The financial world is swirling with numerous claims that the Fed telegraphed QE 3 will be coming at its September FOMC meeting. I don’t see this at all. All that Fed did was admit that its September meeting will be two days instead of one so it can have a “fuller discussion” about things.

A “fuller discussion” doesn’t mean anything. This was just Bernanke throwing the markets a bone so they wouldn’t implode with no QE 3. The majority of his speech was devoted to blaming Congress for his complete and utter lack of understanding of finance and capital markets.

Of course I get what Bernanke’s doing (it was just revealed that he funneled $1,2 trillion to Wall Street behind the scenes). The guy’s going to want to divert attention (and blame) to someone else. And with various Wall Street CEOs now hiring defense lawyers for the REAL wave of litigation, you better believe Bernanke’s getting worried about what’s coming his way in the future.

As for the Fed’s “fuller discussion” in September coming up with QE 3 or something else, give me a break. Do you really think the Fed hasn’t already discussed QE 3 and every other insane intervention you can imagine over since the Financial Crisis began in 2008? Do you really think that the Fed’s magically going to come up with something new that will fix the Financial System?

Let’s be blunt here, the only thing that will cause QE 3 to come out will be :

- Another market Crash (S&P 500 sub-100) or

- A major bank collapsing.

That’s it. QE 3 is not going to be some “let’s push stocks higher” move. It’s going to be a “desperately trying to hold the system together” move.

Now, about the stock rally that began on Friday.

This is not the first market rally that’s occurred as an insane reversal after a disappointing Fed statement. We had the exact same move occur after the Fed’s disappointing August 9th FOMC. That move had “market intervention” written all over it.

This one did too. Indeed, it’s just a little odd that both of the last two Fed announcements saw the markets sell off hard then suddenly stage insane rallies.

What’s even stranger is that the credit markets haven’t bought into either of these moves at all. Do you really think that QE 3 is coming in a few weeks?

What’s even stranger is that the credit markets haven’t bought into either of these moves at all. Do you really think that QE 3 is coming in a few weeks?

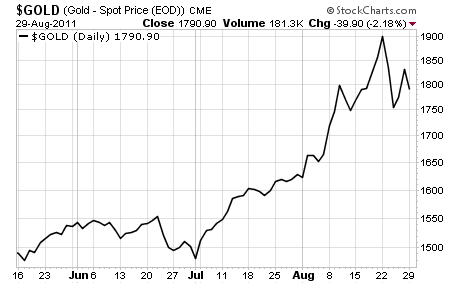

Another thing… shouldn’t Gold be exploding higher if QE 3 was just around the corner? Would it really be forming a Head and Shoulders if more monetization was coming?

Let’s just call this latest rally for what it is: end of the month performance gaming aided by clear Fed intervention in the markets last Friday. This will end badly just as the last rally did (we wiped out ALL of its gains in a few days).

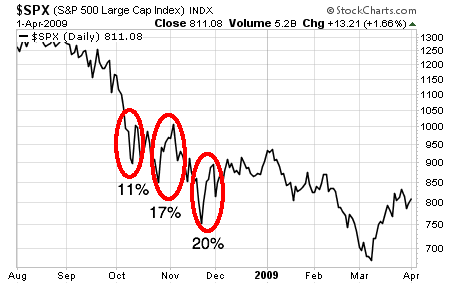

To me, the message is clear. The Fed won’t be unleashing QE 3. And the markets remain on Red Alert. Indeed, we’ve had several insane snapback rallies during the 2008 collapse. Indeed, in the span of two months we saw three rallies of 11%, 17% and 20%.

These last few rapid rallies have the exact same feeling to them. And they will very likely end the same way: in disaster. Many people are going to see their portfolios get completely destroyed.

These last few rapid rallies have the exact same feeling to them. And they will very likely end the same way: in disaster. Many people are going to see their portfolios get completely destroyed.

But you don’t have to be one of them.

Indeed, I can show you how to turn this period into a time of profits, NOT pain. To whit, my clients actually made money in 2008, having been warned a full three weeks in advance of the Crash to get out the market and go short.

I believe we could see another 2008 situation unfold in the near future, which is why I just unveiled six specific trades to subscribers… all of which will pay off HUGE returns as the current stock market collapse accelerates.

We’ve also taken steps to prepare ourselves sand our loved ones for what’s coming to the US economy (bank holidays, food shortages, stock Crashes, debt defaults, civil unrest and more) with my Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports: 40+ pages of material devoted to showing individual investors how to prepare these areas of their lives in great detail.

So we’re ready for whatever may come. And the worse things get… the more profitable our strategy will be.

If you’ve yet to take these steps yourself, it’s not too late… in fact, you’ve still got time to get your financial “house” in order to not only survive what’s coming… but potentially even make serious money from it.

All you need to do is take out a “trial” subscription to my Private Wealth Advisory newsletter. You’ll immediately be given access to the Private Wealth Advisory archives. You’ll also receive copies of the reports I detail above… and you’ll also be on my private client list to receive my bi-weekly investment reports as well as real-time trade updates on when to buy and sell various investments.

And if you should decide that Private Wealth Advisory is not for you, you can ask for a full refund during the first 30 days and I’ll return every cent of your subscription cost.

The reports you’ve downloaded during your “trial” period are yours to keep, even if you choose to cancel.

To get started with you Private Wealth Advisory subscription today, download the Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports and start taking action to prepare for what’s coming…

Good Investing!

Graham Summers

Editor In Chief

Gains Pains & Capital