Yesterday, the Fed has hiked interest rates from 0.25% to 0.5%.

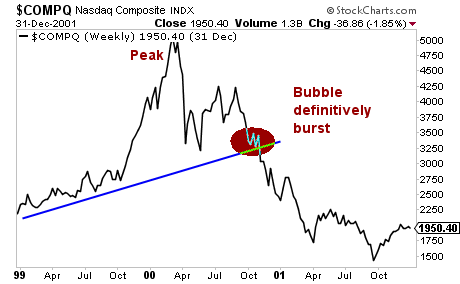

It is the first rate hike in 10 years. And it is now clear that the Fed is not only behind the ball in terms of raising rates… but that it has now primed the financial system for another 2008-type meltdown.

By way of background we need to consider the relationship between the US Dollar and the Euro.

The Euro comprises 56% of the basket of currencies against which the US Dollar is valued. As such, the Euro and the Dollar have a unique relationship in which whatever happens to the one will have an outsized impact on the other.

Here’s why the Fed’s decision to raise rates will implode the financial system.

In June 2014 the ECB cut interest rates to negative. Before this, the interest rate differential between the Euro and the US Dollar was just 0.25% (the US Dollar was yielding 0.25% while the deposit rate on the Euro was at exactly zero).

While significant, the interest rate differential was not enough to kick off a complete flight of capital from the Euro to the US Dollar. However, when the ECB launched NIRP, cutting its deposit rate to negative 0.1%, the rate differential (now 0.35%) and punitive qualities of NIRP (it actually cost money to park capital in the Euro) resulted in vast quantities of capital fleeing Euros and moving into the US Dollar.

Soon after, the US Dollar erupted higher, breaking out of a multiyear triangle pattern and soaring over 25% in a matter of nine months.

To put this into perspective, this move was larger in scope than the “flight to safety” that occurred in 2008 when everyone thought the world was ending.

To put this into perspective, this move was larger in scope than the “flight to safety” that occurred in 2008 when everyone thought the world was ending.

———————————————————————–

The Opportunity to Make Triple If Not QUADRUPLE Digit Gain is Here

The largest investor fortunes in history were made during crises.

For that reason, we’ve launched a special options trading service designed specifically to profit from the coming crisis.

It’s called THE CRISIS TRADER and already it’s locking in triple digit winners including gains of 151%, 182%, 261% and even 436%!

And the REAL crisis hasn’t even started yet!

We have an success rate of 72%(meaning you make money on more than 7 out of 10 trades)…and thanks to careful risk control, we’re outperforming the S&P 500 by over 50%!

Our next trade is going out shortly… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER...

———————————————————————–

The reason this is problematic?

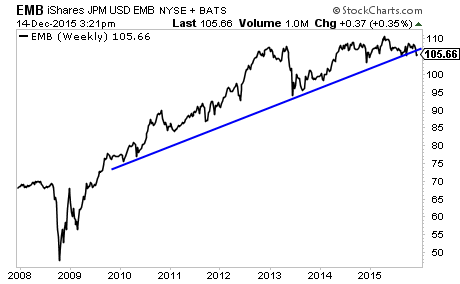

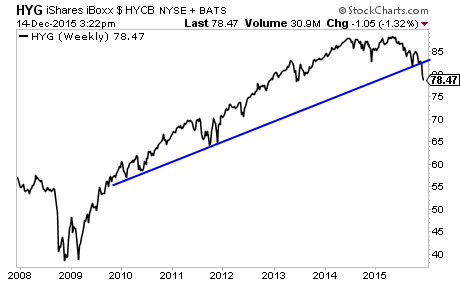

There are over $9 trillion in borrowed US Dollars sloshing around the financial system. And much of it is parked in assets that are denominated in emerging market currencies (the very currencies that have imploded as the US Dollar rallied).

This is the US Dollar carry trade… and it is larger in scope that the economies of Germany and Japan… combined.

In short, when the ECB cut rates to negative, the US Dollar carry trade began to blow up. The situation only worsened when the ECB cut rates even further into negative territory in September 2014 and again last week bringing the rate differential between the US Dollar and Euro to 0.55%.

Now, the Fed has raised interest rates to 0.5%. This has made the interest rate differential between the Euro and the US Dollar 0.75%. This will trigger a complete implosion of the $9 trillion US Dollar carry trade.

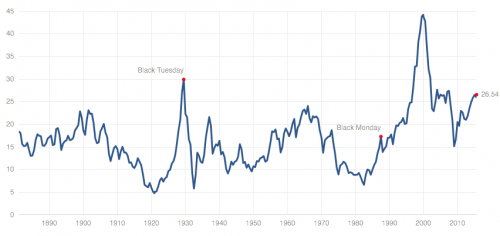

This is a long-term, multi-decade chart of the US Dollar.

As you can see it has just broken out of the largest falling wedge pattern in monetary history. The chart predicts that during the next leg up, the US Dollar will rally to 120 or even 130.

As you can see it has just broken out of the largest falling wedge pattern in monetary history. The chart predicts that during the next leg up, the US Dollar will rally to 120 or even 130.

At that point, the $9 trillion US Dollar carry trade will implode triggering a 2008-type event. Our timeline for this is within the next 12 months.

Smart investors are preparing now.

Private Wealth Advisory subscribers are already profiting from the markets, having just closed THREE more winners yesterday, bringing us to a FORTY THREE trade winning streak…

What is Private Wealth Advisory?

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets. Every week you get pages of high quality editorial presenting market conditions and outlining the best trades to make to profit from them.

It is the only newsletter to have closed 72 consecutive winning trades in a 12 month period (ZERO losers during that time). And we just began another winning streak last year, already racking up 43 straight winners.

And we’ve only closed ONE loser in the last FOURTEEN MONTHS.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents.

However, this offer will be expiring tomorrow at midnight. I cannot maintain a track record of over a YEAR of straight winners with thousands and thousands of investors following these recommendations.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory… and lock in one of the few remaining slots….

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research