The insanity of Central Bankers knows no bounds.

The latest indication of just how far “down the rabbit hole” the financial world has gone comes from Japan where it was announced that the Bank of Japan bought 75% of Japanese Government Debt issuance in FY17.

That is not a typo. Japan’s Central Bank bought $3 out of every $4 in debt Japan issued in fiscal year 2017. And it now owns 40% of Japan’s total debt outstanding.

Things have gotten so out of control that on Tuesday this week not a single 10-Year Japanese Government Bond was traded. Put another way, the daily volume on the 10-Year Japanese Government Bond was ZERO for an entire day.

There’s an expression for this kind of investment behavior: it’s called “cornering the market.”

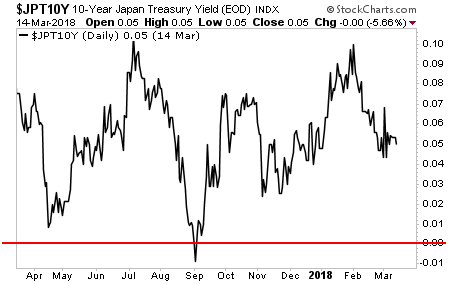

Astonishingly, the BoJ is STILL beginning to lose control of its bond market. Currently the BoJ is targeting a 0% yield on the 10-Year Japanese Government Bond. Despite this, the yield on the 10-Year Japanese Government Bond has remained above this level for the better part of the last year.

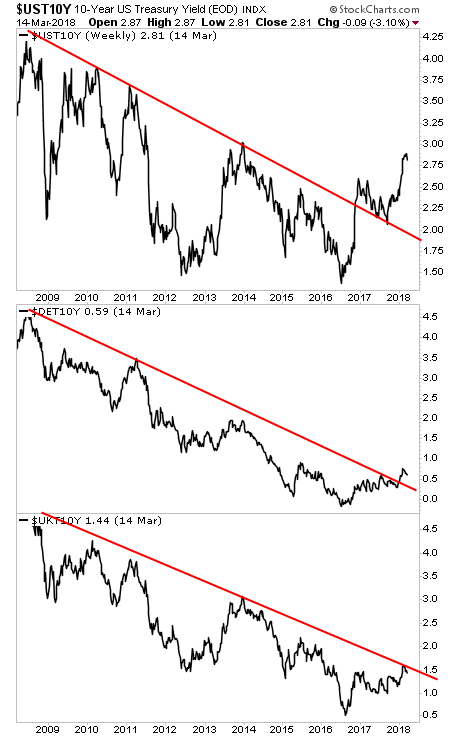

Japan is not alone here. Globally bond yields are rising in most of the major debt markets including Germany, the UK, and the US.

Put another way, despite spending over $14 TRILLION trying to corner the bond markets, Central Banks are STILL beginning to lose control. The Everything Bubble is beginning to burst.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research