Find Out Which Stocks We Bought Yesterday

Stocks sold off violently yesterday morning.

There were three primary reasons for this. By quick way of review, those reasons were:

Reason #1: There was a brief “tariff war” between the United States and Colombia. The issue was resolved rapidly, but it introduced a degree of policy uncertainty and/ or fears of tariffs being introduced in a flippant fashion. The markets don’t like uncertainty.

Reason #2 : A Chinese company Deep Seek, claimed it has created an artificial intelligence (AI) software that is as good, if not better than comparable technology in the U.S. for a fraction of the cost. However, this information has been public since November, so it’s not clear why the markets would suddenly care now as opposed to any other point in the last two months.

Reason #3: Japan’s central bank, the Bank of Japan (BoJ), raised rated for the third time since 2007, thereby blowing up its carry trade (again).

Japan’s currency, the Yen, funds a massive carry trade (a process through which investors borrow in one currency with a low interest rate to invest in higher returning assets). To “cover” a carry trade, an investor needs to sell the higher returning asset (in this case, stocks) and return the borrowed money.

Of the above issues, #3 is the most important one for risk assets. Indeed, a similar situation unfolded in August 2024 when the BoJ raised rates and stocks sold off aggressively, plunging 9% in the span of two weeks.

It’s worth noting that stocks bounced back from that situation rapidly, undoing ALL of the losses in a little over a week.

We expect a similar snapback rally this time around as well.

Remember, fundamentally nothing has changed in the macro environment. The economy is growing. The Fed is easing. And the President of the U.S., Donald Trump, is a stock market cheerleader. The big picture hasn’t changed for stocks. What has changed is a higher degree of uncertainty has appeared in the markets.

At Phoenix Capital Research, we view this correction as an opportunity, NOT the start of a market crash or bear market.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

This is the ONLY Thing You Need to Read About This Morning’s Bloodbath

By Graham Summers, MBA | Chief Market Strategist

Stocks are selling off violently this morning.

You should NOT be alarmed by this. There are three primary reasons for this sell-off is occurring. None of them are true “game changers” indicating that the bull market in stocks is over.

Those three reasons are:

Reason #1: There was a brief “tariff war” between the United States and Colombia over the latter initially refusing to accept planes returning illegal immigrants from the former.

Despite this issue being resolved rapidly (Colombia buckled), this situation introduced a degree of policy uncertainty and/ or fears of tariffs being introduced in a flippant fashion. The markets don’t like uncertainty, especially for policies that can hurt global trade or the economy.

Reason #2: Japan’s central bank, the Bank of Japan (BoJ), has raised rated for the third time since 2007.

Japan’s currency, the Yen, funds a massive carry trade (a process through which investors borrow in one currency with a low interest rate to invest in higher returning assets). The BoJ raising rates threatens this carry trade which is believed to be worth tens if not hundreds of billions of dollars in size.

To “cover” a carry trade, an investor needs to sell the higher returning asset (in this case, stocks) and return the borrowed money. A similar situation unfolded in August 2024 when the BoJ raised rates and stocks sold off aggressively.

Reason #3 : A Chinese company Deep Seek, claims it has created an artificial intelligence (AI) software that is as good, if not better than comparable technology in the U.S.. The significance of this development is that Deep Seek claims it was able to do this for a fraction of the cost.

This claim is absurd, but the markets appear to be taking it seriously with shared of the tech firms involved in the A.I. buildout in the U.S. (Nvidia, Meta, Apple, etc.) down 5% or more this morning. Here again, this issue introduces uncertainty (in this case uncertainty as to whether U.S. tech firms are overspending on their AI buildouts) and the markets don’t like uncertainty.

As a result of these issues, the markets are a sea of red today, with the S&P 500 down 2.3% and the tech-centric NASDAQ down 4%.

The reality is that none of the above issues is likely to end the bull market in stocks. However, combined, they are creating a volatile situation that appears to have “come out of nowhere.”

Do NOT panic.

Corrections of 5% or even 10% are a regular feature of bull markets. The fact that the S&P 500 managed to pass through 2024 without single 10% correction does NOT mean that we’ve entered a new period for stocks that is without downside risk

So where will this drop end?

The S&P 500 left three separate gaps during its sharp 300-point rally that occurred over the course of just five trading sessions during the week of January 13th. It would not be unusual for at least one if not two of these to be “filled” during a back-test of this recent rally.

Why are we not panicking?

The macro picture for stocks has not changed. The economy is growing. The Fed is easing. And the President of the U.S., Donald Trump, is a stock market cheerleader. The big picture hasn’t changed for stocks. What has changed is a higher degree of uncertainty has appeared in the markets.

At Phoenix Capital Research, we view this correction as an opportunity, NOT the start of a market crash or bear market.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Get Ready For New All Time Highs

By Graham Summers, MBA | Chief Market Strategist

Yesterday I shared a chart that helped us to determine that the S&P 500’s correction was a “buy the dip” opportunity, NOT the start of a serious correction/ bear market.

By quick way of review…

1) The chart showed the percentage of S&P 500 companies trading above their 50-day simple moving average (DSMA). This is a GREAT tool for tracking where the market is trading relative to its prior trend.

2) Prior to last week’s rally, the reading on this chart had fallen to ~15%.

3) A reading this low is typically associated with significant market bottoms. Indeed, the only times the reading has fallen lower during the last five years was during the pandemic crash or the major bottoms of the 2022 bear market.

You can review the chart below.

I sincerely hope all of you bought the dip. If you did, you’ve made a significant return on your trade as the S&P 500 has ripped higher by 280 points in the span of a single week.

Our research indicates this move is just getting started.

High yield credit typically leads the stock market. The reason for this is that high yield credit investors are typically more sophisticated/ sensitive to macro changes for the simple reason that they are investing in bonds that have a high probability of default. As a result of this, high yield credit can give clues as to where stocks will be heading.

The short answer today is “UP, A LOT.”

The high yield credit ETF (HYG) is back at its all-time highs. This strongly suggests stocks will be moving sharply higher from here.

Ultimately, it all comes down to this: as investors, our goal is MAKING MONEY.

To do that, you NEED to know when to “buy the dip” and when to get out of stocks to avoid bear markets. And the best way to do that is to use real quantifiable tools, not opinions, that tell you when to get out to the markets.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Get Ready For New All Time Highs

By Graham Summers, MBA | Chief Market Strategist

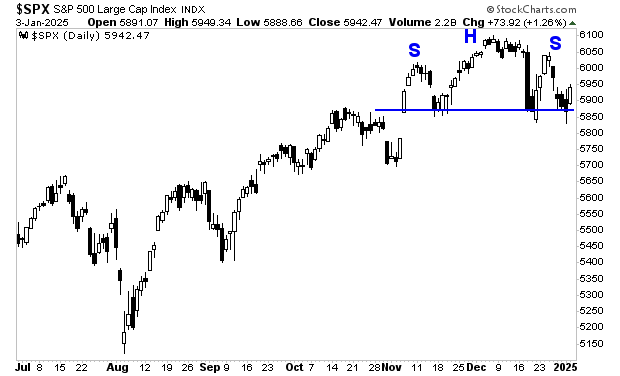

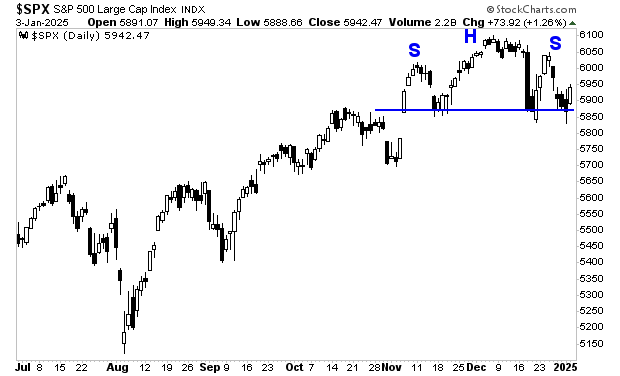

Yesterday, I noted that the S&P 500 has a clear Head and Shoulders pattern. As a result of this, the bears were convinced that a top was in.

Unfortunately for them, investing is rarely easy or obvious. And everyone and their mother saw that pattern forming. Thus, the odds of it actually working out in their favor were slim.

Sure enough, stocks exploded higher yesterday. And by the look of things, the S&P 500 will retest its former highs if not establish new all-time highs shortly.

High yield credit typically leads stocks. It is roaring higher after putting in a series of higher highs and higher lows. Based on this alone, the S&P 500 should be over 6,000 already.

Indeed, Senior Loans, which also lead equities are already at new all-time highs. This is NOT bearish. If anything it indicates the financial system is in an aggressive risk on framework.

Put simply, the pullback of the last two weeks was a MAJOR “buy the dip” opportunity. We had our clients ready to profit from it with specific downside targets at which to buy multiple new trades.

Come join us!

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Three Areas That Are EXPLODING Higher in the Markets

By Graham Summers, MBA | Chief Market Strategist

Ignore the doomers, there is ALWAYS a profit to be made somewhere.

Because of a 5% drop in the last two weeks, the overall stock market, as measured by the S&P 500, is effectively flat since election night. Put another way, stocks have gone nowhere for two months straight. Worse still, the S&P 500 is clearly forming a Head and Shoulders topping pattern.

Seeing this, the doom cloud is proclaiming that the market is forming THE top for this bull market begun in 2022. Perhaps this is true. I doubt it. None of my proprietary market timing tools are registering that this is THE top or even a major top.

Moreover, in investing, the REAL money isn’t made in timing a top. It’s made in following market leaders. And while the S&P 500 has done nothing for the better part of eight weeks, certain key sectors of the markets are EXPLODING higher.

I mentioned Quantum Computing as a key sector to watch in mid-December. This area of the market continues to EXPLODE higher with some names like Rigetti Computing (RGTI) up QUADRUPLE digits.

Quantum Computing isn’t the only area of the market showing massive returns. Robotics is another area of the market that has begun to ignite upwards. Nauticus Robotics (KITT) is just one play that is up triple digits in the last few weeks.

And then there are drones. Here again numerous names are exploding higher producing triple digit gains in the last few weeks alone. Mobilicom Limited (MOB) is just one such name that has proving the “there’s no money to be made in stocks” narrative incorrect.

These are just a handful of market leaders. But there are more. Many more. So feel free to listen to the doomers who tell you the market is done. But you’ll be missing out on a lot of great opportunities in the markets.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Beneath the Surface a Bloodbath is Unfolding

Stocks look very weak.

The overall index is holding up relatively well, but “beneath the surface” a bloodbath is unfolding.

High yield credit breaking down quite badly. As I write this, it is signaling a pullback in the S&P 500 to at least 5,850.

Breadth, which also typically leads the S&P 500, is signaling something similar: a decline to roughly ~5,800.

The bad news doesn’t stop there either. Only two sectors out of the 11 that comprise the S&P 500 are positive in December. They are: Consumer Discretionary and Tech. The other NINE are all red for the month thus far.

Put simply, the only reason the S&P 500 is holding up is due to a handful of large tech plays that receive a tremendous amount of weight in the index. When you remove the impact of these companies by referring to an equal-weighted S&P 500, it’s clear a bloodbath is unfolding.

How deep will this correction run? We’ll address that in tomorrow’s article.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Did You Buy the Dip?

By Graham Summers, MBA | Chief Market Strategist

Last week I warned that that the Fed would be spooked by the uptick in inflation.

In particular, I noted that the CPI had begun turning up after effectively flatlining for six months. See for yourself.

The incoming Trump administration has made it clear that it sees the Fed as a political entity that favors the left. In this context, Trump sees any uptick in inflation as 100% the fault of the Fed.

As I warned last week, this meant the Fed was likely to disappoint the markets at its Wednesday meeting, resulting in stocks getting slammed lower. Specifically, I warned that the Fed would get spooked by the inflation data, that it would pull back on its intended rate cuts in 2025, and that this would result in stocks getting slammed downward as investors panicked.

And that is precisely what happened.

The S&P 500 experienced one of its worst down days in years, falling nearly 3% and wiping out all of its post-election gains. Most investors panicked and sold the farm as they believed this was IT as far as the bull market was concerned.

I didn’t.

This was a BUYABLE dip as I alerted subscribers of our stock/ ETF-trading newsletter Private Wealth Advisory in last week’s market update.

Why?

Our proprietary research told us that the markets would correct but that it was a buyable dip that would quickly rebound into year-end. And that is precisely what is unfolding as I write this.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

I Guarantee You, the Market Isn’t Ready For This

By Graham Summers, MBA | Chief Market Strategist

Today is Fed day.

The market widely believes the Fed will cut rates today and then hint at a pause in January. The reality, however, is that the Fed might very well NOT cut rates today due to political pressure.

Why would the Fed NOT cut rates?

An inflationary rebound.

As noted on these pages and elsewhere, inflation continues to be a major problem in the U.S., no matter what mainstream economists claim. None of the three official inflation measures, the Consumer Price Index (CPI), Producers Price Index (PPI) and Personal Consumption Expenditures (PCE) are declining anymore. In fact, one could easily argue that on a year over year basis, the data has been flatlining or even turning up again!

CPI serves as a great example of what I’m writing about. No one looking at this chart would claim that inflation is gone. If anything, it looks as if it’s about to make a comeback!

This is not too surprising, the only part of the CPI that is down on a year over year basis is energy prices (well that and used cars). Take those data segments out of the CPI data and prices are still rising across the board!

See for yourself.

Put simply, all we need is for energy prices to rebound higher and the official inflation data will start coming in hotter than expected.

President Trump would pin that development 100% on the Fed.

Trump has made no secret of his disdain for the Fed in the last few months. At one point, Team Trump even went so far as to float the idea of President Trump removing current Fed Chair Jerome Powell before the latter’s term ends. Other ideas include the President having a say in the Fed’s interest rate decisions, and the Treasury taking over some of the Fed’s responsibilities concerning rates and QE.

In this context, the Fed needs to avoid any rebound in inflation, which likely means fewer rate cuts happening in the near future. And this would result in stocks collapsing.

Would that collapse mark the end of this bull market… or a garden variety correction that investors should use to “buy the dip”?

To find out, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST). We’ll be covering this development in great detail shortly…

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Three Areas of Profits That 99% of Investors Are Ignoring

By Graham Summers, MBA | Chief Market Strategist

One of the key differentiators for investors is your ability to find profits in the markets. It sounds obvious, but you’d be amazed how many people keep staring at the same charts waiting for something to happen… while other investments are soaring and making investors extraordinary profits.

Consider the “Trump Trade,” for example.

The overall stock market as indicated by the S&P 500 is up only 4% since election day. And in fact, it’s down for the month of December. Seeing this, numerous analysts have claimed that the Trump Trade is fizzling out.

Meanwhile, key areas of the market that are closely aligned with the incoming administration’s policies and agendas are breaking out to new highs. Rather than fizzling out, these areas of the market are showing investors serious profits.

Consider…

Bitcoin: the incoming Trump administration is extremely pro-Bitcoin, going so far as to propose a Strategic Bitcoin Reserve designed to hold and acquire a Bitcoin stockpile for the U.S. much as the Strategic Petroleum Reserve houses our oil reserves.

Bitcoin is up 33% since the election vs ~4% for the S&P 500. And the momentum isn’t stopping either. Bitcoin has just broken out to new all-time highs, clearing $100,000 for the first time in history. This has been a place to profit even as the S&P 500 sputters out.

Tesla (TSLA) has been another area of market momentum and profits. TSLA founder Elon Musk has become one of Trump’s most trusted advisors. This cozy relationship, combined with TSLA’s development of autonomous robots, self-driving taxis, and other revolutionary technologies, has resulted in TSLA shares ERUPTING nearly 60% higher since election night.

Put simply, investors have seen EXTRAORDINARY profits here while the overall market has been going nowhere. Again, the profits are there if you know where to look!

Quantum Computing: the incoming Trump administration has made it clear it will be aggressively promoting American innovation. Quantum computing uses quantum mechanics to solve extremely complicated problems in a fraction of the time traditional computing would require. This is the next “AI” or revolutionary technology that will dramatically alter the corporate landscape. As a result of this, quantum computing stocks have been on an absolute tear with shares of IonQ (IONQ), the industry leader, more than doubling since election night.

Again, there are MAJOR profits to be found in stocks today, if you know where to look.

Like this kind of content?

Join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Why Quantum Computing Will Dominate 2025 Markets

By Graham Summers, MBA | Chief Market Strategist

You’re going to be hearing a LOT about quantum computing in 2025.

Quantum computing is a type of computing based on quantum mechanics. Experts believe it to be the next generation in computing. It is highly complicated and capable of handling problems that traditional computers cannot.

And by the look of things, it’s going to be the next “AI” theme: a technological breakthrough that produces massive gains for investors.

Quantum computing names have been EXPLODING higher in the markets.

IonQ (IONQ)

Quantum Computing Inc (QUBT)

Rigetti Computing (RGTI)

Again, the first major move has already happened in these names and the easy money has been made. But the bigger players will be moving into the space shortly. Indeed, Alphabet (GOOGL) has just announced the introduction of its own quantum computing chip Willow.

Join 56,000 readers in over 56 countries in receiving the this daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Is Inflation About to Come Roaring Back?

By Graham Summers, MBA | Chief Market Strategist

Has inflation been slain?

According to the official data, the answer is “maybe” at best, but most likely “no.”

There are three official inflation measures in the U.S. They are:

- The Consumer Price Index (CPI).

- The Producer Price Index (PPI).

- Personal Consumption Expenditures (PCE).

CPI has effectively stopped declining for six months now. A lot of commentators are pointing to the recent uptick from October’s data as indicating that inflation is coming back, but the reality is that this is a noisy data set that is subject to multiple revisions. Put simply, this data point shows CPI is close to target but refusing to decline any further.

When we remove the noisiest portions of this data set (food and energy), Core-CPI hasn’t declined since July. Again, this doesn’t necessarily mean it’s about to surge higher… but it does indicate that inflation isn’t moving towards the Fed’s target of 2% anymore.

This brings us to the Producer Price Index (PPI).

The latest round of data (October) was released mid-November. It reported an uptick in inflation with a month over month reading of 0.2% and a year over year reading of 2.4%. This chart is more worrisome for those claiming inflation is on the rise again.

As was the case with CPI, when we strip out food and energy, the chart isn’t any better.

Which brings us to the Fed’s preferred measure of inflation: Core-Personal Consumption Expenditures (PCE), or PCE excluding food and energy prices. This is arguably the single most important data point for inflation as it is the one the Fed watches closely. It has flatlined since May 2024.

Add it all up, and at best, we can argue that inflation has stopped declining for the last six months. At worst, you could make a case that any spike in energy prices would result in a major uptick in inflation. Remember, the ONLY parts of the CPI data that is down year over year are energy prices (and used cars). Every other segment of the data continues to rise in price!

Put simply, the picture for inflation is at best blurred and at worst, indicating a second wave if coming.

We fully believe inflation is going to be one of the dominant themes of 2025. Take a look at what gold or bitcoin imply is coming and you’ll see what we mean.

Our Special Investment Report on how to profit from a 2nd wave of inflation is flying off the shelves. To grab yours go to the link below.

www.phoenixcapitalresearch.com/inflationlead

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

It’s Trump’s Stock Market, Invest Accordingly

The stock market is increasingly being driven by Trump and his agenda for his second term. If you’re looking to make money in this market, focusing on these items has been working well.

Consider what has taken place with Meta (META).

Historically, META’s CEO Mark Zuckerberg has been left leaning in his political views. He wasn’t just verbal in his politics either: he spent $400 million helping the Democrats defeat Trump in 2020.

With this in mind, one of the biggest “tells” that Trump would win the election was when Zuckerberg pivoted politically away from the left. In late August, he penned a letter to Congress claiming that he didn’t want to suppress right wing views on META but had done so due to pressure from the Biden administration. This was quite a move as polls had Harris leading at the time.

However, polls are quite inaccurate (as we’ve discovered this election cycle). But Zuckerberg had/has access to one of the greatest databases for voter behavior in the world via META. Americans might not tell pollsters who they intend to vote for, but you better believe they’re revealing that in private to their family and friends on social media. In this sense, Zuckerberg’s political pivot had less to do with true repentance for prior transgressions and more to do with pragmatism: he saw voters were going to deliver a landslide victory to Trump and was positioning himself and his company accordingly.

Having said that, once Trump won on November 5th, META shares lagged as investors were uncertain whether Trump would seek vengeance for Zuckerberg’s prior political actions. While the overall market exploded higher on election night (red line in the chart below), META shares (black line in the chart below) failed to participate.

Then Zuckerberg had dinner with Trump on November 27th, and META shares EXPLODED higher. They’re now up 6% since that date, having broken through critical overhead resistance (red line in the chart below) and soaring to new all-time highs.

Bear in mind, literally NOTHING changed about META’s business during this time other than Zuckerberg cozying up to Trump and publicly stating that he’d love to have a role in Trump’s new administration. But as you can see for yourself, those developments had a MAJOR impact on META’s share price action.

So again, as I stated at the beginning of this article, The stock market is increasingly being driven by Trump and his agenda for his second term. If you’re looking to make money in this market, focusing on these items has been working well.

If you’re looking for guidance on this, we just published a Special Investment Report detailing that, as well as the #1 investment to own during Trump’s 2nd Term.

We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.

We are making only 99 copies available to the public.

As I write this, there are only 19 left…

To pick up yours…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Can DOGE Fix This? We’ll Find Out Soon!

By Graham Summers, MBA | Chief Market Strategist

More Department Of Government Efficiency (DOGE) news.

As the Trump administration prepares to take office on January 20, 2025, more and more data points detailing the egregious fraud, waste, and abuse in government spending are being made public.

Consider…

The Federal Government spends $15 billion per year on office buildings/ energy costs, not to mention hundreds of millions if not billions of dollars on office furnishings. Despite this massive overhead, the government is current sitting on over 7,000 vacant office buildings as most Federal government employees are still allowed to work from home.

Bear in mind, the pandemic ended over 18 months ago.

Having said that, the primary issue as far as government waste is concerned isn’t the number of Federal employees which hasn’t grown by much over the last 20 years… rather it’s the government spending, particularly on ludicrous projects/ programs that offer little if any real benefit to society.

Some of the more disturbing items DOGE has noted…

- Congress dispensed $516 billion to programs whose authorizations previously expired under federal law. Over half of that ($320 billion) pertained to programs whose authorizations expired over a decade ago.

- The Pentagon has failed its 7th STRAIGHT AUDIT and is unable to account for where $824 BILLION in spending went. That’s roughly the same size as Poland’s GDP.

- In 2023, federal programs made $236 billion in improper payments. That’s billion with a “b.”

- Some $200 billion in pandemic spending/ stimulus went to fraud/ abuse whether it be companies that didn’t qualify for PPP loans, fake companies that didn’t even exist, etc.

These are just the LARGE line items of note. Once you start delving into the smaller, individual programs the government funds, things go from disturbing to ludicrous.

Some of the worst of the worst that DOGE has highlighted on X (formerly Twitter).

- $45 million for a diversity and inclusion scholarship in Burma

- $3 million for “girl-centered climate action” in Brazil

- $288,563 for diverse bird watcher groups

- $100,000 to study if tequila or gin makes sunfish more aggressive

- Almost $1 million to study if cocaine makes Japanese quail more sexually promiscuous

- $750,000 to study if Neil Armstrong said “One small step for Man” or “One small step for ‘a’ man” during the moon landing.

- $28 million in licensing fees for a green camouflage pattern for Afghan National Army uniforms. Bear in mind, the “camouflage” didn’t work as Afghanistan is mostly desert.

- $2.5 million on a Super Bowl Ad for the Census

- $1.7 million for holograms of dead comedians

- $500,000 to build an IHOP in Washington, DC

And on and on.

The mere fact DOGE is bringing these items to the public’s consciousness is a worthy endeavor. Hopefully, DOGE can get rid of this stuff and get government spending under control. As we write this, the Federal debt has cleared $35 TRILLION and is adding $1 trillion in new debt every 100 days.

This spending isn’t free. Interest payments on the federal debt have cleared $1 trillion per year and are now the largest line item in our annual federal budget. If DOGE doesn’t get government spending under control, a debt crisis is coming sooner rather than later.

The one thing that IS clear is that DOGE would improve the U.S. fiscal situation. This would remove one of the biggest concerns for the stock market (the U.S. debt mountain/ massive deficits) and open the door to new highs.

On that note, we just published a Special Investment Report detailing that, as well as the #1 investment to own during Trump’s 2nd Term.

We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.

We are making only 99 copies available to the public.

As I write this, there are only 54 left…

To pick up yours…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

What Are the Implications of DOGE?

By Graham Summers, MBA | Chief Market Strategist

The Trump administration intends to treat the government like a business, removing waste and increasing productivity. Can it be done? It’s difficult to say. Firing government employees is notoriously difficult (hence the “fail up” theme that is common in the public sector).

Having said that, there’s clearly room for improvement/ cost cutting. The bigger issues pertain to how the Elon Musk and Vivek Ramaswamy’s Department of Government Efficiency (DOGE) would affect the overall economy.

Let’s dive in.

All told, over 23 MILLION people are employed by the government in the U.S. That’s not a typo. You can see this for yourself. The chart has gone straight up with few drops in the last 80 years.

Of this, the Federal Government is currently responsible for ~3 million workers. To put that into context, Wal-Mart employs roughly 1.6 million people in the U.S. So, Uncle Sam employs a little under two times as many people as the country’s largest private sector employer.

Does the government need all these employees? It’s difficult to say. There are plenty of stories of wasteful spending in government, but is the wasteful spending pertaining to programs, employees, or both? Put another way, is DOGE’s mission to improve the U.S.’s fiscal situation… or is it meant to primarily reduce the size of the government?

This remains to be seen.

Moreover, is DOGE meant to apply to just Federal Employees, of is it mean to also streamline state and local government operations? The U.S. has 167 million people in its labor force. With three million of these people employed by Uncle Sam, this means that less than 2% of labor force would be in DOGE’s targets. If DOGE is meant to also apply to state and local government, then the percentage of people who could be affected jumps to 13% of the labor force.

These issues need to be clarified for us to get a better sense of the impact of DOGE on U.S. employment.

Finally, and perhaps most pressing for investors, will DOGE trigger a recession? Elon Musk famously laid off 80% of Twitter (now X’s) employees without too much difficulty. If he and Vivek Ramaswamy manage to accomplish even half of that (meaning laying off 40% of Federal Government employees), if would mean 1.2 million Federal Employees losing their jobs.

There are currently 6.9 million people unemployed out of a labor force of 168.4 million. This comes to a U-3 unemployment rate of 4.1%. Adding 1.2 million unemployed people to this ratio would increase the U-3 unemployment rate to 4.8%. And bear in mind that this analysis assumes that the overall labor force dynamics do NOT change at all in the private, state or local government sectors (unlikely if DOGE is also cutting spending).

The lowest U-3 unemployment rate during this current cycle was 3.4%. So, a spike to 4.8% in unemployment would mean a total increase of 1.4% to the unemployment rate trough to peak. That is roughly equal to the unemployment rate spikes that occurred during the recessions of the early ‘90s and the early ‘00s (1.6% and 1.4%, respectively) so this is recessionary territory.

Would President Trump be willing to stomach a technical recession if it was triggered by delivering a campaign promise to shrink the government? I have no idea. President Trump was extremely proud of the economy’s strength during the first three years of his first term. Would the pride of shrinking government for the first time in decades eclipse the perceived economic “failure” of a technical recession occurring during the first two years of his term?

This remains to be seen.

The one thing that IS clear is that DOGE would improve the U.S. fiscal situation. This would remove one of the biggest concerns for the stock market (the U.S. debt mountain/ massive deficits) and open the door to new highs.

We just published a Special Investment Report detailing that, as well as the #1 investment to own during Trump’s 2nd Term.

We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.

We are making only 99 copies available to the public.

As I write this, there are only 59 left…

To pick up yours…

We just published a Special Investment Report detailing that, as well as the #1 investment to own during Trump’s 2nd Term.

We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.

We are making only 99 copies available to the public.

As I write this, there are only 67 left…

To pick up yours…

Best Reghttps://phoenixcapitalresearch.com/trump2ndterm-leadgen/

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

The Markets Are SCREAMING to Buy This, Not Stocks

By Graham Summers, MBA | Chief Market Strategist

Sometimes we think too much about trades.

It’s easy to do… every day we are inundated with thousands of pieces of information. And if you’re an active investor, there is no shortage of opinions from the mainstream media, social media, and even financial advisors as to what you should own.

However, sometimes it’s best to simply block out all that stuff and let the market show you where to invest.

With that in mind, below is a chart illustrating the performance of three assets since election night.

Which one would prefer to own?

It’s a no brainer: one is up 75% while the others are up just 4% and down 5% respectively. So obviously you want to buy the top performer right?

Here’s the chart with the assets labeled. The top performer is crypto market maker Coinbase Global (COIN) .

The message is clear here: the Trump administration is going to be EXTREMELY bullish for all things crypto.

Don’t overthink this. The markets are literally telling you where you need to invest.

For those investors looking fror specific investment strategies to profit from Trump’s 2nd term, we just released a Special Investment Report detailing what we consider to be the #1 investment to own during Trump’s 2nd Term. It rose 2,000% during his first term… and it’s already up 32% since election night!

We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.

We are making only 99 copies available to the public.

As I write this, there are only 56 left…

To pick up yours…

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Breaking Down Trump’s Strategic Bitcoin Stockpile…

Let’s dive into the latest development that has the financial community buzzing – Donald Trump’s proposal for a Strategic Bitcoin Stockpile. This proposition is stirring quite a bit of excitement and curiosity, so let’s unpack what it could mean for you and your investment strategy.

Trump’s Bold Move: A Strategic Bitcoin StockpileIn a recent announcement, Trump unveiled his plans to establish a Strategic Bitcoin Stockpile, a move that underscores his shifting view on the cryptocurrency market. This Stockpile is designed to hold the U.S.’s bitcoin, leveraging its potential as a digital asset class and a hedge against traditional market fluctuations.Trump put it simply at a conference in Nashville in July of this year, “NEVER sell your bitcoin… If elected, it will be the policy of my administration to keep 100% of all the bitcoin the U.S. government currently holds or acquires into the future.”Now that Trump is President, this proposal can become a reality.Why It Matters: Potential Impact on the MarketThis isn’t just another fund – it’s a statement. By proposing a Strategic Bitcoin Reserve, Trump is signaling a significant shift in how influential figures understand and utilize digital currencies.Here are a few key takeaways on why this proposition matters:

- Legitimacy Boost: Trump’s endorsement provides a significant vote of confidence for Bitcoin and could help cement its place as a mainstream investment vehicle. This might encourage other prominent investors and institutions to follow suit, driving further adoption and integration into traditional finance.Investor Confidence: For savvy investors like yourself, greater institutional involvement can translate to more confidence in the market. With influential figures backing Bitcoin, the perceived risk may diminish, making it a more attractive option for a diversified portfolio.

So, what can we expect if Trump’s Strategic Bitcoin Stockpile gets off the ground? Here are a few predictions based on current trends and insights:

- Increased Institutional Interest: Following Trump’s lead, we might see more institutional investors entering the Bitcoin market. This could drive significant growth and potentially more stable price movements.Regulatory Advances: With more high-profile figures betting on Bitcoin, there may be a push toward clearer and more supportive regulatory frameworks. This can provide a more secure environment for all investors.Mainstream Adoption: As Bitcoin becomes more integrated into traditional finance through such strategic Stockpiles, we could see broader adoption and everyday use cases emerging, further solidifying its role in the financial landscape.

Final ThoughtsTrump’s proposed Strategic Bitcoin Reserve is more than just a bold move; it’s a pivotal moment for the cryptocurrency market. For investors, it presents new opportunities to consider Bitcoin within a diversified, forward-looking investment strategy.Smart investors are already positioning themselves to profit from this.We just published a Special Investment Report, The Bitcoin ETF You NEED To Know About that details a unique investment through which you can buy bitcoin via the stock market, like a regular stock (instead of with a crypto-based brokerage account).We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.We are making only 99 copies available to the public.To pick up yours…CLICK HERE NOW!Best RegardsGraham Summers, MBAChief Market StrategistPhoenix Capital Research

How Trump Will Engineer a MAJOR Bull Market

By Graham Summers, MBA | Chief Market Strategist

Let’s grab a cup of coffee and talk about something that’s intrigued many of us over the past few years – Donald Trump’s impact on the stock market.

Whether you loved him, hated him, or found yourself somewhere in between, it’s undeniable that Trump’s presidency had a significant impact on the markets. And as investors, our goal is on making money, NOT choosing political sides. So, let’s break down how and why this happened, without getting caught in the political weeds.

Let’s start with Trump’s 2016 policies, and what they meant for stocks…

Key Policies and Their Impacts

Corporate Tax Cuts:

One of the cornerstone policies of Trump’s administration was the Tax Cuts and Jobs Act of 2017. This piece of legislation slashed the corporate tax rate from 35% to 21%. Lower taxes meant higher net profits for companies, and subsequently, higher dividends for shareholders. This injection of optimism contributed to a bullish market.

Deregulation:

Trump’s administration took significant steps to roll back regulations, particularly in the financial and energy sectors. By reducing regulatory burdens, companies found it easier to do business and increase profitability. As a result, the market reacted positively, favoring sectors directly impacted by deregulation.

Trade Policies and Tariffs:

Perhaps the most contentious aspect of Trump’s economic policy was his approach to trade, particularly with China. The imposition of tariffs led to increased costs for businesses reliant on global supply chains and created uncertainty in the markets. However, many investors saw these moves as part of a broader strategy to level the playing field for American businesses.

Add it all up, and this mix of lower taxes, lower regulatory burden, and America-first dynamics were a boon for corporate profits, which drive stocks. The market roared higher during Trump’s 1st term. Even when the pandemic hit, Trump’s combination of aggressive stimulus along with the Fed’s extraordinary actions resulted in a rapid recovery.

Stocks finished Trump’s term up over 85% for average annual gains of over 20%. This was an EXTRAORDINARY period to be a stock investor.

Now Donald Trump is President once again. And by the look of things, he’s going to be even more stock market obsessed with a specific focus on controlling the Fed top insure stocks go higher.

This is going to have a profound impact on the economy and stock markets. Our Chief Market Strategist, Graham Summers, MBA will be hosting a webinar addressing this situation next Friday, November 22nd at 1PM.

During this webinar, Graham will detail Trump’s proposals for reorganizing the Fed, who are the likely candidates for the next Fed chair, and what this will mean for the financial system and stock markets including specific investment strategies to profit from these developments.

This webinar will available to the general public for $49.99…

However, as a Gains Pains & Capital subscriber, you can reserve a place for just $9.99.

To do so… please use the button below.

For those investors looking fror specific investment strategies to profit from Trump’s 2nd term, we just released a Special Investment Report detailing what we consider to be the #1 investment to own during Trump’s 2nd Term. It rose 2,000% during his first term… and it’s already up 32% since election night!

We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.

We are making only 99 copies available to the public.

As I write this, there are only 56 left…

To pick up yours…

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Three Things Serious Investors Should Know About This Week

The Fed claims to be politically independent, but that’s largely a myth. And no one is more aware of that than the new President of the United States, Donald Tump.

This week our host, Graham Summers, MBA, delves into the history of the Fed’s political interference, outlining clear examples in which the Fed has “tipped the scales” in favor of the establishment.

Graham also outlines some of the proposals the Trump administration has floated to address this situation, including handicapping the Fed’s autonomy with interest rate policy and more.

Put simply, a Trump 2nd Term could very well revolutionize the financial system. And this week, Graham breaks it all down into easy to understand terms as only he can.

To access this week’s episode of Bulls Bears and BS…

TONIGHT AT MIDNIGHT, we are DOUBLING the price of Private Wealth Advisory from $249 per six months to $499 per six months.

To join Private Wealth Advisory at the soon to be discontinued price of $249 per six months…

Finally, our crypto trading service Crypto Pro is already MAKING BANK for traders looking to see rapid fire gains from the markets.

The below trades are just from the last five weeks alone.

There are only a handful of slots left for this product. The coins we will be trading are not always super liquid. So we need to keep this product’s subscriber base SMALL.

You can take out a 60-day trial subscription to Crypto Pro today.

Every subscription comes with:

-A copy of our Introduction to Crypto Currencies Special Report outlining what they are, how to trade them, and which broker to use ($249 value)

-Three (3) client-only trading guides that show you how to profit lock in life-changing profits and avoid major losses from crypto ($999 value)

-TWENTY (20) weekly trades (our team has maintained win rates of 75% since 2015)

– A copy of our The Bitcoin ETF You NEED to Know About Special Report ($249 value)

-A Signed copy of Graham’s best-selling book “Into the Abyss”

-Our Weekly Investment Podcast detailing the most important developments in the economy and financial markets.

If you decide Crypto Pro is not for you anytime during the first 60 days, just drop us a note and we’ll issue a full refund .

To grab one of the last remaining slots to Crypto Pro while they’re still available…

Ignore the Donations, the Fed Has Been Political For DECADES, Part 1

By Graham Summers, MBA | Chief Market Strategist

The Federal Reserve (or “the Fed” for short) is supposed to be a politically independent entity.

Political commentators are outraged that Federal Reserve employees donated $10 to Democrats for every $1 to Republicans during this latest election cycle. As you can imagine, this has resulted in numerous accusations of the Fed being a left-leaning or Democrat controlled entity.

Those accusations are true.

However, the reality is that the Fed’s political actions are far greater than the mere $552,000 Fed employees donated to the left in the last four years. Indeed, in the last 15 years alone, there have been at least FOUR occasions during which the Fed engaged in monetary policies that were questionable at best, given the political context.

For those of us who track these things, the Fed:

- Influenced the 2012 Presidential race to aid the Obama Administration’s re-election bid.

- Damaged the economy/ financial system on purpose in 2017-2018 as an act of defiance against President Trump

- Claimed inflation was “transitory” despite mountains of evidence to the contrary, only to then abandon this claim as soon as Fed Chair Jerome Powell was reappointed by President Biden.

- Announced a new focus on climate change/ DEI/ leftist political interests despite those issues being outside the scope of the Fed’s mandates.

Let’s dive in.

First and foremost, consider that in 2012, the Bernanke-led Fed announced QE 3, its largest QE program in history at the time (an $80 billion per month, open-ended program), a mere THREE MONTHS before the U.S. Presidential election.

Bear in mind that the U.S. economy was growing, and the U.S. financial system wasn’t under significant duress at the time. Also bear in mind that the Fed did this within 90 days of a Presidential election.

In this context the decision to launch the largest QE program to date was blatant political interference to aid the Obama Administration’s re-election bid by boosting the stock market and economy. Even if you’re inclined to give the Fed a pass for this, you can’t argue that given the data and the timing, the move was suspect.

A second example of Fed political bias concerns its major shift in monetary policy once Donald Trump became President in 2017. To fully grasp this, we need to provide a little historical context.

Between 2008 and 2016, the Fed engaged in eight years of extraordinary monetary easing, maintaining interest rates of 0.25% (zero), and engaging in over $3 trillion worth of QE. Bear in mind that throughout this time, the U.S. economy was technically NOT in recession. Economic growth was steady:

And the unemployment rate was in a clear downtrend:

Once the Fed actually ended easing, it embarked on one of the feeblest campaigns of tightening monetary policy in history, raising rates only one time in 2015 and 2016 each. To put this into context, during a normal cycle, the Fed raises rates by three or four times per year.

Then Donald Trump won the 2016 Presidential election, and suddenly the Fed “got religion” about normalizing monetary policy. It raised rates three times in 2017 and another four times in 2018. In 2018, it also began shrinking its balance sheet via a process called Quantitative Tightening or QT. It would ultimately drain $500 billion in liquidity from the financial system via QT in 12 months.

All the above represent quite a shift considering the Fed had maintained rates at or close to ZERO for eight years prior to this. And this shift ended up damaging the economy and stock market.

Throughout 2016-2018, the Fed ignored numerous signals that this pace of tightening was placing the financial system under duress, right up until the junk bond market froze and the U.S. stock market crashed 20% during the holidays in December 2018.

For those who would argue that the Fed’s sudden shift from maintaining easy monetary policy for the better part of a decade to aggressively normalizing policy in the span of 20 months had nothing to do with Donald Trump being President, consider that former Fed Vice Chair Stanley Fisher admitted in an interview that the Fed’s raising rates in December 2018 was done specifically to hurt the economy because the Fed was annoyed with President Trump’s constant tweeting about them.

We’ll detail the final two politically egregious Fed actions in tomorrow’s article. But for now, the above examples alone are enough to definitively show the Fed IS a political entity and it DOES lean to the left.

Now Donald Trump is President once again. And he is going to exact vengeance on the Fed.

This is going to have a profound impact on the economy and stock markets. Our Chief Market Strategist, Graham Summers, MBA will be hosting a webinar addressing this situation next Friday, November 22nd at 1PM.

During this webinar, Graham will detail Trump’s proposals for reorganizing the Fed, who are the likely candidates for the next Fed chair, and what this will mean for the financial system and stock markets including specific investment strategies to profit from these developments.

This webinar will available to the general public for $49.99…

However, as a Gains Pains & Capital subscriber, you can reserve a place for just $9.99.

To do so…

Phoenix Capital Research