meaning it spent MORE money propping up the system in January 2019 than it did at any point in 2008.

If things are fine in China, why is it doing this?

Again, structurally the global financial system is in SERIOUS trouble. Buying stocks today based on the idea that the Fed is not as hawkish as before is like buying stocks because of the Bear Stearns deal.

And deep down, the market knows it.

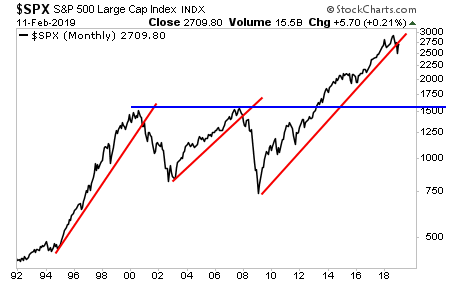

A Crash is coming…

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research