Investors are getting strangely bullish.

If you’ll recall, the entire European banking system nearly imploded just 8 weeks ago. Things were so dire that we even had a coordinated Central Bank intervention among other measures to try and prop things up over there.

The Powers That Be have since launched the Long-Term Refinancing Operation or LTRO: essentially a program through which European banks can borrow from the ECB at just 1% for up to a year. The whole thing is essentially just another liquidity handout and it’s telling that those firms which do borrow from the LTRO are parking almost all the borrowed cash at the ECB soon after.

And while the LTRO has been beneficial in terms of some liquidity concerns, it’s done nothing to address Europe’s solvency issues. Case in point, European banks in general are leveraged at 26 to 1. At that level even a 4% drop in asset prices wipes out all equity.

In this environment, the ability to borrow more money doesn’t accomplish anything from a balance sheet perspective. It’s simply a matter of common sense: you cannot solve a debt problem with more debt.

But since the ECB cannot directly monetize EU bonds without Germany pulling out of the EU, and since the German rules Euro-bonds as illegal, the LTRO is about the best the ECB can do in these circumstances.

What’s truly concerning however, is the fact that investors have piled into risk assets based on the LTRO (and misguided hopes of more QE) as though none of these issues exist.

Folks, just a few months ago, no less than the IMF, Bank of England, and others warned that we were facing a global meltdown and the worst financial crisis in history. Do you really think a few liquidity programs have solved all of this?

Moreover, if a huge round of QE or other stimulus money were coming, shouldn’t commodities be exploding higher just as they did before QE 2 in 2010?

Gold is still in a downward channel well under resistance:

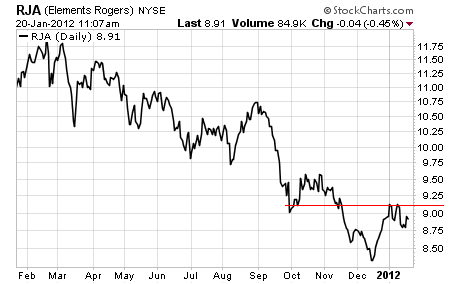

Agricultural commodities, which were the first asset class to predict QE 2 are struggling too.

Agricultural commodities, which were the first asset class to predict QE 2 are struggling too.

These charts don’t scream, “more easing is coming” to me. Which makes the extreme bullishness of investors all the more disconcerting. Any time a trade grows too lopsided, there’s the opportunity for a sharp reversal. Right now, investors are piling into risk assets in anticipation of more QE from the Fed. But none of the fundamental issues that nearly took Europe down have been resolved. And the Fed has made it clear that it’s finding QE less and less “attractive” since as far back as May 2011.

The reality is that the EU in its current form is finished. There is simply no way we can muddle through the debt deleveraging that will take place. And when the smoke clears the EU in its current form will be broken and we will have passed through a Crisis far worse than 2008.

Many people see their portfolios go up in smoke with this. But you don’t have to be one of them. In fact, I’ve laid out a series of steps every investor can take to prepare for the coming European Collapse.

Many people see their portfolios go up in smoke with this. Don’t be one of them. The time to prepare your portfolio for the collapse is NOW before it starts.

I can show you how.

Indeed, while 99.9% of investors lost their shirts in 2008, my subscribers actually MADE MONEY.

We did the same thing during the first round of the Euro Crisis in 2010.

And so far we’ve locked in 34 straight winners in the last five months… including gains of 12%, 15% even 18%.

In fact we haven’t closed a SINGLE LOSING TRADE in the second half of 2011.

We just opened several new positions last week, all of them designed to profit beautifully from the coming collapse of the EU.

To find out what they are… and take action to insure that the coming disaster will produce profits NOT pain for you and your portfolio…

Graham Summers

Chief Market Strategist

Phoenix Capital Research