The world of finance is full of silly and arbitrary definitions.

For instance, a stock market correction is when stocks drop 10%, and a Bear Market is when stocks drop 20%.

Why 10% and 20%? And why a “correction” vs. a “Bear Market?” Who decided on those numbers and those terms and why? Is there even any fundamental analysis backing them up?

Let’s take this line of thinking deeper…

Why are some investors labeled “bulls” and others “bears” based on their assessment of the markets/ risk management?

No one who actually makes serious money from the markets thinks in these terms…

Real investors, who are using the market to grow wealthy, think in terms of “opportunities” and “risk.”

At any time, the market is presenting you with opportunities.

- The opportunities that are relatively clear based on your analysis are the ones you go after with your capital.

- The opportunities that are unclear or opaque are the ones to avoid (ignoring confusion is the biggest risk to your capital in investing).

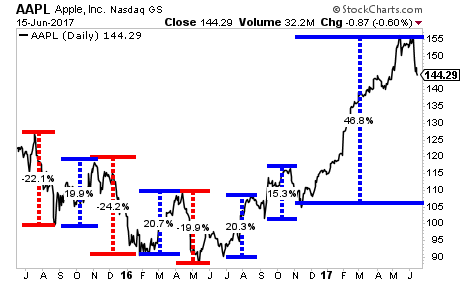

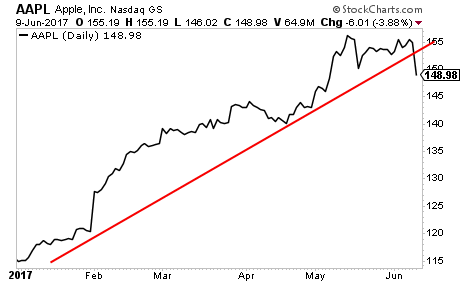

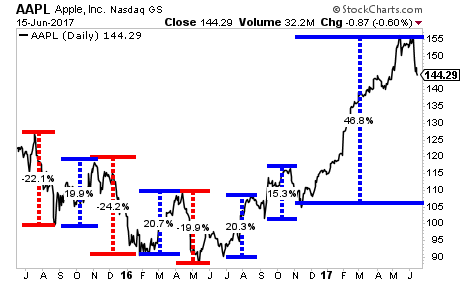

Consider a popular stock like Apple (AAPL).

In the last two years alone, Apple has had three full-blown “Bear Markets”, four “Bull Markets” and at least one “significant rally.”

Anyone who invested based in Apple based on the sue of arbitrary definitions like a “20% Drop=Bear Market” would be bi-polar at this point.

A sensible investor, however, would take a disciplined approach the opportunities and risks Apple presented at a given time and would have successfully profited from its market action.

Again, NO ONE who actually uses the markets to grow wealthy thinks in terms like “bear market” or “correction.”

We’re speaking from personal experience here.

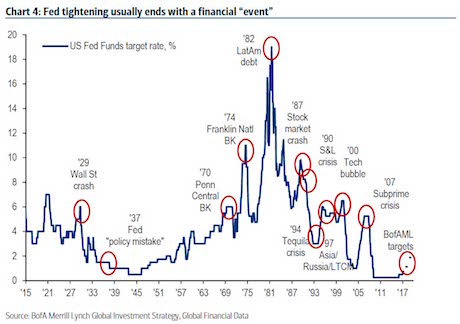

Since 2009, we’ve made it a point to focus on the risks of the financial system.

After all, in the preceding ten years, the US had experience two of the biggest stock market Crashes in history (the Tech Crash and the Housing Crash/Great Financial Crisis).

Because we focus on “risk, we are labeled “Bears” or even worse “Perma-Bears.”

However, focusing on “risk” is very different from actual “investing.” Risk is a framework for thinking about the world. Investing is how you put money to work.

Put simply, the fact we focus on risk doesn’t mean we’re telling our clients to “short the market with every cent of their capital.”

NO ONE does that kind of thing.

We focus on risk to protect the downside. By doing this, the upside takes care of itself. Often times by a LOT.

Case in point…

Last year, Private Wealth Advisory subscribers saw a 40% return on their invested capital.

Yes, 40% in a year in which the S&P 500 returned just 9%.

We didn’t use fancy investments we did this by trading ETFs and stocks without any leverage.

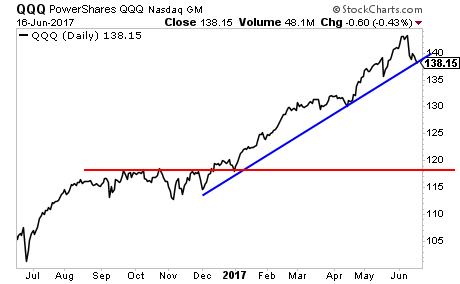

The out-performance continues in 2017…

Year to date, we’ve locked in 32 trades. Of that 27 have been winners, for a success rate of 84%.

Yes, we are making money on more than EIGHT out of every 10 positions we open.

You could be seeing a similar success rate with your investments by following our investment recommendations. And it will only cost you $199 per year.

Of course, not everyone wants to really succeed with their investments. Most people would rather sound smart than see their portfolios grow dramatically.

For that reason we offer a 30 day trial period for potential Private Wealth Advisory subscribers.

Put simply, you can try Private Wealth Advisory for 30 days for just $0.98.

If you decide Private Wealth Advisory is not for you, just send us an email and we’ll cancel your subscription and you won’t be charged another cent.

But I know you’ll want to stay with us once you start seeing the gains for yourself.

In the last 30 days alone we’ve locked in ELEVEN winners including gains of 6%, 8%, 14% and more.

To take out a 30 day $0.98 trial subscription to Private Wealth Advisory…

Click Here Now!!!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research