The Trump administration is doing everything in its power to prop up stocks.

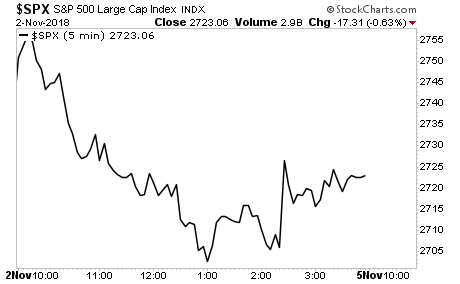

On Friday we had not one but TWO verbal interventions from President Trump: both related to a potential trade deal with China. Stocks rallied on the news, but the rally was short-lived and stocks finished the day DOWN.

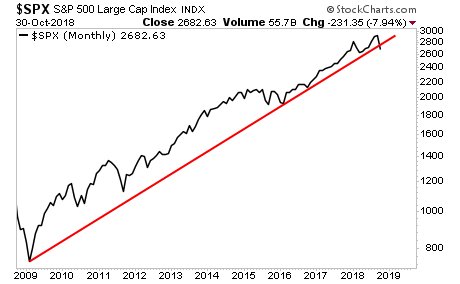

Expect more of this (failed interventions). While the vast majority of investors continue to cling to hype and hope, the reality is that the bull market that started in March 2009 is officially OVER.

The monthly S&P 500 chart has violated its bull market trendline for the first time since the 2009 low. This STRONGLY suggests the bull market is OVER.

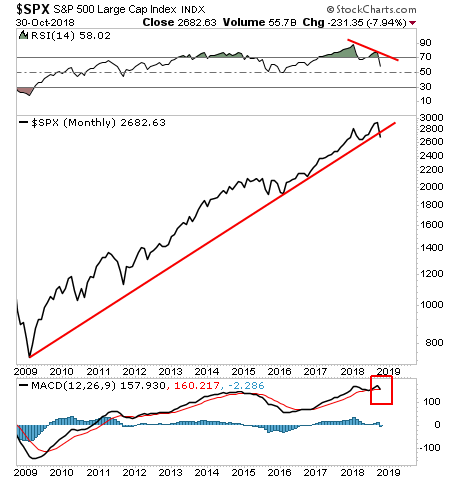

We also have NEGATIVE divergence on the monthly chart for the S&P 500’s RSI. And its monthly MACD is on a Sell signal.

Just one of these signals would be trouble, but all three taken together (broken trendline, negative divergence on RSI, MACD “sell” signal), this is as close as you can get to “ringing the bell” at the top.

Will we get bounces and rallies? Yes. But unless you’re a nimble day trader, they’re going to be VERY hard to catch.

Bottomline: we are officially in a bear market, and stocks are going to collapse in a BIG way.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

We are giving away just 100 copies for FREE to the public.

Today there are just a handful left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research