I warned time and again that a correction was coming.

The signals were all there. Market leading metrics were rolling over. Multiple asset classes were signaling that a “risk off” move was coming. And stocks were entering a period that has historically been weak.

All the markets needed was a trigger.

That trigger arrived on Friday when the Bureau of Labor Statistics (BLS) revealed that ~250,000 of the jobs created in the last three months were in fact fake. July’s jobs numbers came in at 73,000, well below estimates of 104,000 while June and May’s numbers were revised DOWN 133,000 and 125,000, respectively.

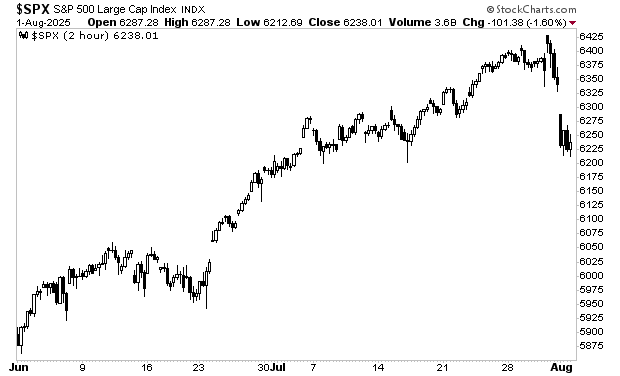

The S&P 500 promptly erased a month’s worth of gains in a day.

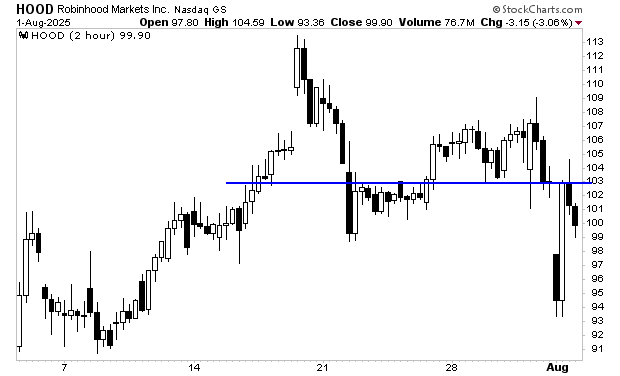

Momentum plays like RobinHood Markets (HOOD) fell even harder, losing over 3% in a single day. Even worse, despite a clear intervention to push the markets higher, HOOD was rejected by former support, signaling that it is now overhead resistance. This is a clear signal that the market’s dynamics have changed, and the markets are now in “risk off.”

Indeed, the selling pressure was so intense that stocks became oversold in the very short-term. However, I would be VERY careful about assuming the lows are in. The markets have gone straight up for nearly three months. And a single day of selling isn’t enough to reset things enough for the next major leg higher.

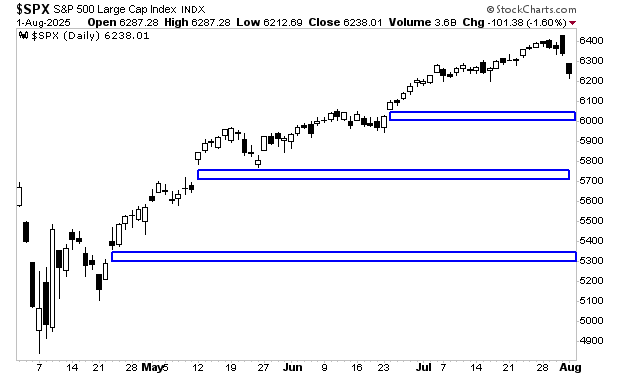

Consider that the rally from the April lows left three open gaps. The S&P 500 hasn’t even closed one yet. And truthfully, I wouldn’t be surprised to see stocks gradually work their way lower to close at least two of these in the next few weeks.

So again, I urge you not to rush back into the markets right now. Indeed, rather than looking to buy stocks aggressively, investors should focus on answering one question:

Will this be a garden variety correction…or are stocks about to roll over and REALLY collapse?

To answer that, we rely on a proprietary market timing trigger that has caught every market meltdown of the last 45 years. We detail it, how it works, and what it’s currently saying about the markets in a special investment report How to Predict a Crash. If you’re looking for a clear signal of when to get out of the markets, this is it!

Normally we’d sell this report for $499, but in light of what’s happening in markets today, we’re making just 99 copies available to the investing public.

To pick one up…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research