China is losing the trade war.

China is not going to be the next superpower. It never was. That was a lie fed to the public in order for voters to sign off on the US political class selling out the US for decades while the corporate class moved manufacturing/ industry offshore to boost profit margins.

The China “growth” story was in fact a “US selling itself out story.”

Remove the US from the equation and China would be in the same place as it was in the early ‘70s albeit with the same degree of economic expansion/development as most developing countries experienced over the same time period.

The key point in the above is that China is a derivative economy that has obtained its growth by stealing US IP and ripping off US products. Name a single major invention to come out of China? How about a single major technology that is a game changer?

You can’t. It’s not an organic economy.

What China IS good at is manufacturing a strong face to the world. But China’s economy/ financial system is rotten to its core, built on unregulated garbage loans/ financial products, and graft/ corruption. Whatever problems you might find in the US economy/ financial system, China is exponentially worse.

Bad debt? China hides its debt via structured products and unregulated loans. In reality China has a Debt to GDP ratio well over 300%. And that’s assuming those numbers are correct.

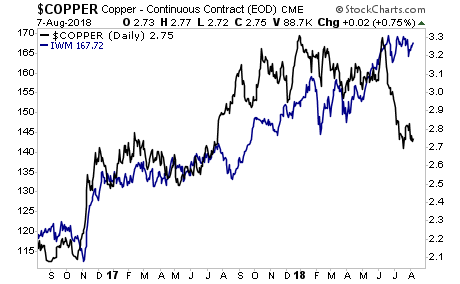

No one has a clue just what is going on in the black hole of the Chinese financial system. Remember when 80,000 tonnes of aluminum and 20,000 tonnes of copper of that was posted as collateral in China went missing in 2014? If an economy manages to lose tens of thousands of tonnes of metal, you better believe its even more careless with paper debts/ loans/ financial products.

What about corruption/ fraud? Time after time we’re told that the US political class is a bunch of crooks. Well, Chinese politicians make them look like amateurs. Between 1991–2011 it’s estimated that between 16,000–18,000 Chinese officials fled China taking 800 BILLION RMB (roughly $125 BILLION) with them.

Yes, Government officials stole $125 BILLION.

The list goes on and on.

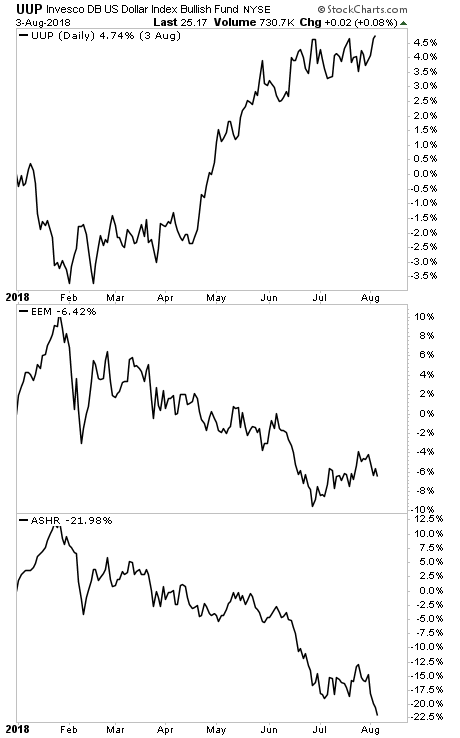

So while China will play the strong face in dealing with the Trump administration on trade, the fact is that China has a LOT more to lose than the US does.

China is the largest buyer of US oil in the world.

China also needs food/ commodities from the US.

What does the US need from China?

Debt financing? The Fed owns more US debt than China does. The market could absorb China liquidating its Treasuries in a matter of weeks.

Low quality/ low cost goods? Americans already own too much stuff. Why do we need to go more into debt to buy more junk?

At the end of the day it’s a simple equation… what is more NECESSARY to an economy… food/ energy or cheap TVs/ discretionary junk?

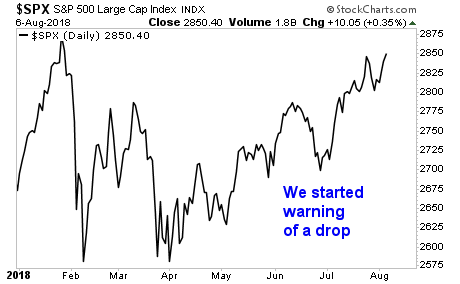

So what does this is all mean?

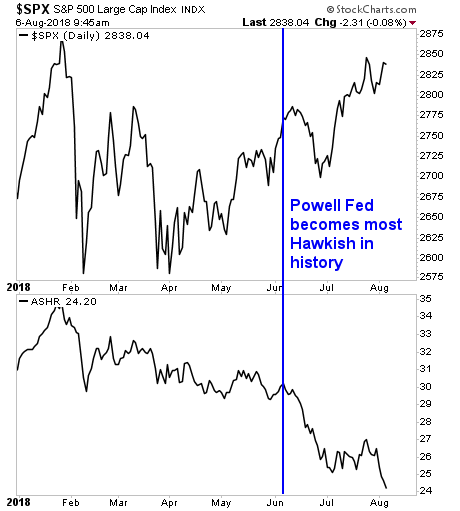

China is going to buckle soon. If the Trump administration gives the Chinese leadership an “out” through which it can sign a deal without looking weak, China will sign the dotted line.

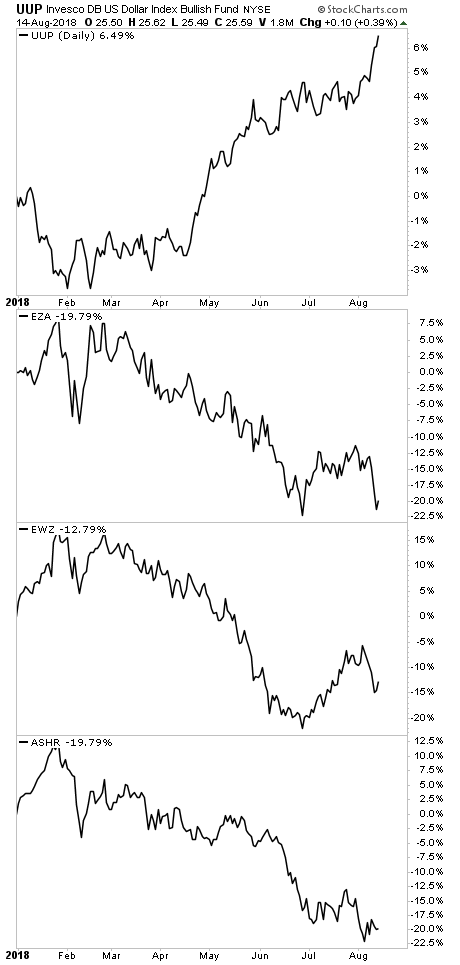

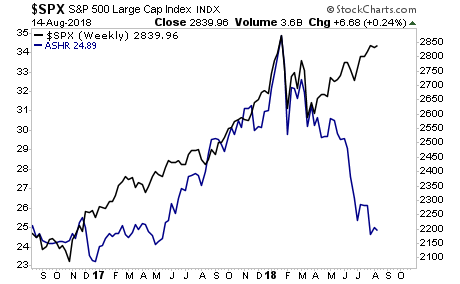

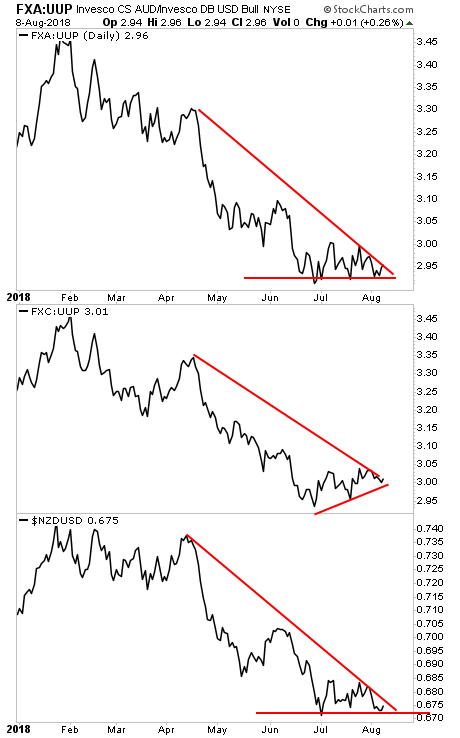

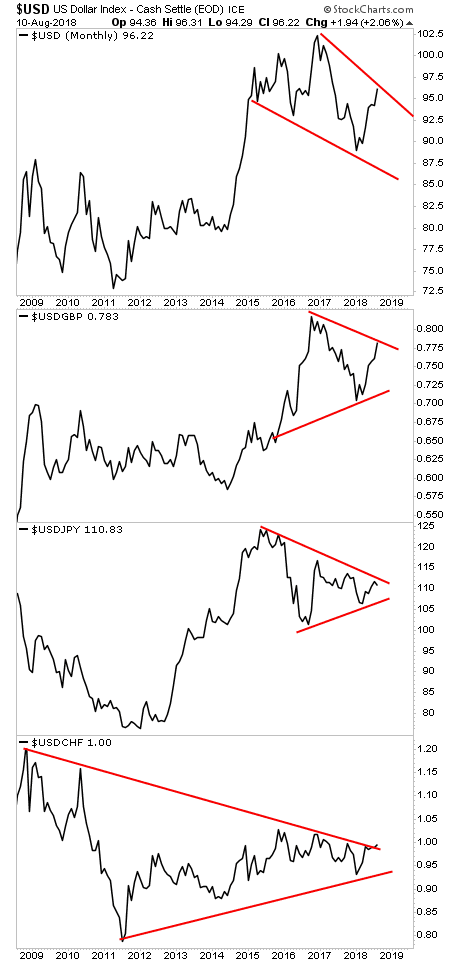

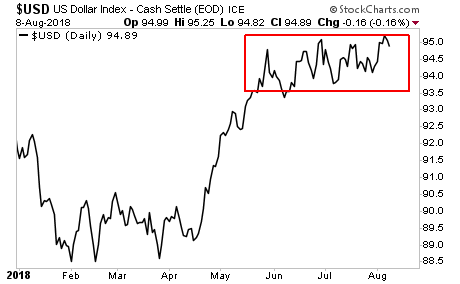

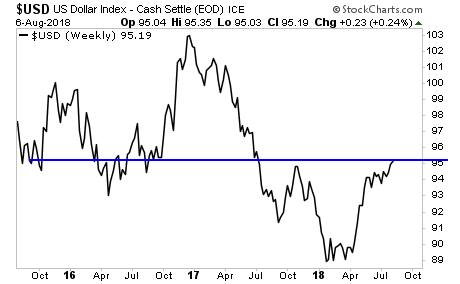

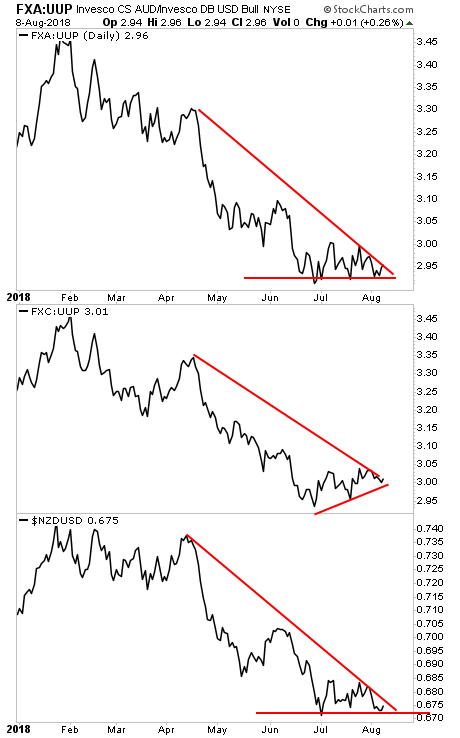

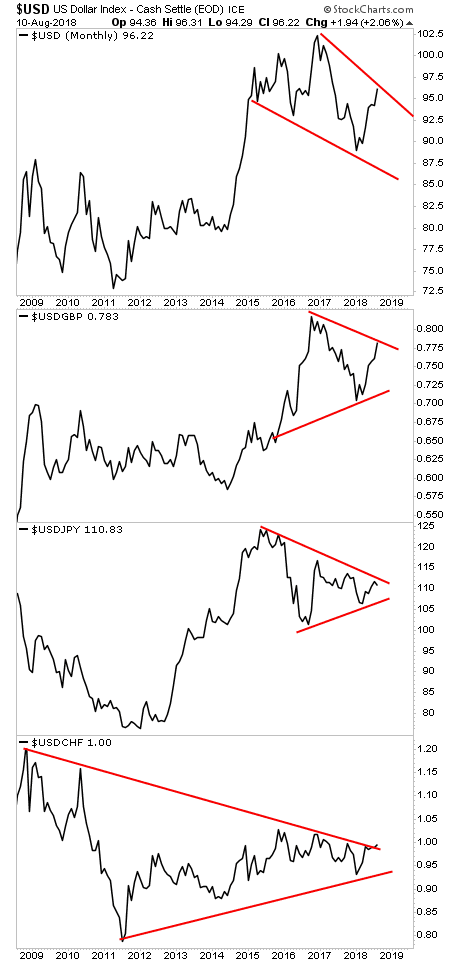

The markets know this, which is why, despite all the “world is ending/ trade wars/ deflation is coming” rhetoric, the $USD is well within the confines of long-term consolidation patterns.

Those big bad $USD breakouts were just bounces, occurring from massively oversold levels. The $USD hasn’t broken out of anything in the Big Picture.

By the way, given that both China and the US want a weak $USD… what are the odds the $USD spikes higher into a raging bull market?

The $USD is about to roll over in a massive way. When it does inflationary trades will EXPLODE higher.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm

We are making just 99 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research