The Fed has gone dovish. In fact, it’s going to allow inflation to explode higher.

That, in of itself, is significant… to understand why, we first need to acknowledge how the Fed currently operates to control risk in the financial system.

The Fed currently has two primary tools for controlling the financial system. They are:

1) The size of its balance sheet (via Quantitative Easing, or QE, and Quantitative Tightening, or QT, programs)

And …

2) The Fed Funds Rate which controls the prices of “money” in the system.

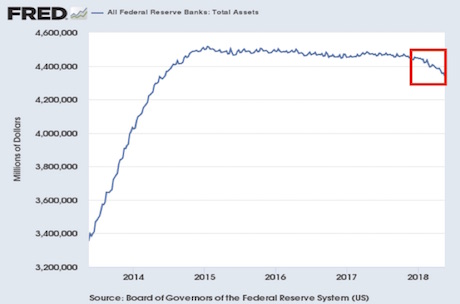

Regarding #1, after engaging off and on in QE for six years (2008-2014), the Fed has only been tapering QE for six months and it’s already in trouble.

The fact the Fed is already “pumping the brakes” despite having shrunken its balance sheet a mere $126 billion (less than 3% of its gargantuan $4.3 TRILLION balance sheet) is telling.

`

`

—————————————————————-

That Makes NINE Straight Double Digit Winners!

Our options trading system is on a HOT streak, having locked in NINE double digit winners in the last four weeks.

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 41% this year alone.

In fact, we haven’t had a losing trade APRIL 2018.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

Regarding #2, the Fed has raised the Fed Funds Target rate six times from 0.15% to its current level of 1.5%-1.75%. While this DOES seem significant, it is worth noting that these are usually the levels to which the Fed CUTs rates during a recession/ crisis.

Put another way, having kept the Fed Funds Target Rate at ZERO for seven years (’08-’15), even after some 2+ years of tightening, rates remain at levels that USUALLY mark EXTREMELY easy conditions.

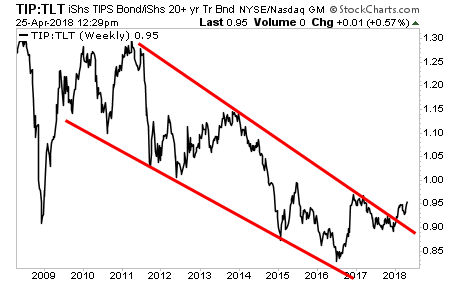

To conclude… both of the Fed’s primary tools for controlling the financial system have barely budged towards normalization… and the Fed is already going dovish. Indeed, the Fed opened the door to an inflationary “overshoot” of its 2% inflation target in last month’s FOMC release!

Let me be blunt… The Fed will ALWAYS understate things because its primary role is to maintain financial stability. So if the Fed is even hinting at permitting an inflationary overshoot, it’s because the Fed knows this is unavoidable.

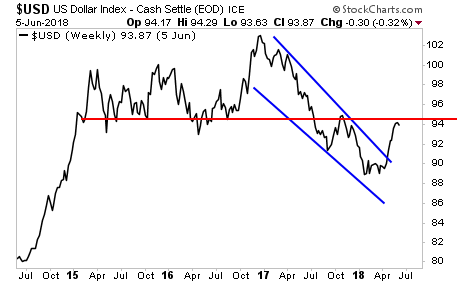

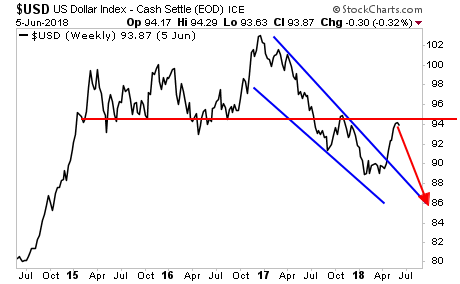

The $USD has already figured this out and is rolling over on its way to a NEW lows.

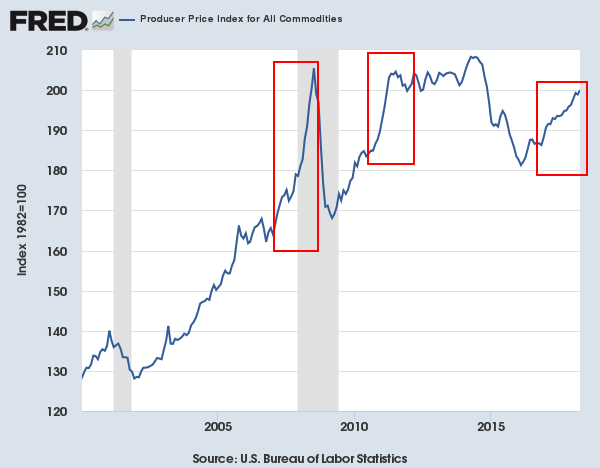

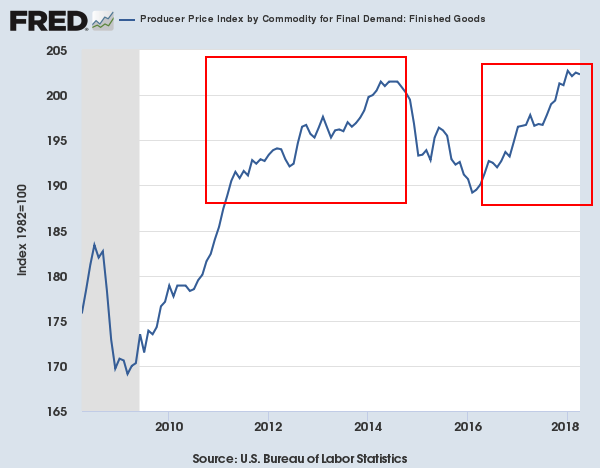

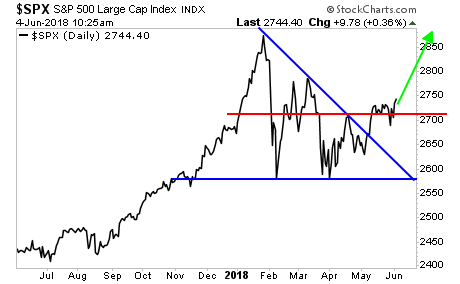

And this move is going to send risk assets, especially inflation/ reflation trades THROUGH THE ROOF.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist