By Graham Summers, MBA

The fate of the stock market is in the hands of Treasury Secretary Janet Yellen this week.

Every quarter the Treasury announces its financing needs via its Quarterly Refunding Announcement (QRA). In the QRA, the Treasury announces:

1) How much debt it will need to issue total to fund the government for the coming quarter.

2) The amount of new debt the Treasury will need to issue as opposed to simply rolling over old debt.

3) The breakdown of the debt issuance: short-term T-bills versus longer-term Treasury Bonds.

These three items are the MOST IMPORTANT issues for the markets today.

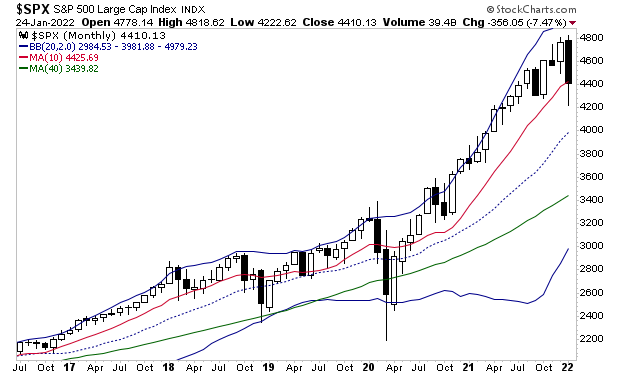

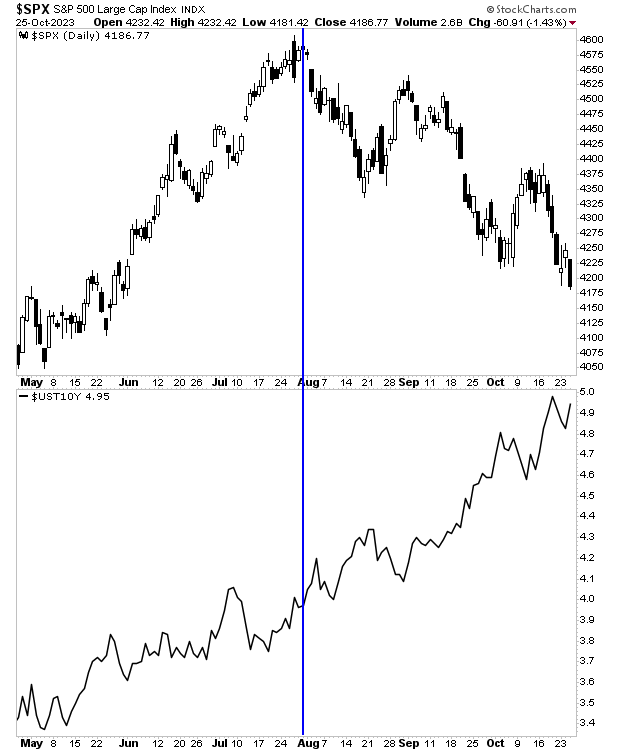

If you think I’m exaggerating this, consider that the last time the Treasury made its QRA was July 31st 2023. That was THE day that stocks topped and bond yields began to skyrocket.

The Treasury will announce the basics of the #1 and #2 in the list above today. But we won’t get the full breakdown of debt (#3) until Wednesday.

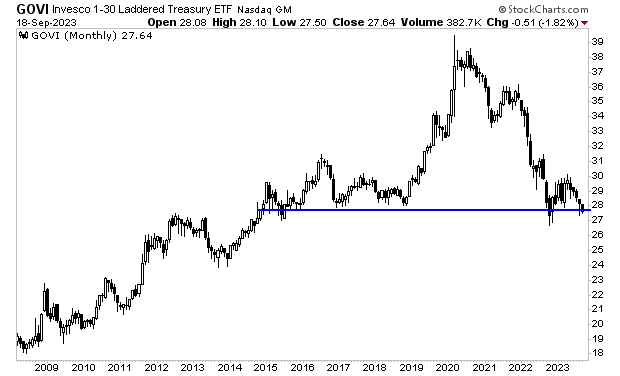

Historically, the Treasury tries to keep the amount of short-term debt issuance to just 20% of total issuance. The reason for this is that if the Treasury relies too heavily on short-term debt to fund spending, it opens the door to a rate shock.

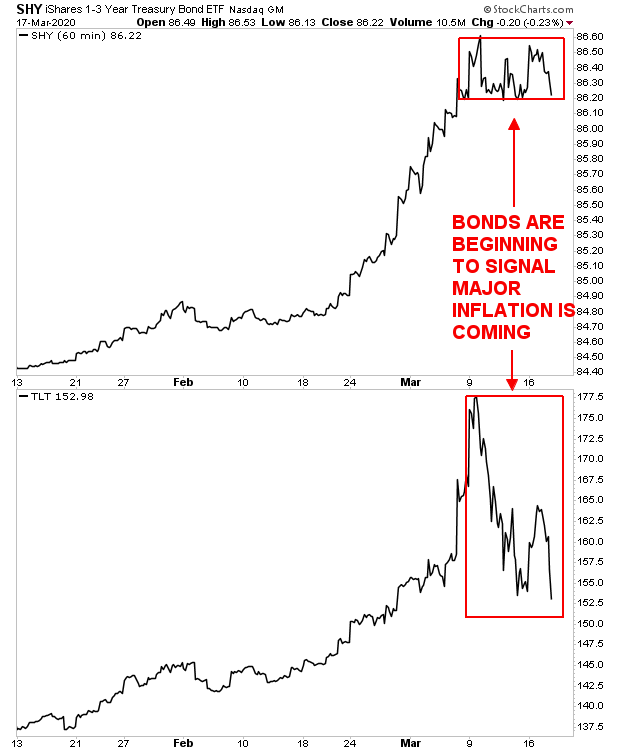

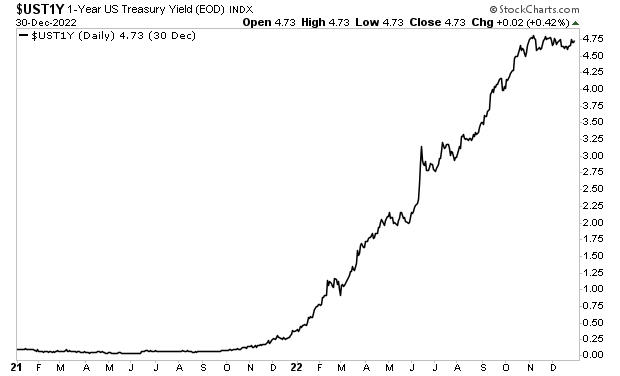

Consider what would have happened if the Treasury had issued 80% of total debt in short-term T-bills in 2021 when rates were at 0.25%. At the time, the move would have looked quite clever as the Treasury would be taking advantage of the fact that rates were so low. However, fast forward a year to 2022, and the Treasury would need to roll over that same debt at a time when rates were now ABOVE 4%! Interest payments would have been EXPONENTIALLY higher and a debt crisis would arrive.

So again, the Treasury usually keeps T-bill issuance to just 20% of total issuance… unless it’s intentionally trying to calm the markets and juice stocks higher for political purposes.

Which brings us to today.

Janet Yellen is ACUTELY aware of the impact that her decisions will have on the stock market. Indeed, the hallmark of her tenure as Fed Chair from 2014-2018 was to implement monetary policy that benefitted stocks, even if the economic data didn’t warrant it.

So the odds favor her doing something to prop the markets up… especially as we enter an election year in 2024.

However, doing this only sets the stage for a debt crisis down the road. If the Treasury relies extensively on T-bills to finance the budget now, that same debt will come due in a year… which opens the door to a MAJOR rate shock at that time, especially if inflation rebounds.

Again, the fate of the stock market is in Treasury Secretary Janet Yellen’s hands today. If she chooses to game the debt markets for political purposes it only delays the inevitable debt crisis… and not by much.

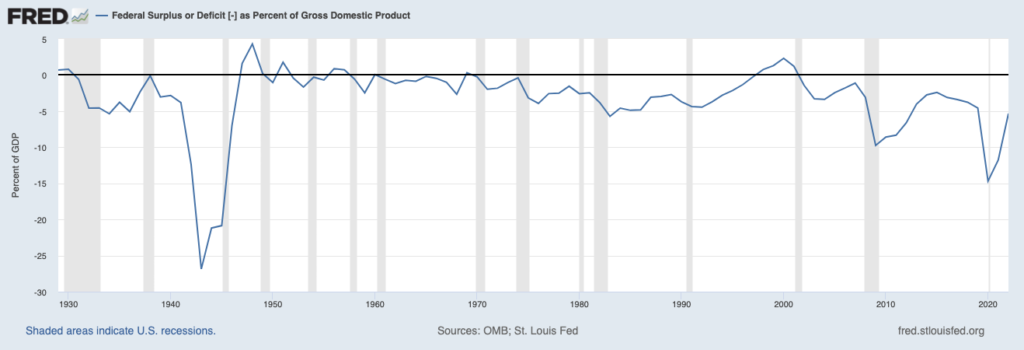

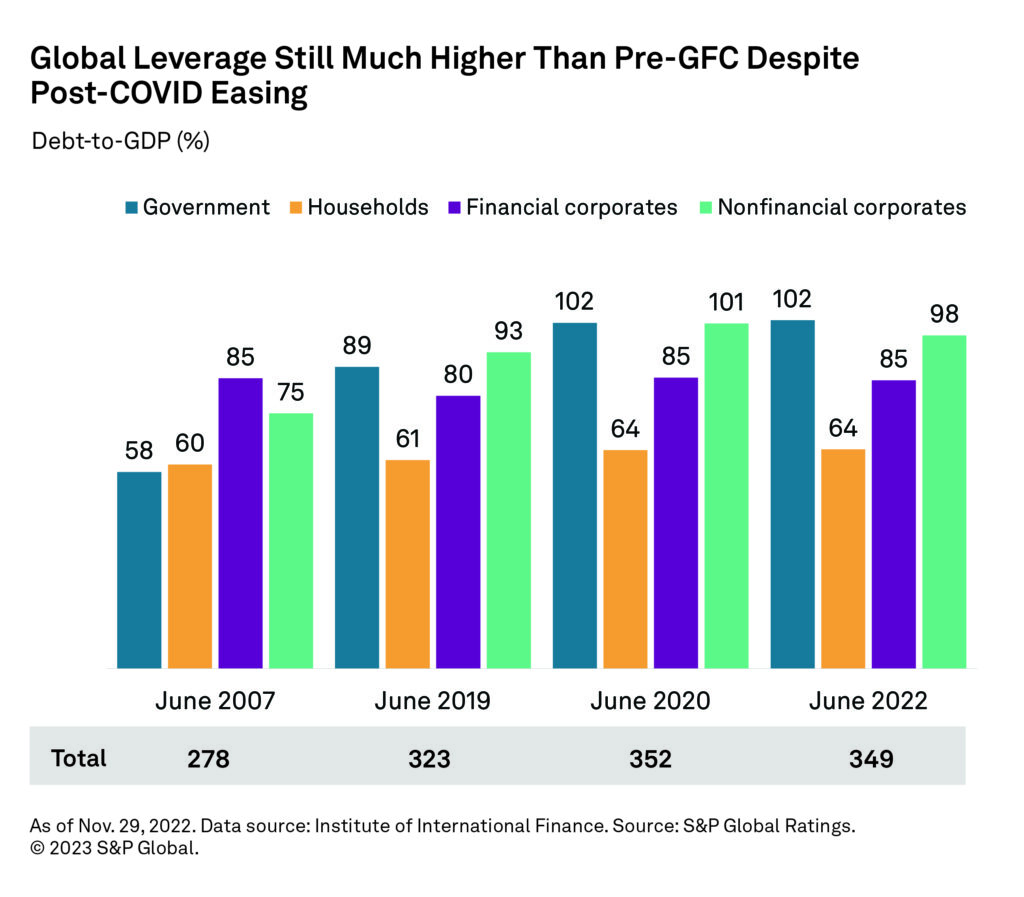

As I keep warning, the Great Debt Crisis of our lifetimes is fast approaching.

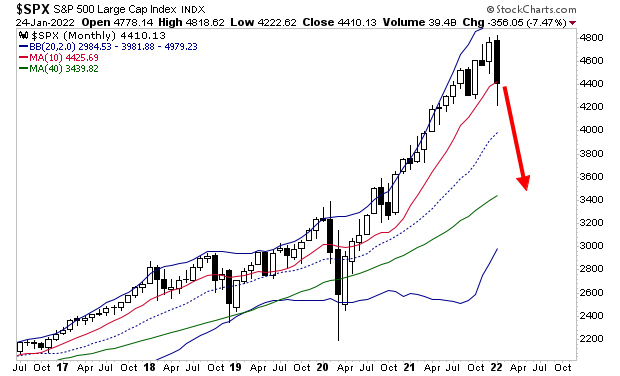

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The Great Debt Bubble burst in 2022. And the crisis is now approaching.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/BM.html