By Graham Summers, MBA | Chief Market Strategist

As I warned yesterday, this market rally is extremely tired.

Stocks have gone straight up for three months. Trough to peak the S&P 500 is up over 30%. And has gone over 60 days without touching its 20-DMA. This is NOT normal market action and a consolidation if not a correction is long overdue. Indeed, the last time the S&P 500 had a streak such as this, was during the Dot Com Bubble!

Numerous red flags are now pointing towards a pullback hitting.

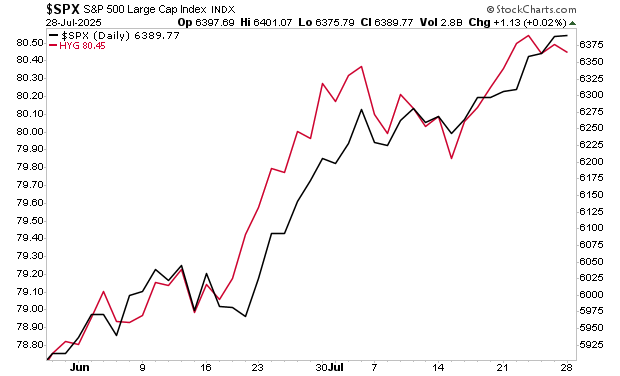

First and foremost, high yield credit which typically leads stocks (note how the red line led the black line during this recent rally) has already begun to roll over.

Secondly, market breadth, another metric that typically leads the overall index, has begun to roll over. Here again, this is a red flag that a pullback is coming shortly.

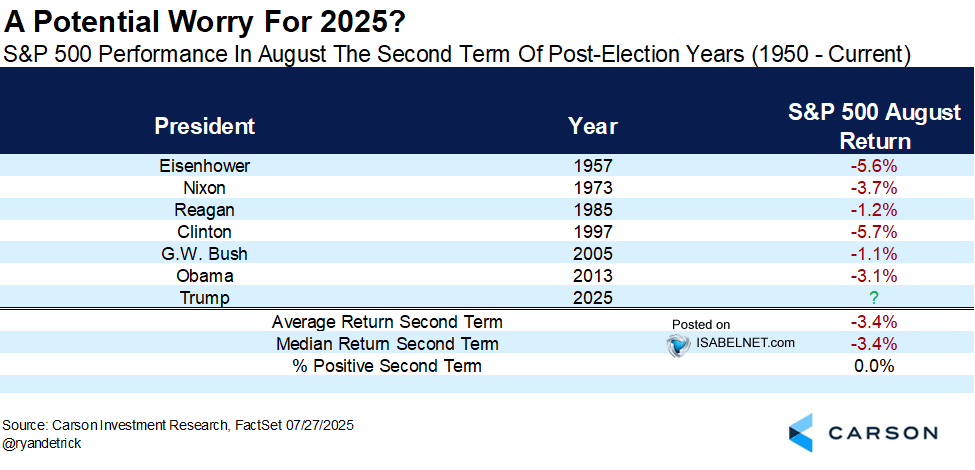

Finally, seasonals and historical trends are favoring a pullback. As Ryan Detrick notes, August is typically a weak month during the second term of a President. The average return is DOWN 3.4%.

Add if all up and numerous signals point towards a pullback if not a correction hitting shortly.

The big question is if the inevitable pullback will be a garden variety correction or the start of something worse: the bubble bursting and a crash.

To answer that, we rely on a proprietary market timing trigger that has caught every crisis of the last 45 years. We detail it, how it works, and what it’s currently saying about the markets in a special investment report How to Predict a Crash.

Normally we’d sell this report for $499, but in light of what’s happening in markets today, we’re making just 99 copies available to the investing public.

To pick one up…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research