By Graham Summers, MBA

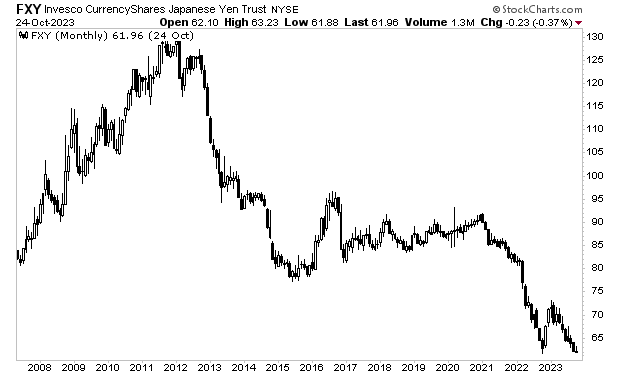

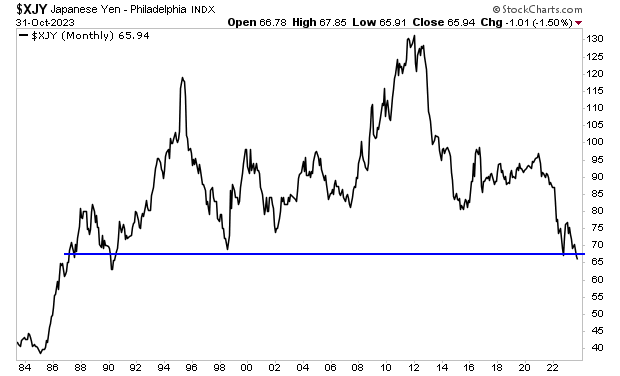

Japan’s currency is now collapsing.

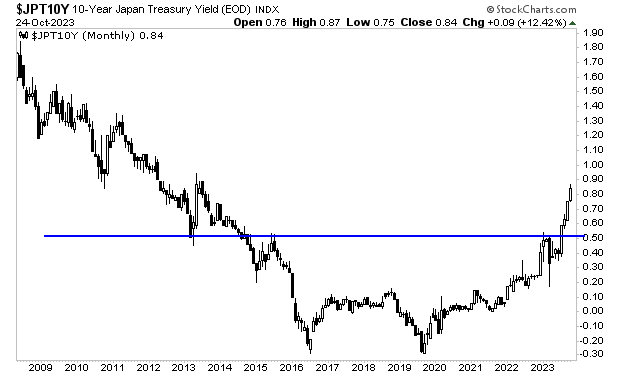

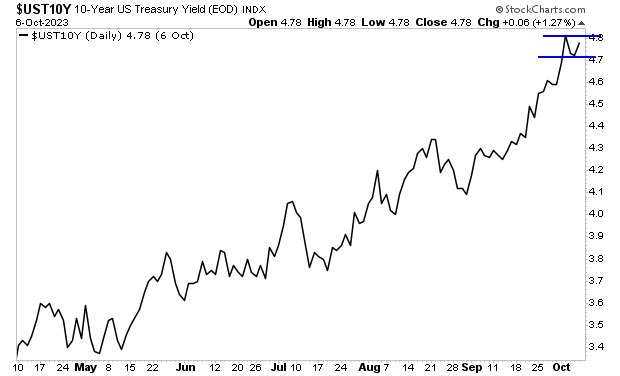

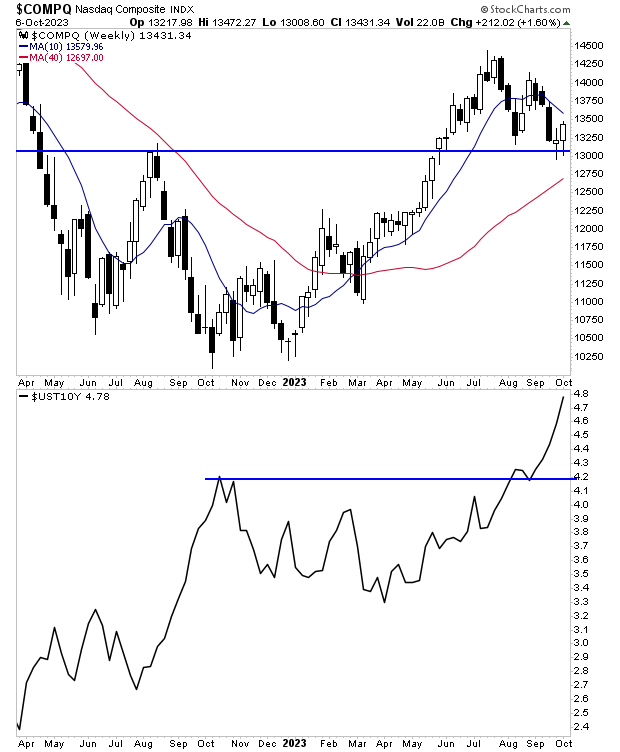

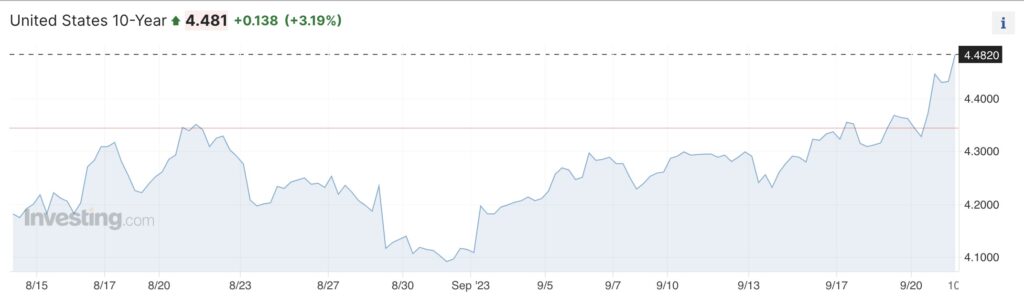

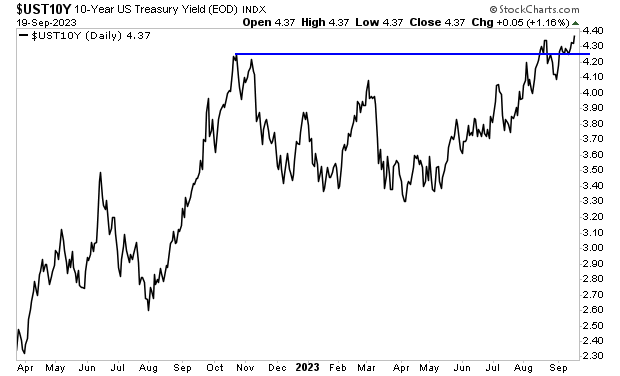

Japan’s central bank, the Bank of Japan (or BoJ for short) is currently engaged in an open-ended Quantitative Easing (QE) program. In its simplest rendering, the BoJ starts buying the 10-Year Japanese Government Bond any time that bond’s yield rises to 1% or higher.

It’s possibly the boldest QE program in history: a definitive “line in the sand” drawn by a major central bank as far as bonds are concerned. Again, this is an open-ended, unlimited QE program through which a MAJOR central bank does whatever it takes to keep is country’s bond yields from rising.

However, even this program is proving inadequate.

The BoJ has had to engage in previously unscheduled bond market interventions SIX TIMES in the last four weeks. And yesterday, it finally gave in and announced that its “line in the sand” of 1% for the yield on the 10-Year Japanese Government bond is now a “loose upper bound” instead of a definitive cap.

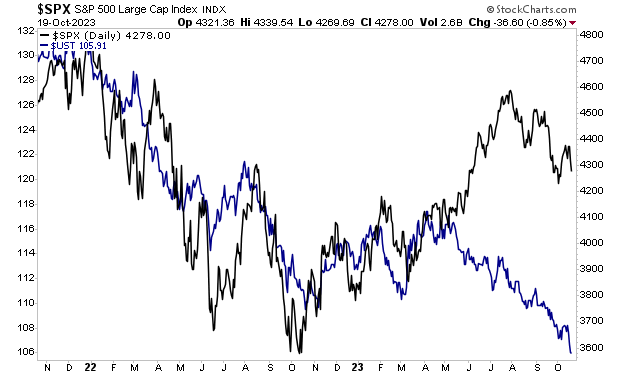

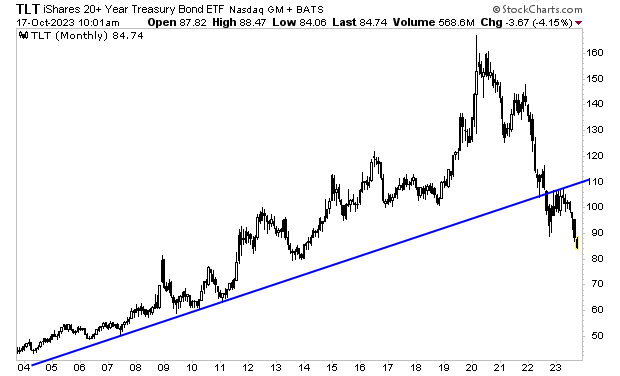

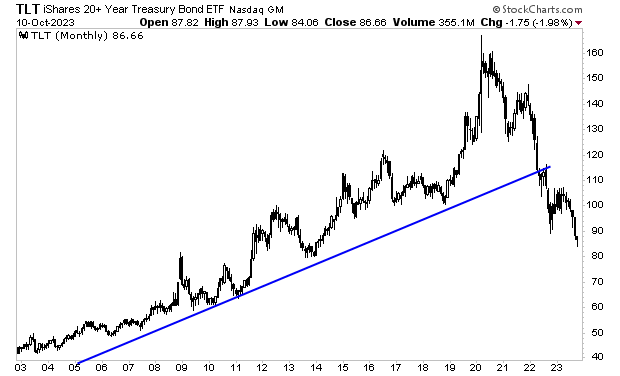

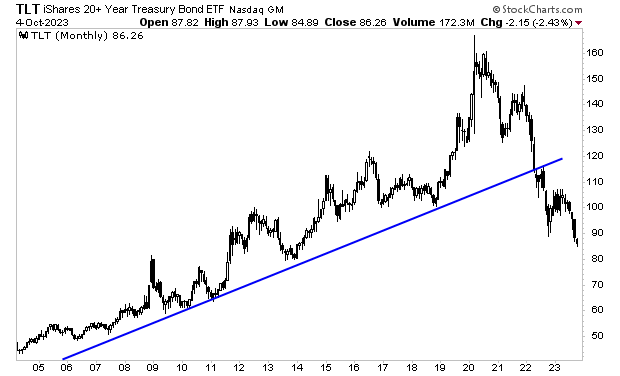

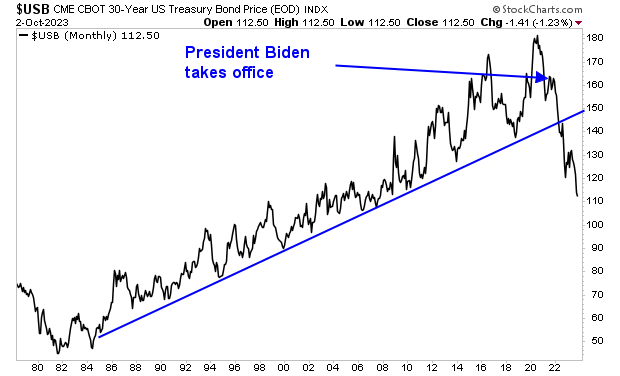

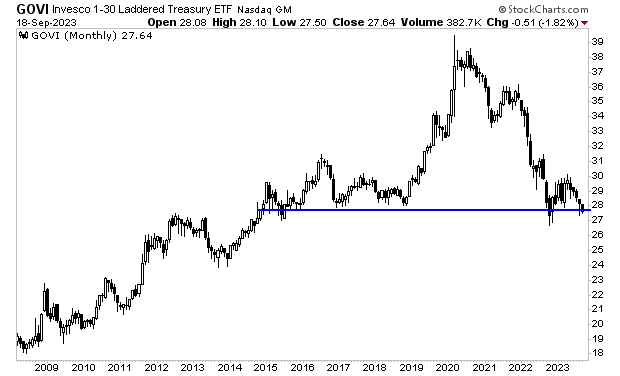

The below chart needs little explanation.

In response to this announcement, Japan’s currency, the Yen, broke to new lows. The Yen hasn’t traded at this level since the late 1980s!

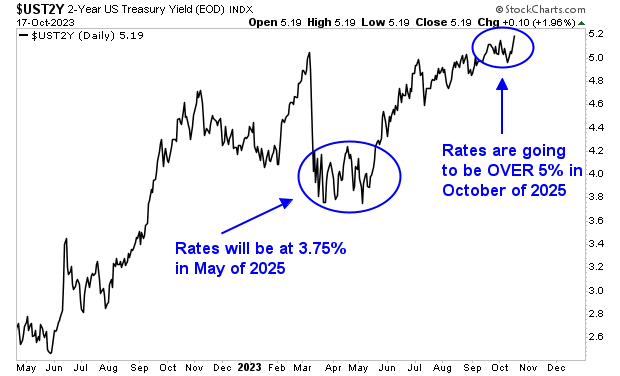

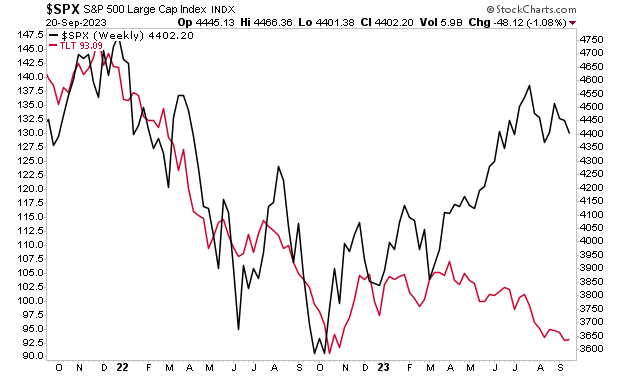

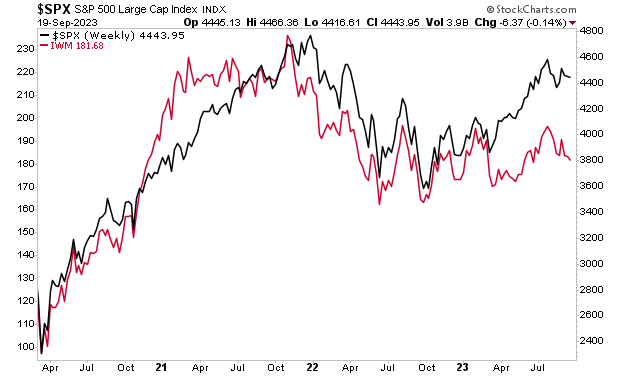

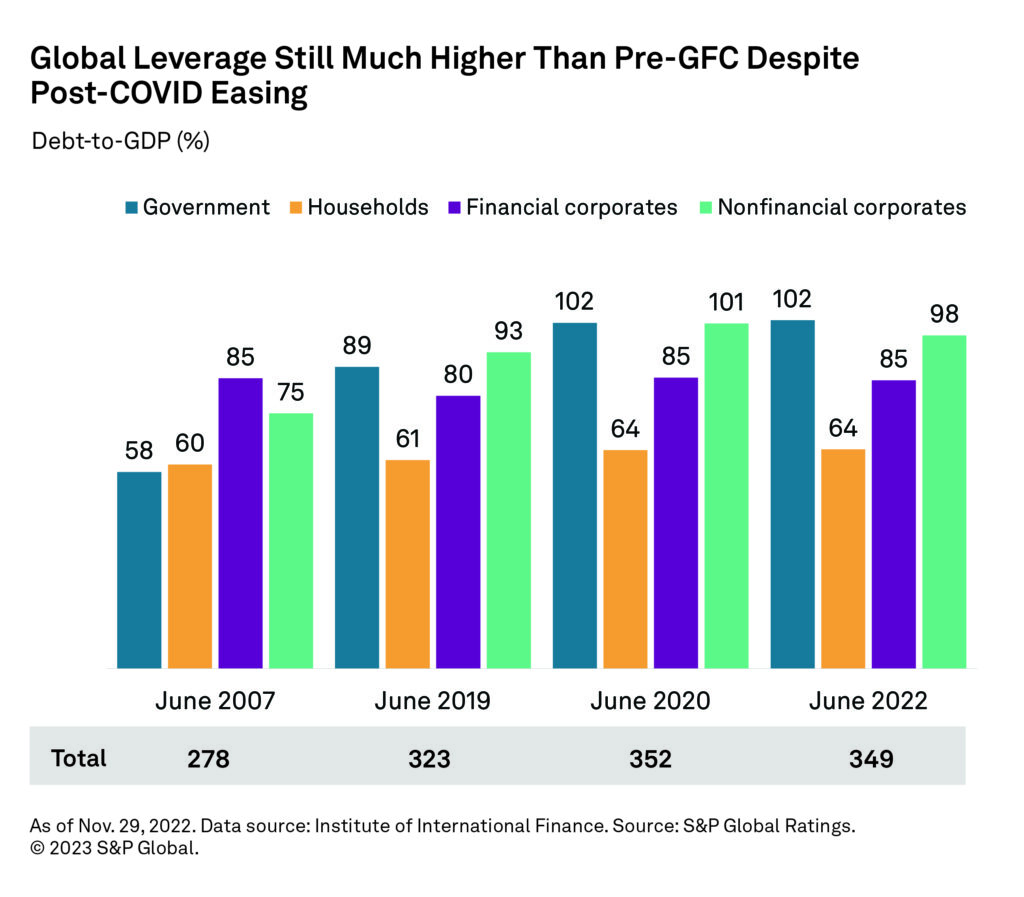

This is the end game for every major central bank: the gradual losing control of the bond market… and having to sacrifice your currency in order to stave off a debt crisis. But even that won’t work eventually as the weaker the currency, the less value bonds will have.

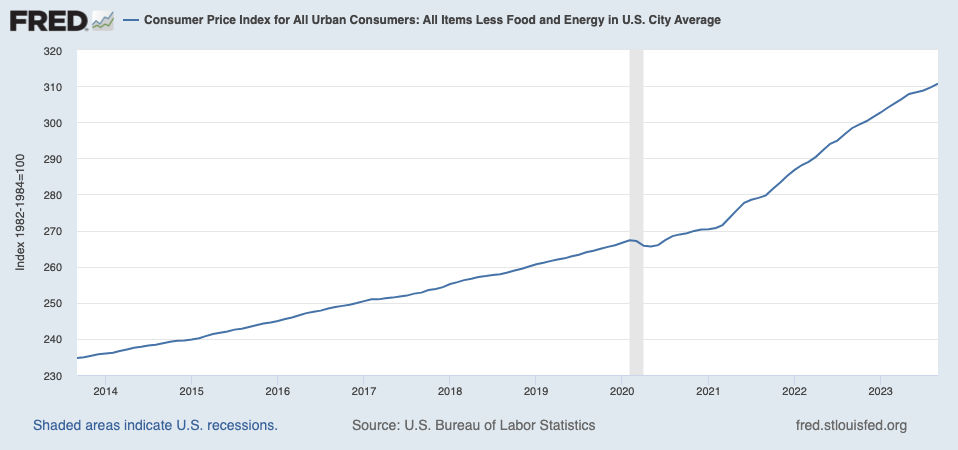

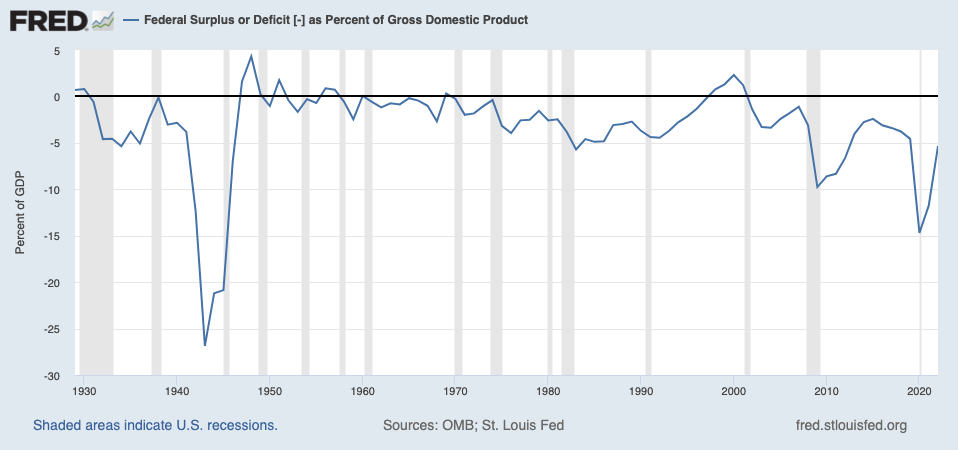

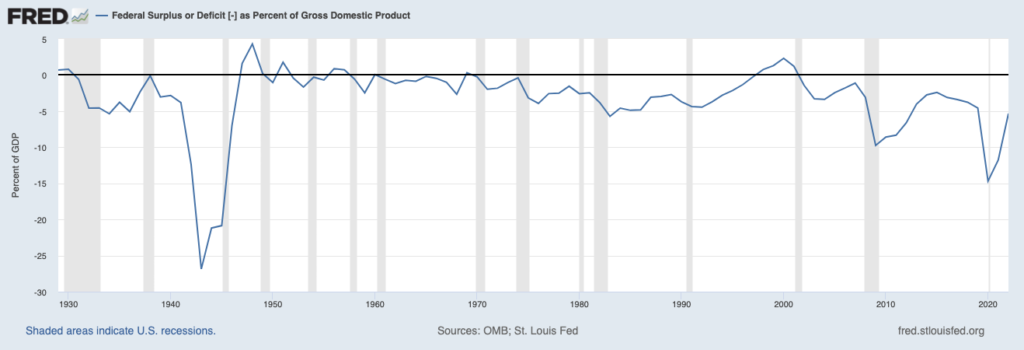

As I keep warning, the Great Debt Crisis of our lifetimes is fast approaching.

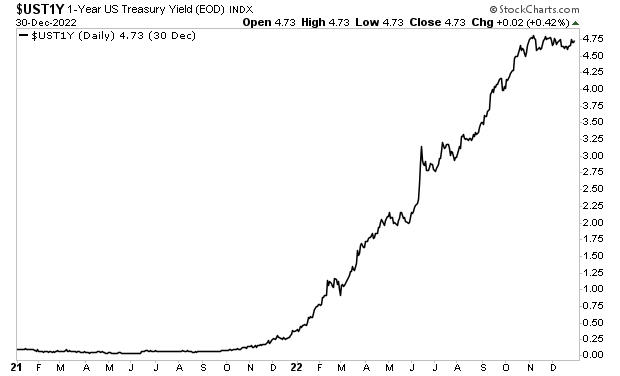

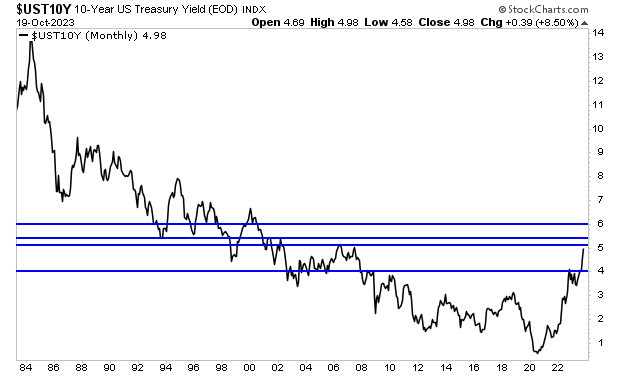

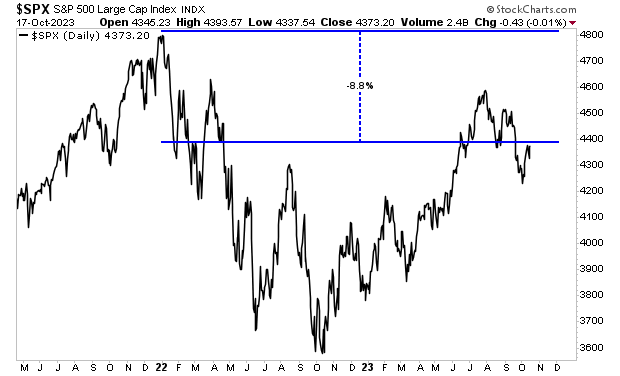

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

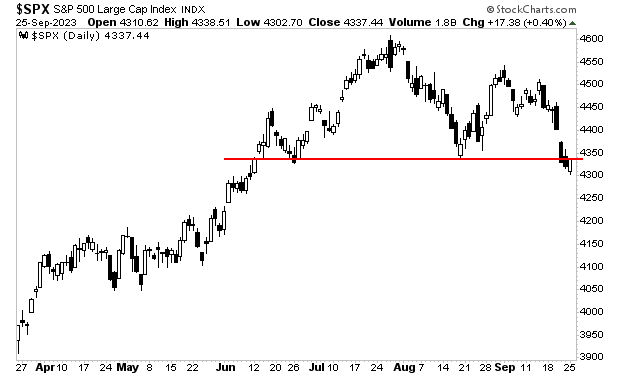

The Great Debt Bubble burst in 2022. And the crisis is now approaching.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/BM.html