Is China an economic miracle, or one massive Government-sponsored fraud?

History has shown us countless times that centrally-‐planned, command style economies do not produce long-term economic growth. We’ve seen this will the Soviet Union, the UK, the US-since the Tech Crash, and today in China.

I realize that many would argue China has adopted free market policies with its “free market zones.” However, even this terminology reveals China is nowhere near a free, dynamic market (a free market is simply a free market, not a “zone.”).

Instead, China should be viewed through the lens of rampant corruption, fraud, and insider dealing that has seen a select handful get rich (usually those with close ties to the ruling party) via paper wealth (real estate and stock prices).

First and foremost, no Chinese economic data is even close to accurate. The reason for this, is that unlike the US in which GDP is measured using final sales, China simply counts any and all economic production as economic growth.

So, let’s say that China built a city. Regardless of whether any of the buildings are ever purchased or leased, China will count the entire city in its GDP growth. As one can imagine, this has highly incentivized China’s government to build “bridges to nowhere” or economic projects that are never actually used.

As a result the country is replete with ghost towns…

China’s ghost towns and phantom malls

“In Chenggong, there are more than 100,000 new apartments with no occupants,” according to the World Bank’s Holly Krambeck.

Designed as an overspill point for nearby Kunming, a city of nearly six-‐and-‐a-‐ half million, Chenggong began to take shape in 2003.

High-‐rise apartment blocks have mushroomed but today it is still largely deserted after failed attempts by the authorities to attract new residents.

Matteo Damiani, an Italian journalist who worked for seven years in Kunming, has visited Chenggong several times, photographing empty tower blocks that loom over gigantic plazas, peopled only by enormous works of art.

He found a small community of students, workers and security guards but nobody else.

“The suburbs and even the city centre are empty,” he says. “You can find a big stadium, shopping malls and hundreds of buildings finished but abandoned.”

There is even an area for luxury villas that is totally abandoned, he adds. It is said to be one of the biggest ghost cities in Asia. http://www.bbc.co.uk/news/magazine-‐19049254

…as well as widespread economic fraud and counterfeiting:

Fraud, Culture and the Law: Can China Change?

Counterfeit goods and scams are used to defraud millions of Chinese daily.

This week alone, the country’s state media have reported the arrests of two men for fraud: one a high-‐profile real estate financier suspected of manipulating bids, the other a sales manager at milk producer Mengniu who reportedly tampered with production dates on milk and yogurt labels.

Those cases follow the announcement earlier this month by police that they had seized more than $182 million in counterfeit pharmaceuticals, including drugs used to treat diabetes and high blood pressure, as part of a nationwide crackdown on fake food and drugs. Drug counterfeiters “are coming up with new schemes, becoming craftier and better able to deceive” police warned in a statement accompanying the news.

The persistence and extent of fraud in China, despite a near constant string of crackdowns and arrests, raises fundamental questions about cultural forces in Chinese society that limit the reach of law…

…The production of counterfeit cigarettes, for example, has been estimated to reach 400 billion cigarettes, although cigarette manufacturing and distribution is supposed to be exclusively state-‐ owned and controlled. One manufacturer reportedly went so far as build a counterfeit cigarette factory in Fujian designed to look like a military compound, including laborers dressed in second-‐hand military uniforms who conducted false military drills to complement the masquerade. In Sichuan, meanwhile, police are said to have raided a black-‐ market cigarette factory that had been disguised as the “Number 1 Block” of a provincial prison.

http://blogs.wsj.com/chinarealtime/2012/08/24/fraud-‐culture-‐and-‐the-‐ law-‐can-‐china-‐change/

Some more striking evidence of fraud, corruption, and counterfeiting in China:

1) In 2010, 30 animals died in the Chinese zoo of Shenyang due to malnutrition.

2) China built the world’s largest mall in 2005. Of the over 2,300 spaces

available for lease only 47 were rented.

3) China alone accounted for 73 % of $1.69 billion in counterfeit goods seized in

the EU in 2011.

4) Chinese officials have seized over 50 TONS of counterfeit pharmaceuticals.

5) Raids have seized more than 350,000 counterfeit golf products.

These sorts of issues don’t come out of a free market with a stable regulatory bodies, sound accounting principles, and a legitimate legal structure: they come out of control style economy that are based on fraud and corruption. Indeed, as noted in previous articles:

1) In 2010 alone, 146,000 cases of corruption were launched in China (that’s 400 PER DAY).

2) How much these officials stole is unknown. But… of the 14 cases that were actually reported in the Chinese media, the average amount stolen was 18 MILLION RMB (for perspective, the average college graduate in China earns 2,500 RMB per year).

3) Between 1991–2011, it’s estimated that between 16,000–18,000 Chinese officials fled China taking 800 BILLION RMB (roughly $125 BILLION) with them. Bear in mind China’s entire GDP was just 2.1 trillion RMB in 1991.

So I fully believe that China is heading for a full-scale economic collapse a la the Soviet Union, not just a hard landing.

Indeed, if you need evidence of just how desperate the Chinese Government has become to maintain control, you should consider that it has launched $1 trillion in stimulus projects:

China’s More Than $1 Trillion Stimulus Will Disappoint, Barclays Says

From the central government and the PBoC to regional governments, spending plans worth approximately more than 11 trillion RMB ($1.74 trillion) have been announced, according to Barclays and Nomura. Analysts at the Japanese bank expect Chinese GDP to hit 7.7% in the third quarter and then rebound strongly to 8.8% in the fourth.

There are reasons to be skeptical of these growth expectations, as China is going through both structural and cyclical changes that will limit the impact, and the breadth, of the coming stimulus, Barclays’ team argues. “This time is different,” they wrote, noting that both in the Asian crisis and in the 2008-‐9 financial crisis, China suffered massive job losses and deflation.

http://www.forbes.com/sites/afontevecchia/2012/09/17/chinas-‐more-‐ than-‐1-‐trillion-‐stimulus-‐will-‐disappoint-‐barclays-‐says/

To put this number into perspective, China’s entire economy is only $7.3 trillion. So China just unveiled stimulus measures equal to 23% of its entire GDP. This is more than TWICE the size of the 2008 stimulus plan.

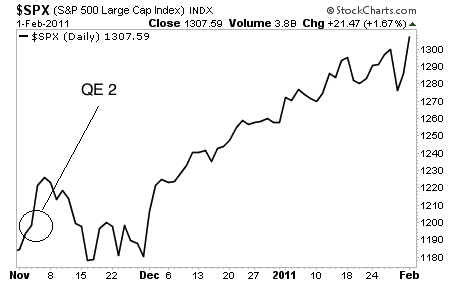

Imagine if the US announced a QE program equal to over $3 trillion. That’s the equivalent scale of the recent stimulus programs announced in China. And the Chinese stock market barely reacted to this.

Again, China is beyond a hard landing at this point. Combine this with growing food inflation and it’s possible China may in fact break into several smaller countries in the coming years.

On that note, I’m currently preparing subscribers of my Private Wealth Advisory newsletter for the coming epic global downturn as China, the EU, and even the US experience sharp recessions if not outright depressions.

To find out how we’re doing this, all you need to do is take out a trial subscription to my Private Wealth Advisory newsletter. You’ll immediately be given access to all of our current open trades as well as my three Special Reports titled Protect Your Family, Protect Your Savings, and Protect Your Portfolio.

Collectively, these reports outline critical information for the coming crisis including:

1) What banks are most exposed to systemic risk.

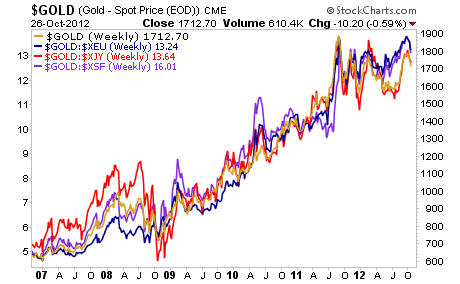

2) How, why, and where to buy Gold and Silver bullion.

3) How much food you need to stockpile, where to buy it and how to store it.

And more!

To take out trial subscription to Private Wealth Advisory…

Click Here Now!!!

Best Regards,

Graham Summers