24

Sep

2018

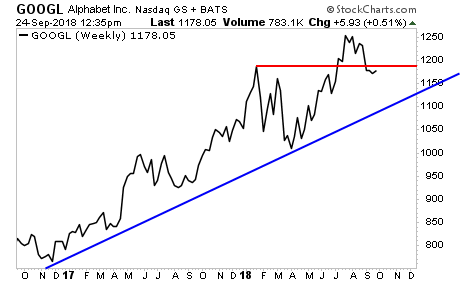

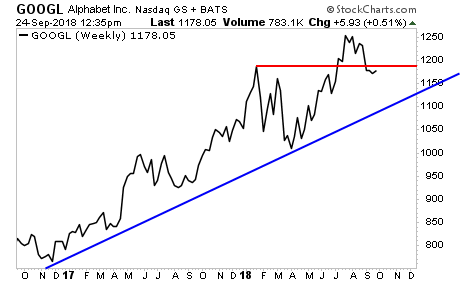

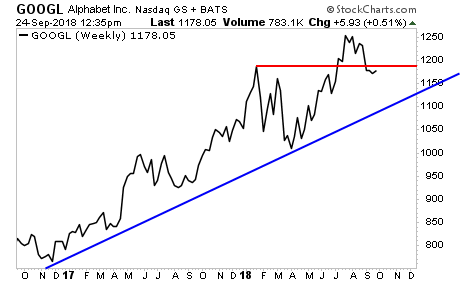

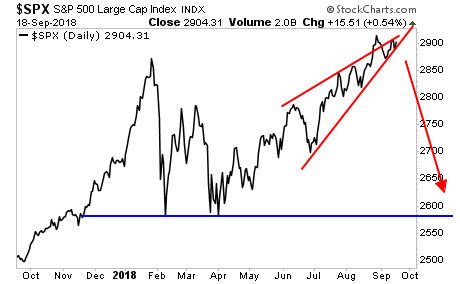

Alphabet Breaks Support… A drop looming? $GOOGL

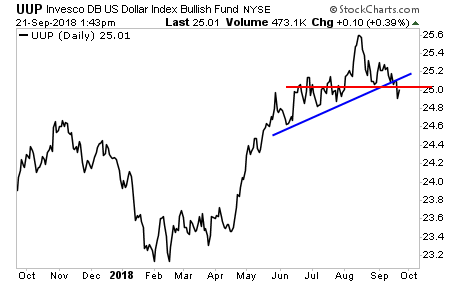

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

Around the globe, bond yields are now rising, having broken decade long downtrends.

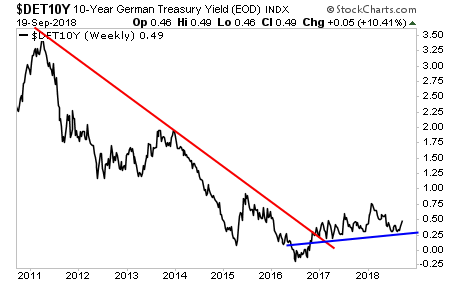

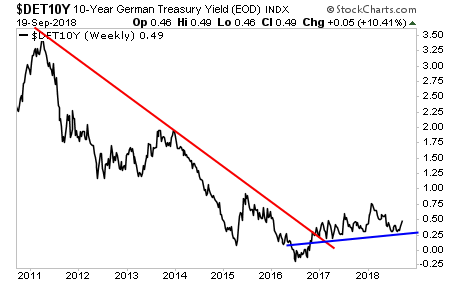

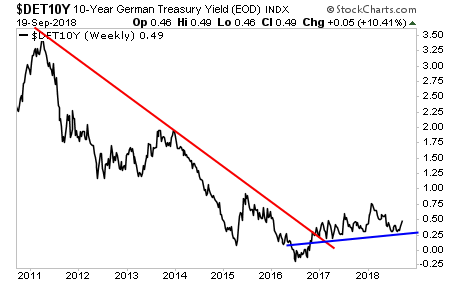

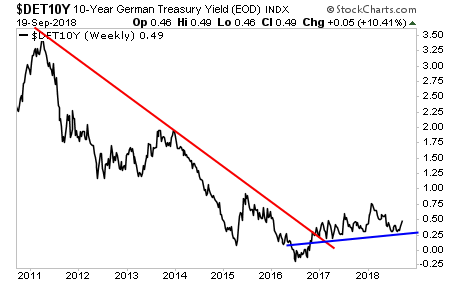

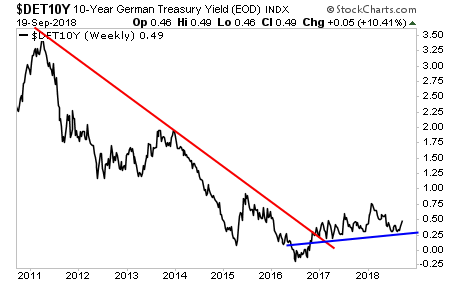

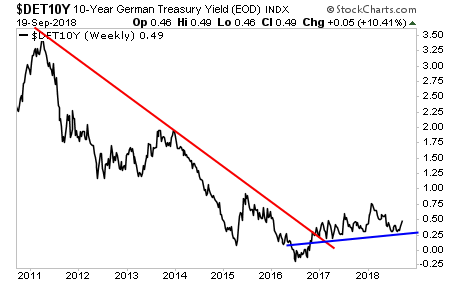

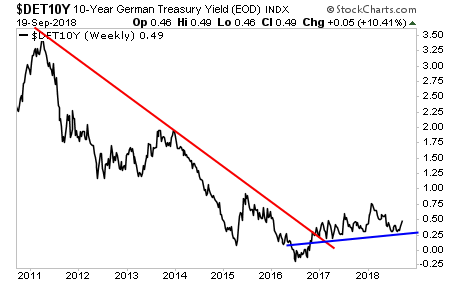

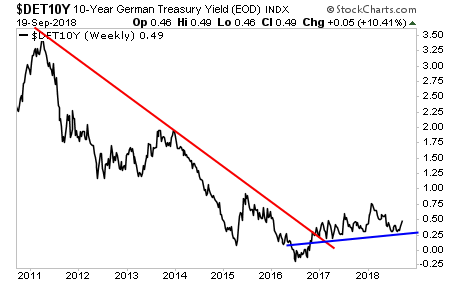

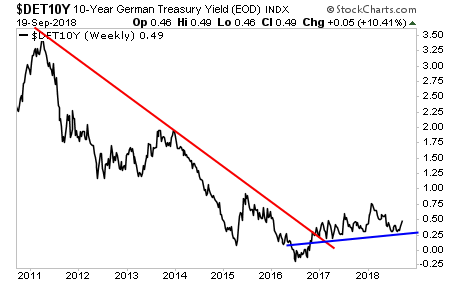

Germany’s 10-Year Government Bond Yields:

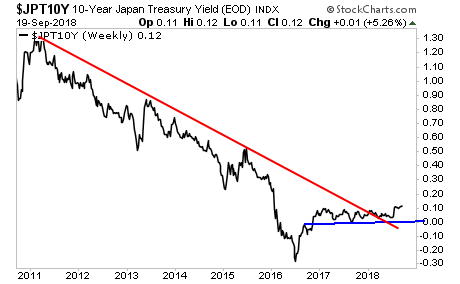

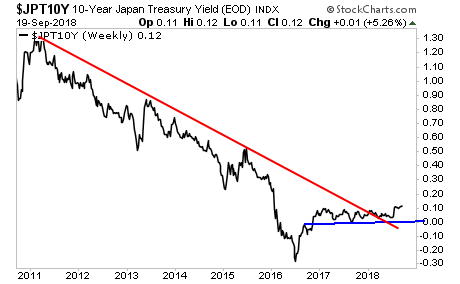

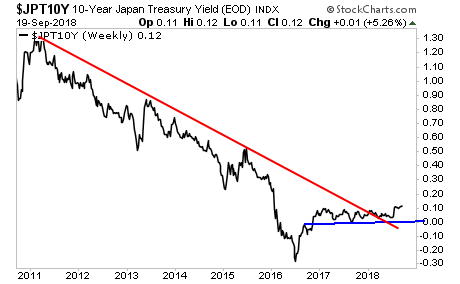

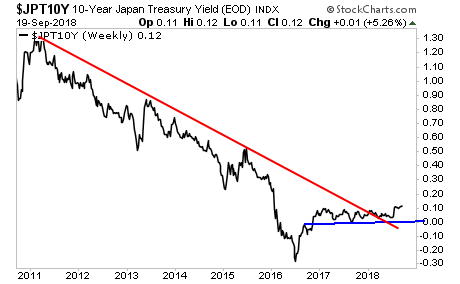

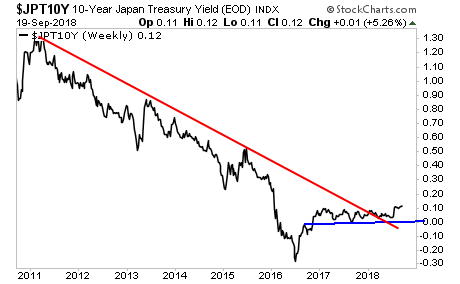

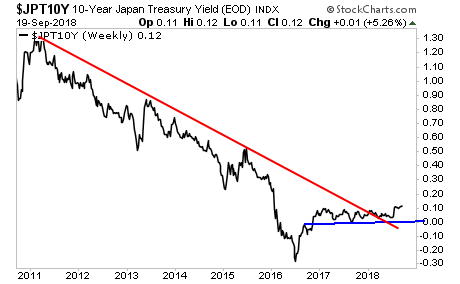

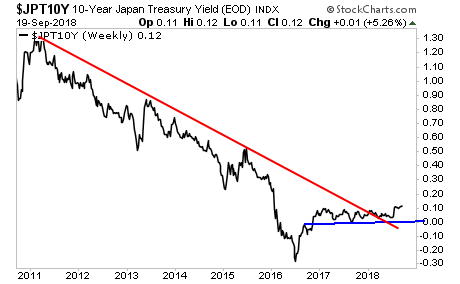

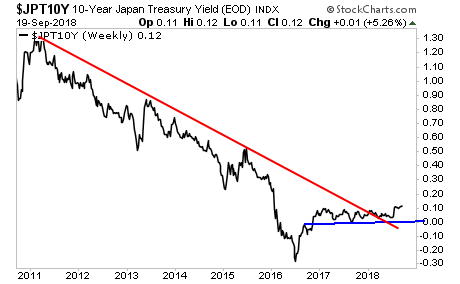

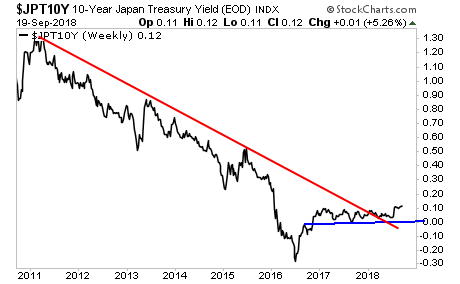

Japan’s 10-Year Government Bond Yields:

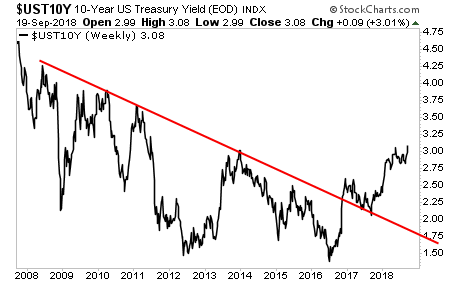

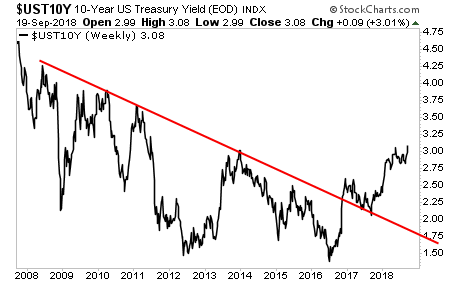

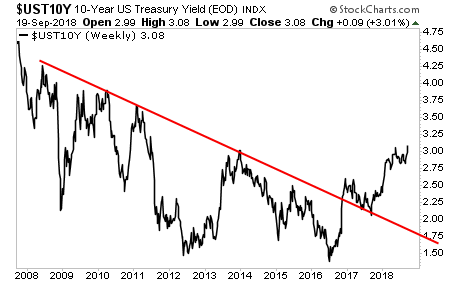

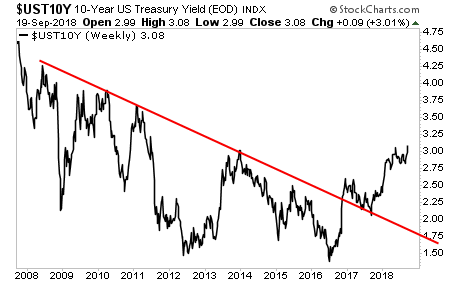

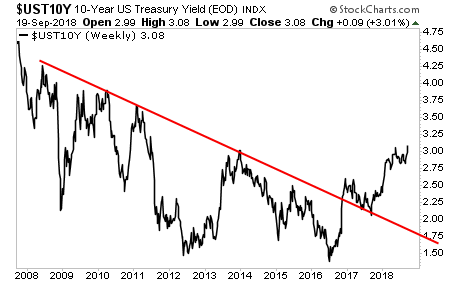

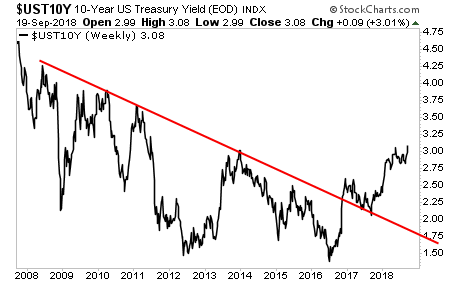

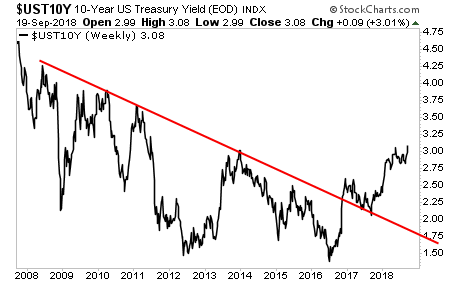

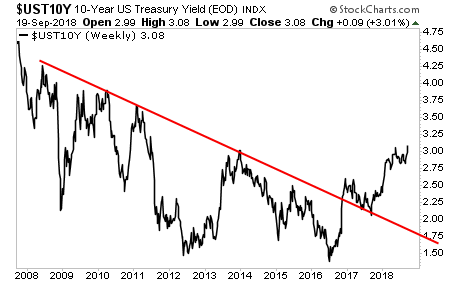

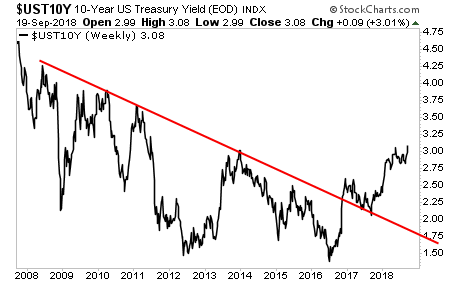

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

Around the globe, bond yields are now rising, having broken decade long downtrends.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

Around the globe, bond yields are now rising, having broken decade long downtrends.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

Around the globe, bond yields are now rising, having broken decade long downtrends.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Looks awful.

Dear Reader

Sometimes understanding how things work can be a bit lonely…

especially when it comes to knowledge of our current financial system.

Trust me, I know… if you want to talk about “banks” or

“the US Dollar” or “the Federal Reserve” to those around

you, they typically look at you as though you’re talking

about UFOs or some other crazy subject.

However, these issues affect all of us. There isn’t a person in

the United States (or the world for that matter) who is not

affected by the actions of the Central Bank one way or another.

This is a big reason why I chose to write my book

The Everything Bubble: The

Endgame For Central Bank Policy:

to explain how the financial system was set up and how it truly works…

NOT in complicated terms, but in a language that ANYONE,

even those with ZERO experience in finance, could understand.

On that note, Amazon is currently running a special on The Everything Bubble…

11% off on the

paperback and an astonishing 85% off on the Kindle version.

So if you’ve yet to pick up a copy… or would like to gift a copy

to family and friends, this is the single best opportunity all year to

do so.

To take advantage of these prices… and potentially change someone’s

life with the gift of knowledge and understanding of how our

financial system truly works…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

As if we didn’t have enough reasons to be concerned about stocks already, the bond market is blowing up again.

Why does this matter?

Because the entire move in the financial markets since 2008 has been based on Central Banks cornering the bond market. In the simplest of terms, Central Banks dealt with the crash in one major asset class (housing) by creating a bubble in another even more senior asset class (government bonds).

Because these bonds are the backbone of the current financial system, (the senior-most asset class), when they went into a bubble, everything followed.

Which is why the sudden rise in bond yields is a MAJOR problem.

If bond yields rise, bond prices fall.

If bond prices fall, the bond bubble begins to burst.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

As if we didn’t have enough reasons to be concerned about stocks already, the bond market is blowing up again.

Why does this matter?

Because the entire move in the financial markets since 2008 has been based on Central Banks cornering the bond market. In the simplest of terms, Central Banks dealt with the crash in one major asset class (housing) by creating a bubble in another even more senior asset class (government bonds).

Because these bonds are the backbone of the current financial system, (the senior-most asset class), when they went into a bubble, everything followed.

Which is why the sudden rise in bond yields is a MAJOR problem.

If bond yields rise, bond prices fall.

If bond prices fall, the bond bubble begins to burst.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

As if we didn’t have enough reasons to be concerned about stocks already, the bond market is blowing up again.

Why does this matter?

Because the entire move in the financial markets since 2008 has been based on Central Banks cornering the bond market. In the simplest of terms, Central Banks dealt with the crash in one major asset class (housing) by creating a bubble in another even more senior asset class (government bonds).

Because these bonds are the backbone of the current financial system, (the senior-most asset class), when they went into a bubble, everything followed.

Which is why the sudden rise in bond yields is a MAJOR problem.

If bond yields rise, bond prices fall.

If bond prices fall, the bond bubble begins to burst.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

As if we didn’t have enough reasons to be concerned about stocks already, the bond market is blowing up again.

Why does this matter?

Because the entire move in the financial markets since 2008 has been based on Central Banks cornering the bond market. In the simplest of terms, Central Banks dealt with the crash in one major asset class (housing) by creating a bubble in another even more senior asset class (government bonds).

Because these bonds are the backbone of the current financial system, (the senior-most asset class), when they went into a bubble, everything followed.

Which is why the sudden rise in bond yields is a MAJOR problem.

If bond yields rise, bond prices fall.

If bond prices fall, the bond bubble begins to burst.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

As if we didn’t have enough reasons to be concerned about stocks already, the bond market is blowing up again.

Why does this matter?

Because the entire move in the financial markets since 2008 has been based on Central Banks cornering the bond market. In the simplest of terms, Central Banks dealt with the crash in one major asset class (housing) by creating a bubble in another even more senior asset class (government bonds).

Because these bonds are the backbone of the current financial system, (the senior-most asset class), when they went into a bubble, everything followed.

Which is why the sudden rise in bond yields is a MAJOR problem.

If bond yields rise, bond prices fall.

If bond prices fall, the bond bubble begins to burst.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

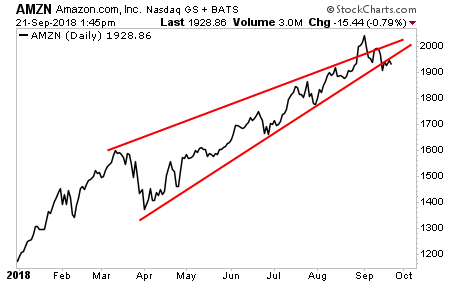

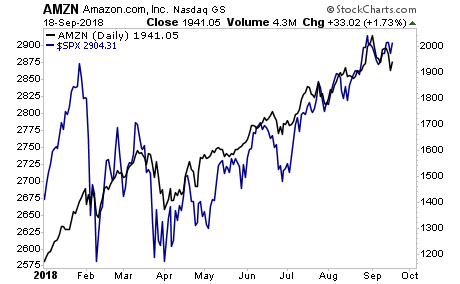

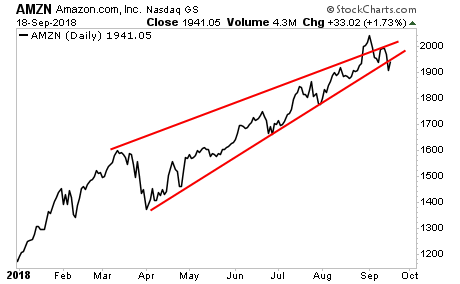

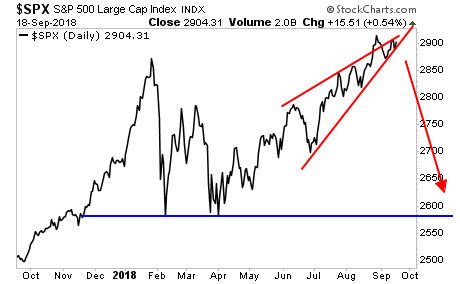

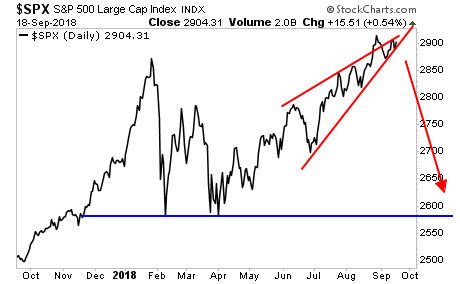

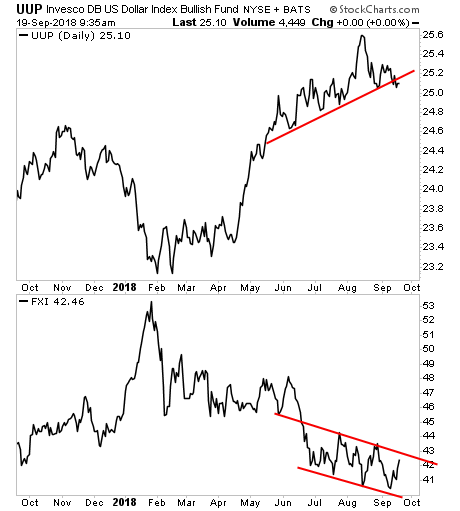

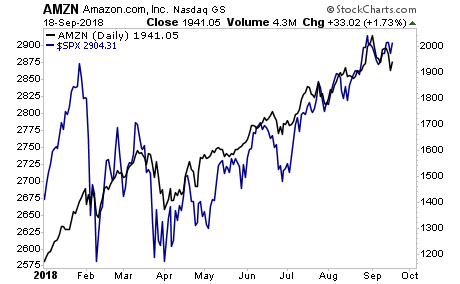

The single most important stock in the world is Amazon (AMZN)

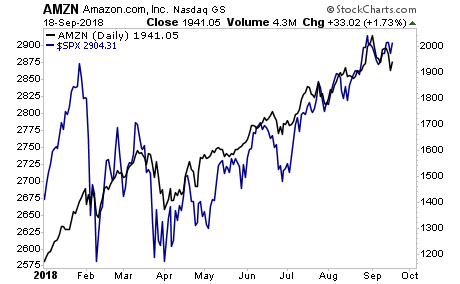

AMZN has become a proxy for the entire stock market. If you overlay AMZN’s chart with the S&P 500 (below) AMZN has lead the S&P 500 beautifully during this latest bull run.

Indeed, AMZN’s chart is effectively the same move as the broader market, with less volatility (not surprising given how intense buying has been of this one stock).

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

With that in mind, what happens to AMZN provides a glimpse into what will happen to the rest of the market. Which is why the failed breakout to the upside in August was a big warning to investors that the market was losing steam.

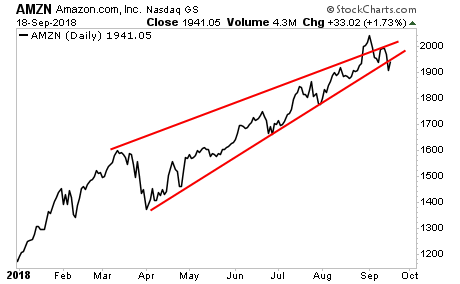

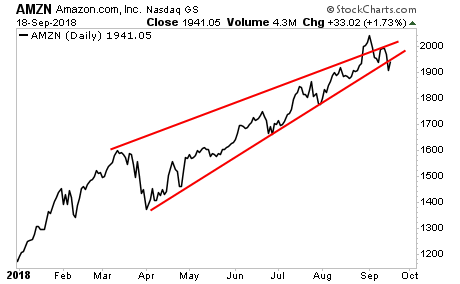

But what’s REALLY important is the recent breakdown. As you can see in the below chart, AMZN has broken its bull market trendline. It’s now bouncing to “kiss” former support. And if it cannot reclaim that line, the market is in SERIOUS trouble.

How serious?

Something like this.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

The single most important stock in the world is Amazon (AMZN)

AMZN has become a proxy for the entire stock market. If you overlay AMZN’s chart with the S&P 500 (below) AMZN has lead the S&P 500 beautifully during this latest bull run.

Indeed, AMZN’s chart is effectively the same move as the broader market, with less volatility (not surprising given how intense buying has been of this one stock).

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

With that in mind, what happens to AMZN provides a glimpse into what will happen to the rest of the market. Which is why the failed breakout to the upside in August was a big warning to investors that the market was losing steam.

But what’s REALLY important is the recent breakdown. As you can see in the below chart, AMZN has broken its bull market trendline. It’s now bouncing to “kiss” former support. And if it cannot reclaim that line, the market is in SERIOUS trouble.

How serious?

Something like this.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

The single most important stock in the world is Amazon (AMZN)

AMZN has become a proxy for the entire stock market. If you overlay AMZN’s chart with the S&P 500 (below) AMZN has lead the S&P 500 beautifully during this latest bull run.

Indeed, AMZN’s chart is effectively the same move as the broader market, with less volatility (not surprising given how intense buying has been of this one stock).

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

With that in mind, what happens to AMZN provides a glimpse into what will happen to the rest of the market. Which is why the failed breakout to the upside in August was a big warning to investors that the market was losing steam.

But what’s REALLY important is the recent breakdown. As you can see in the below chart, AMZN has broken its bull market trendline. It’s now bouncing to “kiss” former support. And if it cannot reclaim that line, the market is in SERIOUS trouble.

How serious?

Something like this.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research