Yesterday President Biden suggested that the U.S. might face another wave of lockdowns. Among the various policies he hinted at were:

1) Mandating that all Americans get the Covid-19 vaccines.

2) Shutting down businesses, schools, society like in 2020.

The question now is whether this is a political ploy or if the American people will go along with these proposed policies.

After all, the only reason we had lockdowns in 2020 was because people complied.

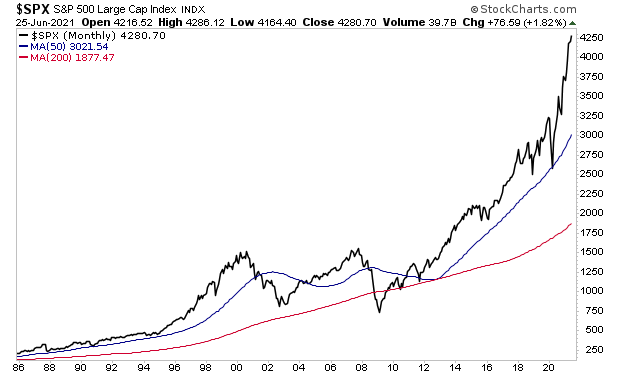

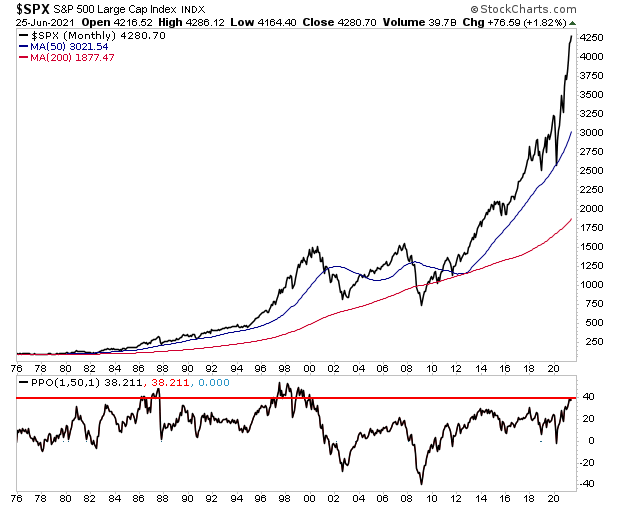

I’m not a psychic and cannot claim to have answers to this. But I do know that the stock market is forward-looking and can provide us with some clues.

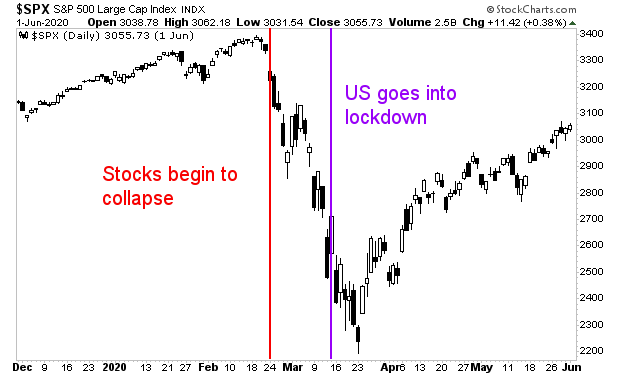

After all, back in 2020, stocks began to collapse in late February, several weeks before the country formally went into lockdown.

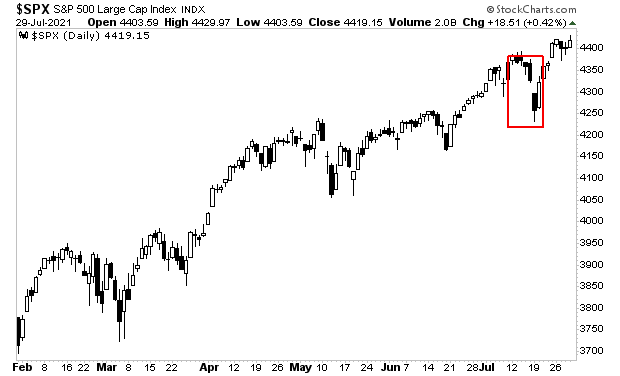

Today, stocks are not collapsing (at least not yet).

We had the beginnings of a breakdown in mid-July, but that quickly reversed and gave way to new all-time highs. Moreover, that particularly breakdown wasn’t distinguishable from other corrections over the last six months.

Still, it’s always good to keep an eye on things. So below are two stocks I’m watching for signs of whether or not another round of lockdowns is coming.

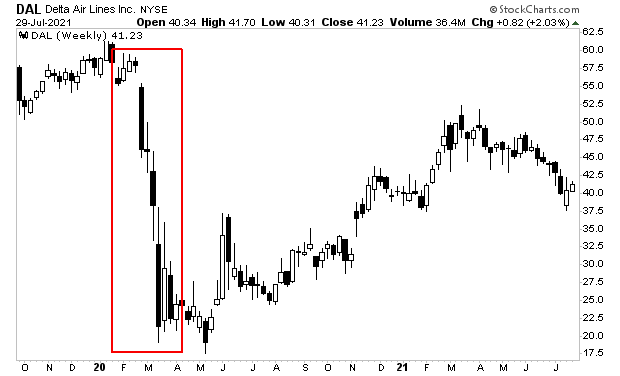

First is Delta Airlines (DAL).

Airlines were one of the hardest hit industries from the 2020 lockdowns. DAL was no exception with shares collapsing over 70% during the first wave of lockdowns (red rectangle).

If we’re heading into another round of lockdowns, I would expect this chart to breakdown BADLY in the coming days. DAL shares have begun to breakdown, but they’ve yet to really nosedive.

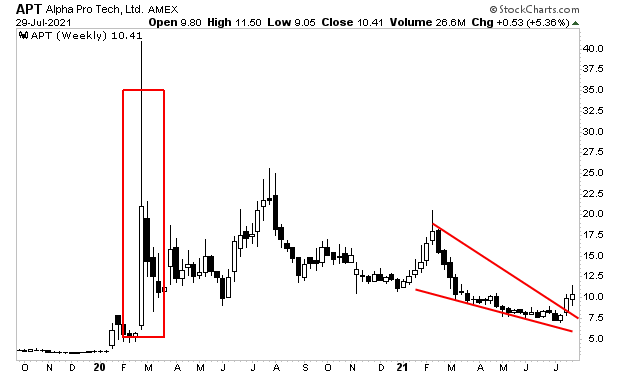

Another company I’m watching is Alpha Pro Tech (APT).

This company makes masks, hazmat suits, shields and other infection control apparel. If we were going towards another round of lockdowns, I would expect to see APT shares start to explode higher as they did in February of 2020 (red rectangle).

Is another COVID-19 shutdown coming? I don’t know. But if it does, we should experience another financial crisis.

With that in mind, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the general public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research