I’ve received a number of emails from readers asking me how I can be so certain that the $USD will be dropping hard going forward.

The answer is simple… neither the US Government, not the US corporate sector can afford an extremely strong $USD.

The Trump administration has proven itself to be Keynesian on steroids… and is planning to run $1 trillion deficits despite the roaring economy.

A strong $USD would make this very difficult to do.

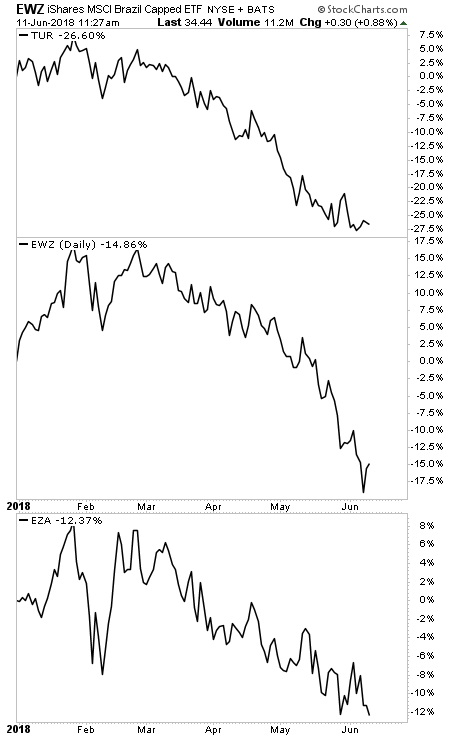

It would also have a highly negative impact on US corporations that derive nearly 50% of revenues from overseas. We are already seeing C-level executives discussing the negative impact on recent $USD strength during conference calls.

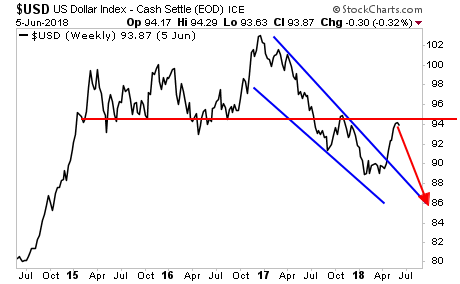

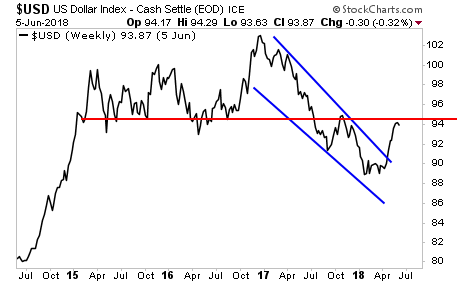

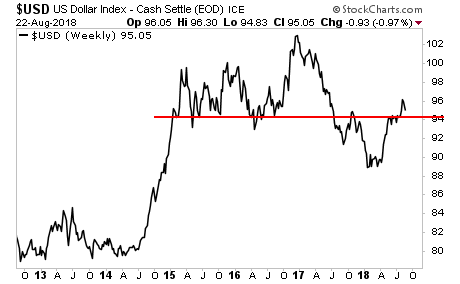

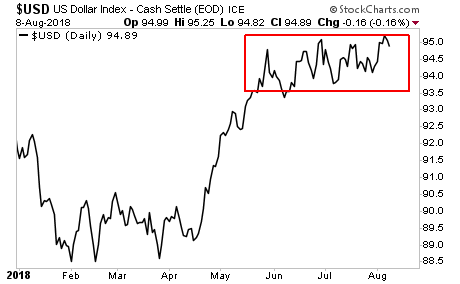

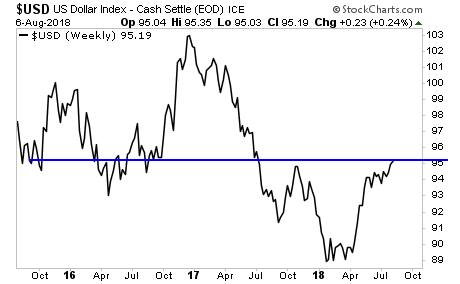

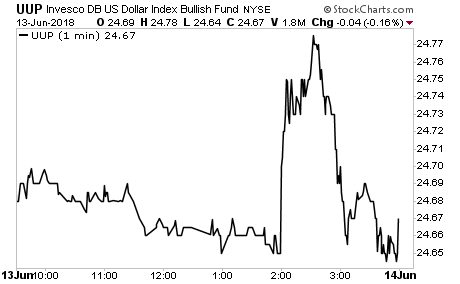

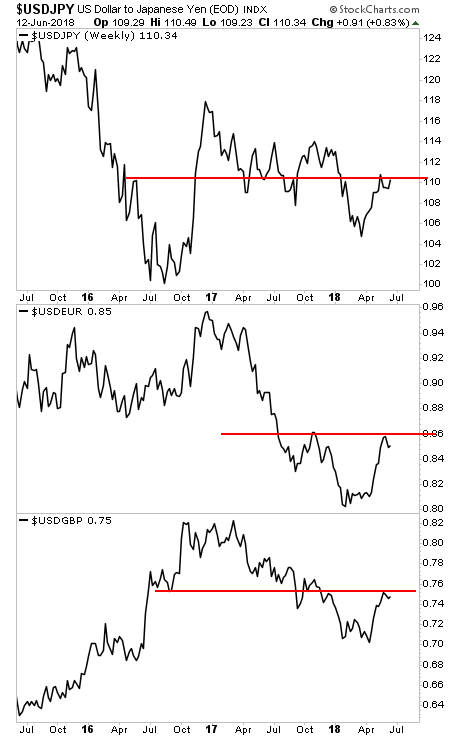

This happens any time the $USD approaches the mid-90s… which we call “the line in the sand.” There is a reason we had an “earnings recession” in 2015-2016: it’s the fact the $USD was in the upper -90s/ low 100s crushing profit margins.

Put simply, both the Government and the Corporate sector want the $USD to roll over here and now.

So we expect the $USD to roll over hard soon. But I want to be clear here… I’m calling for the $USD in the mid-80s… not some full-scale collapse.

Why?

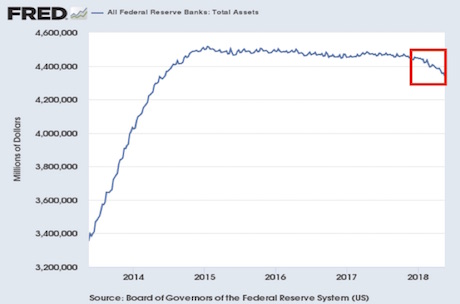

The Fed NEEDS the $USD to remain strong enough to attract capital so the US can continue to fund its deficits and debt issuance… but not strong enough that it actively hurts the economy.

If the $USD were to collapse rapidly it could cause a crisis of confidence in the currency. That is the LAST thing you want if you’re attempting to run $1 trillion deficits.

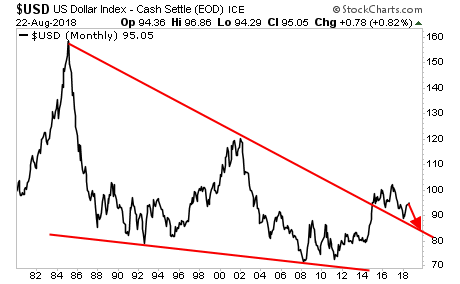

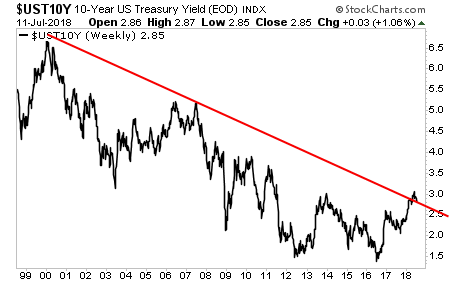

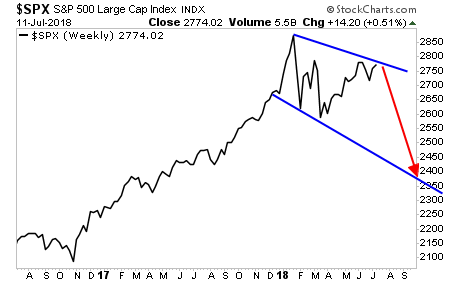

The long-term chart paints a nice picture for what I’m expecting. The $USD has in fact been forming a series of lower lows since 2014. The next low will take us to the mid’80s (see the red arrow).

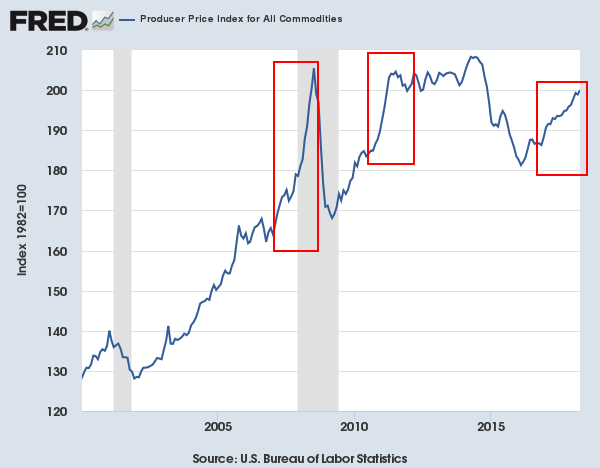

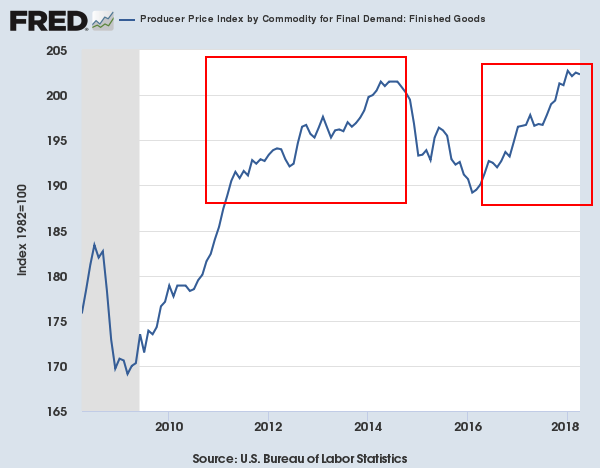

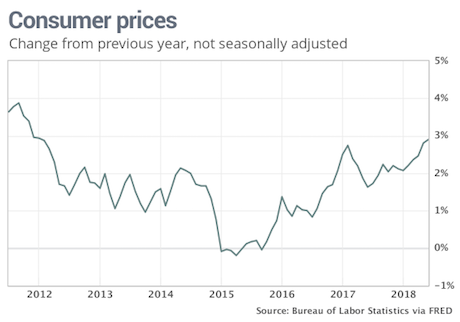

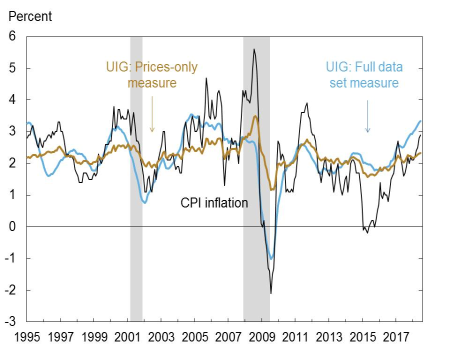

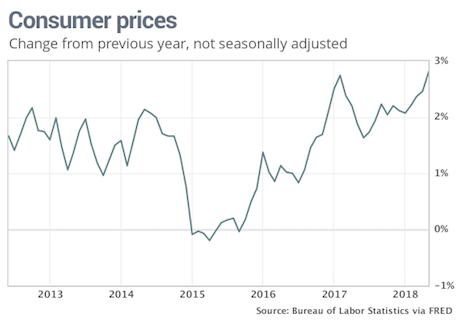

That’s a heck of a “tell” from the markets. And it’s “telling” us that we’re about to see a major inflationary move as the $USD drops hard.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm

We are making just 99 copies available to the public.

There are just 29 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

`

`