By Graham Summers, MBA | Chief Market Strategist

The Trump administration has announced multiple trade deals in the last few weeks.

Last week it was Japan, Indonesia and the Philippines. This week it’s the European Union (EU). One by one, nations are lining up to make deals with the U.S. And the deals are heavily in favor of the U.S., NOT the other nations.

Case in point, consider the details of the trade deal with the EU announced over the weekend.

- The U.S. will impose tariffs of 15% on all imports from the EU, except pharmaceuticals.

- The EU will impose tariffs of 0% on US goods, except automobiles which will face a 15% tariff.

- The EU will also purchase some $750 million in energy AND invest up to $600 billion in the U.S.

Frankly, this is an extremely lopsided deal in favor of the US… which is not too surprising given that the US is the top exporter nation for the EU. Take away US markets from EU exporters and the EU has a REAL problem. Still, it’s astonishing how many analysts and strategists believed that the US was going to be the loser in these negotiations.

Which brings us to the markets.

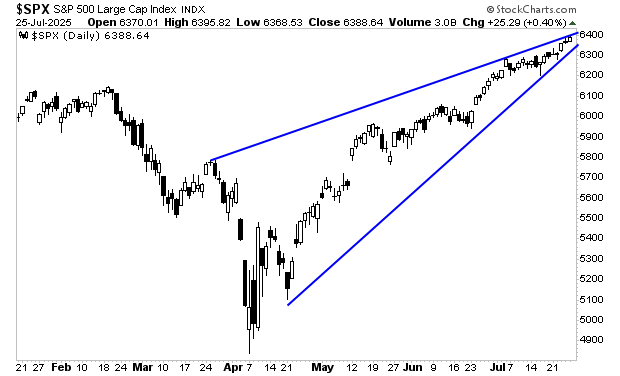

Stocks have climbed a wall of worry driven as they discounted these deals. They are now extremely overbought and more than due for a pullback. Indeed, the S&P 500 has formed a clear rising wedge formation, which is usually a bearish development. A breakout is coming… and the bulls better hope it’s UP, not down.

Indeed, the S&P 500 is now over 4% above its 10-week moving average (the same as the 50-DMA) and 9% above the 40-WMA (the same as the 200-DMA). Over the last three years, anytime stocks were this stretched to the upside, they corrected, usually well below the 10-WMA/ 50-DMA.

The big question is if the inevitable pullback will be a garden variety correction or the start of something worse: the bubble bursting and a crash.

To answer that, we rely on a proprietary market timing trigger that has caught every crisis of the last 45 years. We detail it, how it works, and what it’s currently saying about the markets in a special investment report How to Predict a Crash.

Normally we’d sell this report for $499, but in light of what’s happening in markets today, we’re making just 99 copies available to the investing public.

To pick one up…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research