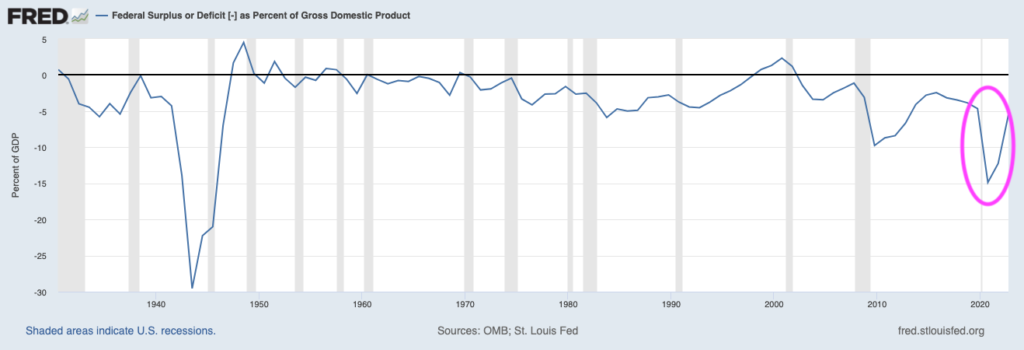

Japan is showing us the endgame for central bank insanity.

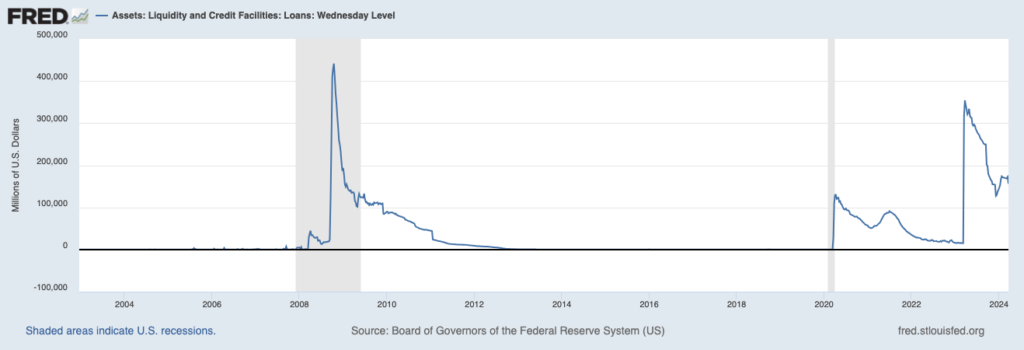

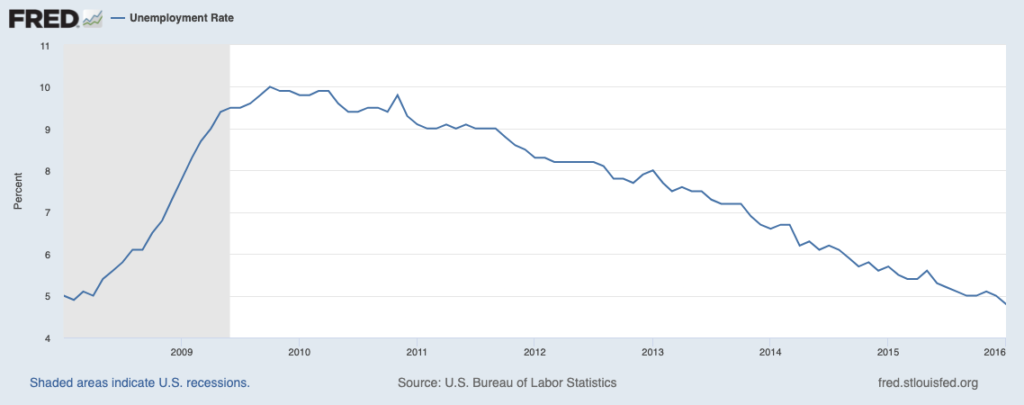

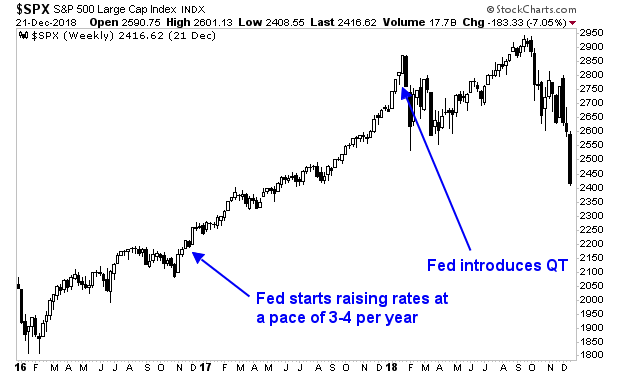

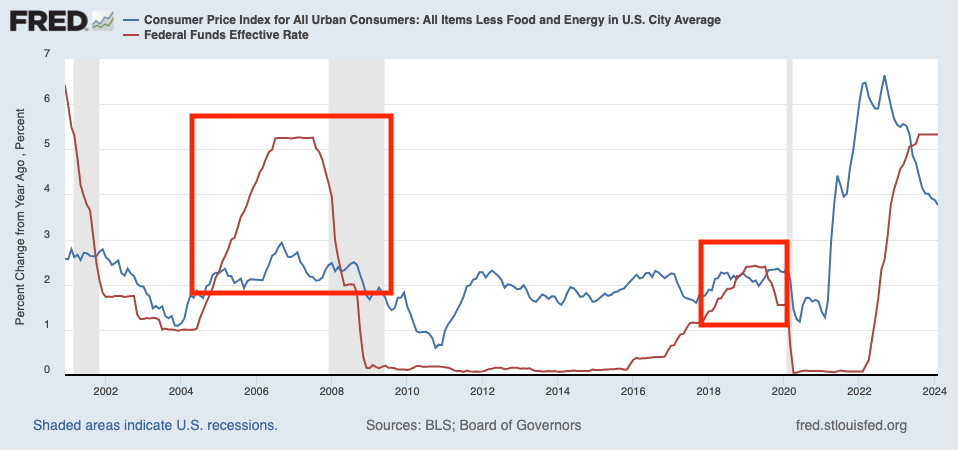

Ever since the Great Financial Crisis, the Fed has been following Japan’s playbook for propping up a financial system. Indeed, everything the Fed has done, Japan originally nearly a decade earlier.

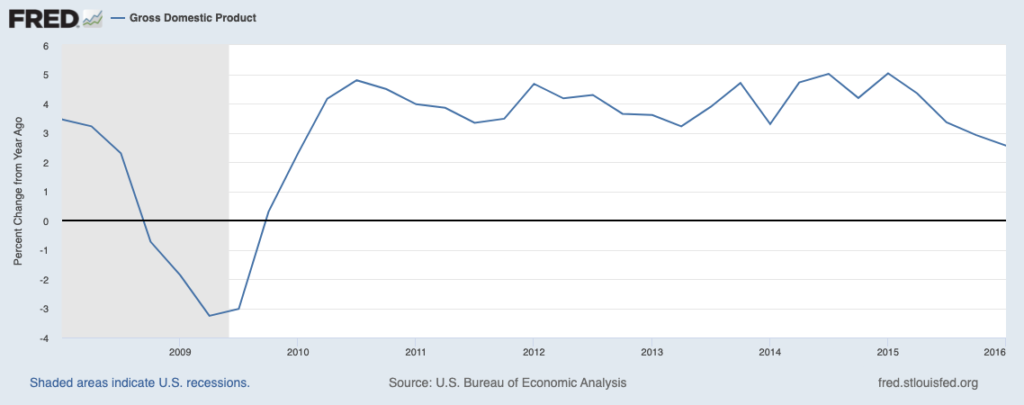

The Fed first cut interest rates to zero in 2008. Japan did that in 1999.

Similarly, the Fed first introduced large-scale Quantitative Easing (QE) programs in 2008. Japan first did that in 2001.

My point is that Japan is the grandfather for central bank insanity. Because of this, the current situation in that country bears watching as it shows us the endgame for what will eventually unfold in the US.

I’m talking about the collapse of a currency.

Japan’s currency, the Yen, started collapsed in 2002. Since that time, Japan’s central bank, the Bank of Japan or BoJ for short, has begun intervening to prop up the currency.

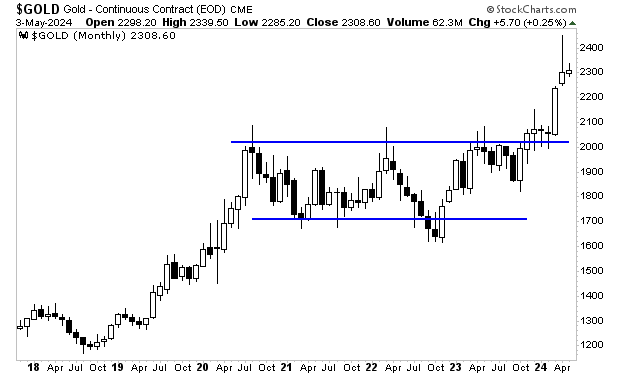

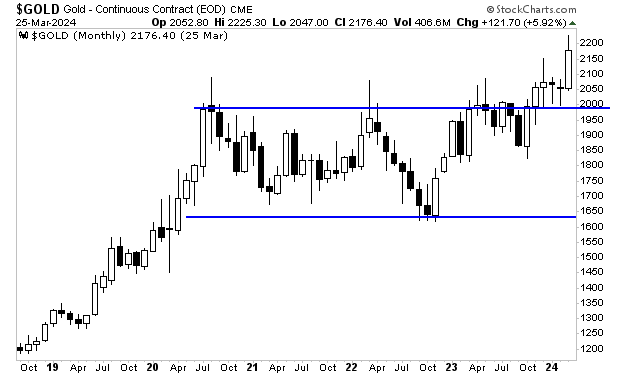

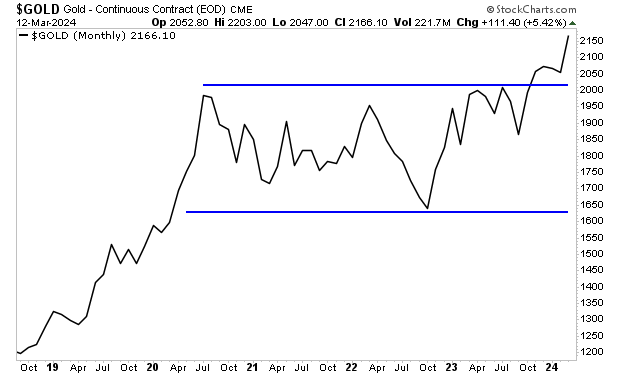

As you can see in the below chart, every single one of these interventions has failed. The Yen is now hanging on to the edge of a cliff by its fingernails. If this last line of support gives way, it could enter a free-fall.

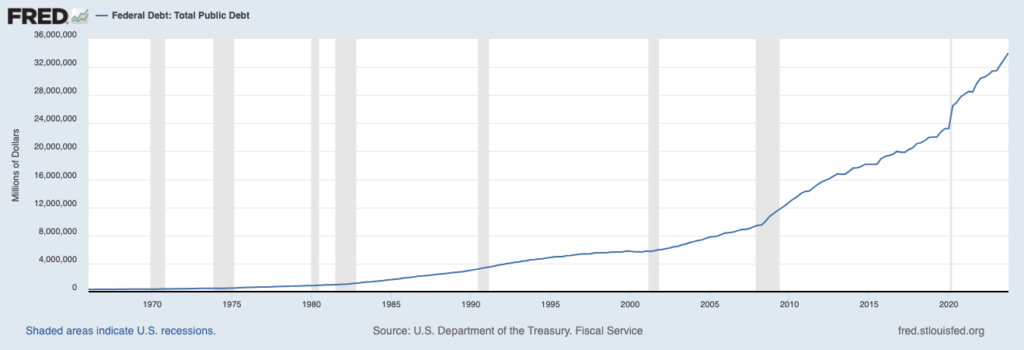

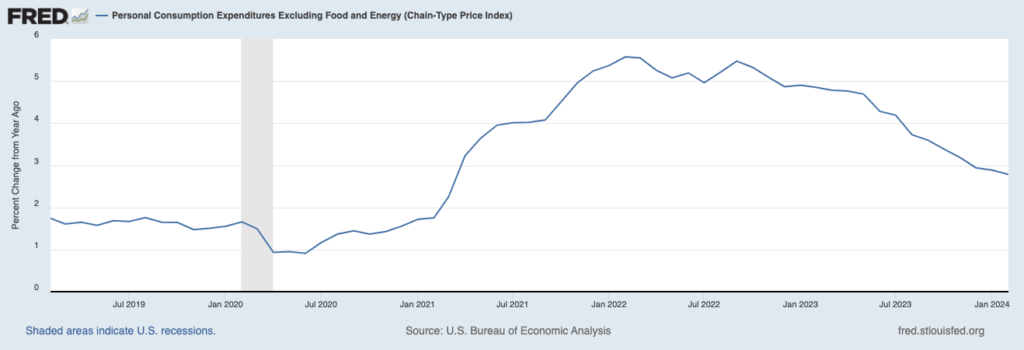

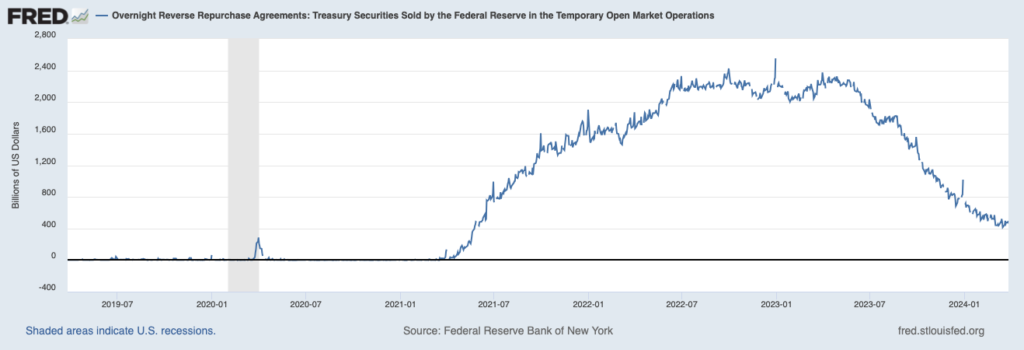

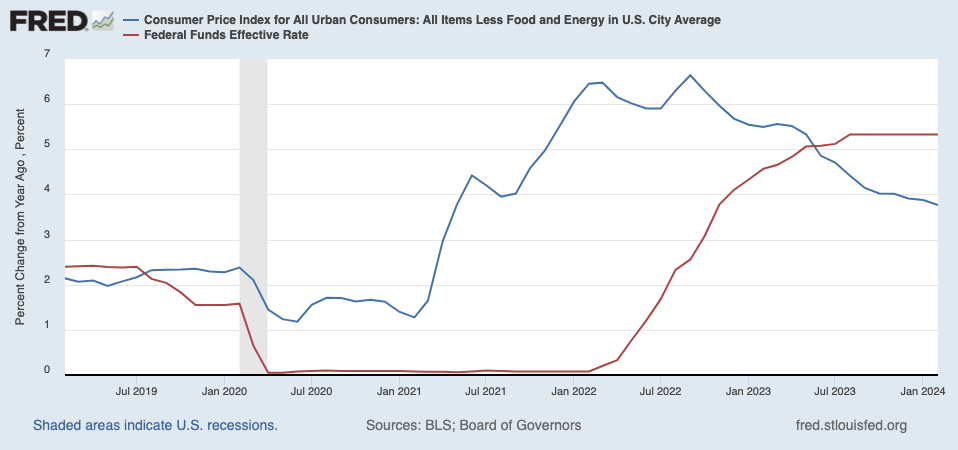

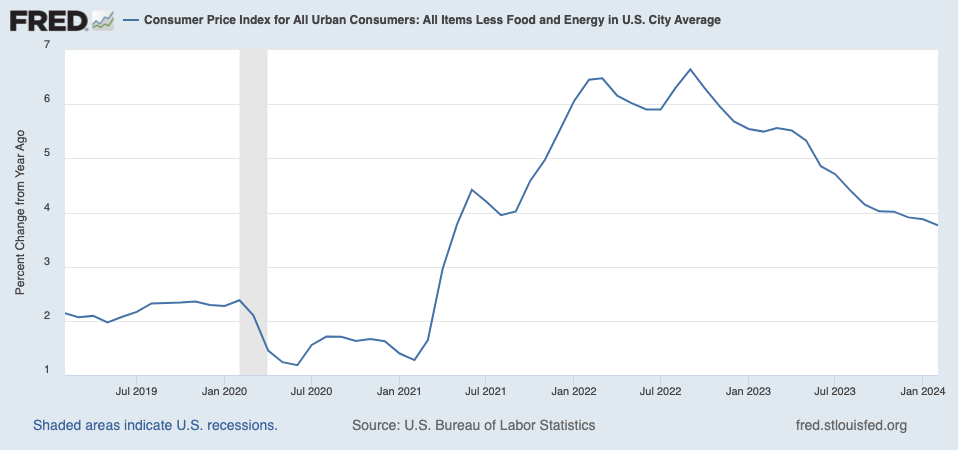

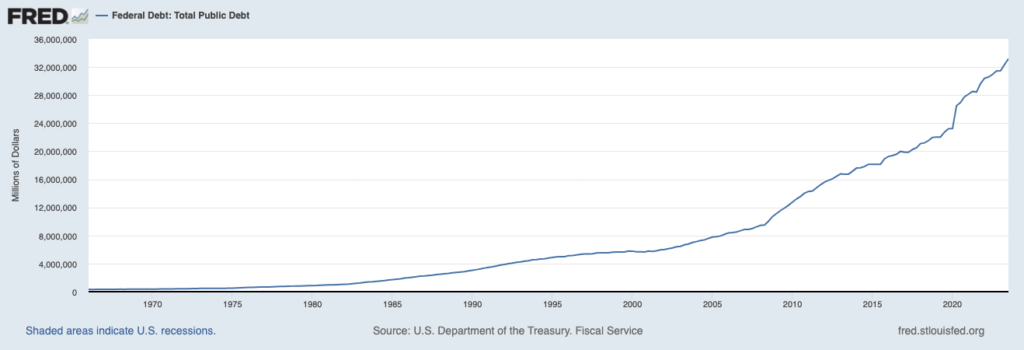

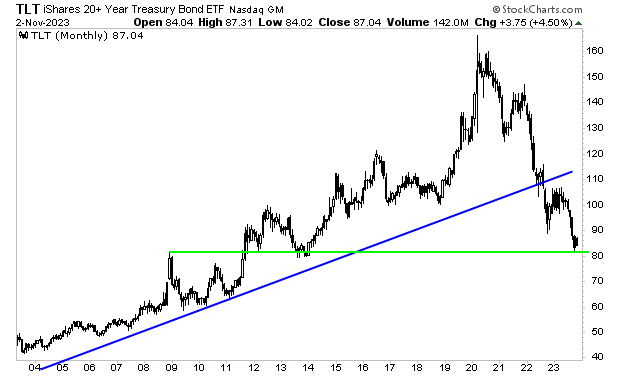

Put simply, the third largest economy in the world is on the verge of an outright currency collapse. And if you think this couldn’t happen in the U.S., you are mistaken. The Fed has already signaled that it will be inflating away the U.S. debt in the coming years.

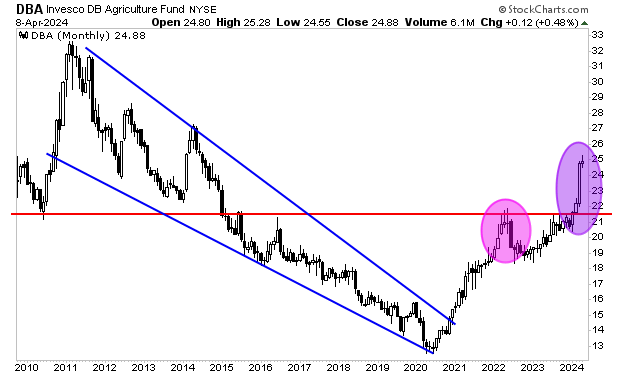

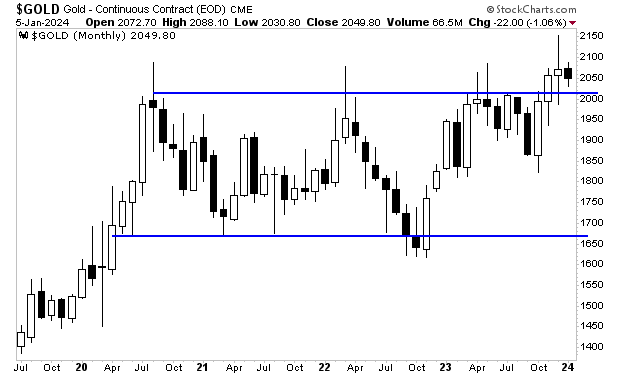

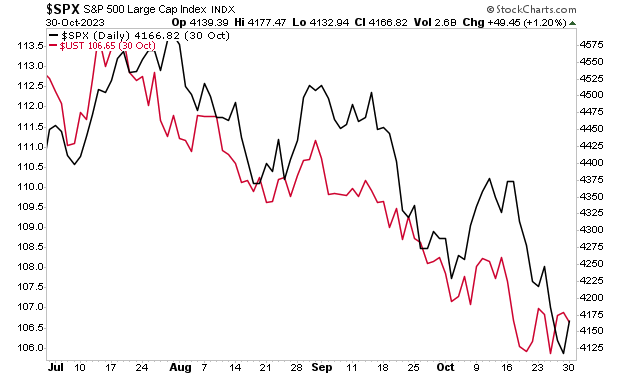

This means the $USD slowly entering a death spiral… and inflation trades making fortunes.

There is a LOT of money to be made here… and if you’re looking for a means to to insure you profit from it, we recently published a Special Investment Report detailing three investments that will profit from the Fed’s inflationary mistakes. As I write this, all three of them are exploding higher.

Normally this report would cost $499, but we are giving copies FREE to anyone who joins our daily market commentary.

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA