The Powers That Be are getting desperate.

Yesterday marked the third time in the last FIVE trading sessions that we have a coordinate intervention to prop up stocks. Not only are the exchanges “throttling” the flow of sell orders so that selling pressure doesn’t overwhelm buyers, but “someone” has been placing large orders of stock futures to induce a rally.

You can guess who that “someone” is.

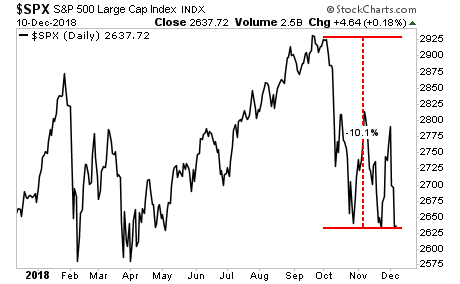

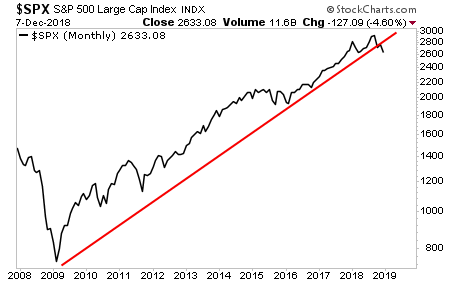

So what is the big concern? After all, stocks are a mere 10% off of their all-time highs after staging the longest bull market in HISTORY. A 10% correction is a healthy thing after a rally of this magnitude.

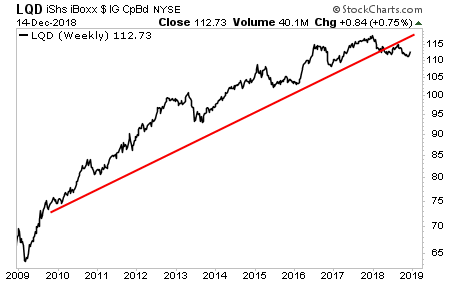

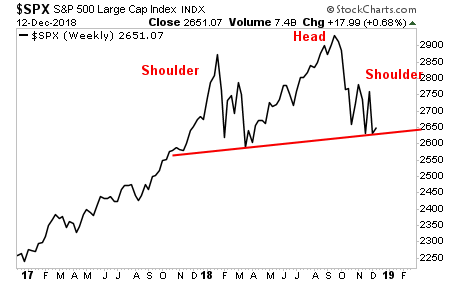

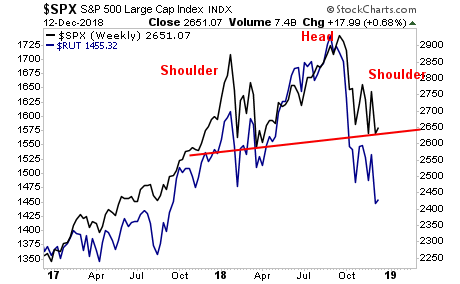

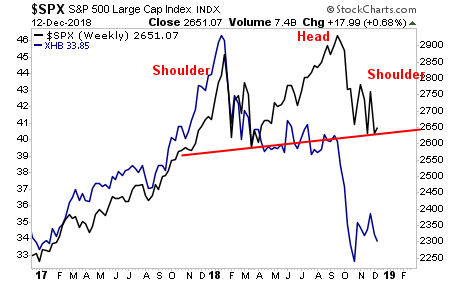

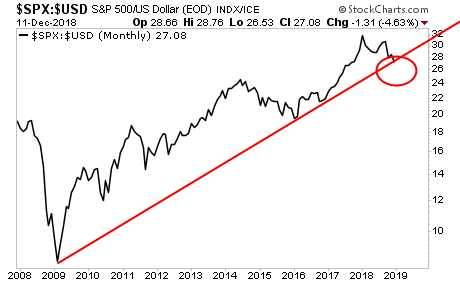

The Powers That Be are terrified of the below chart.

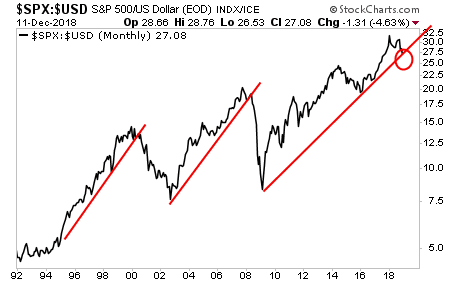

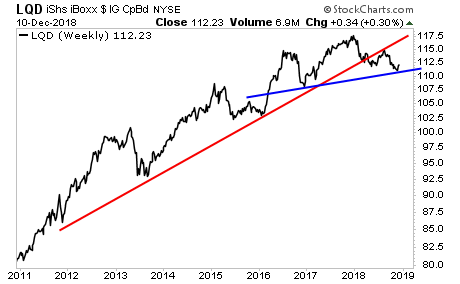

As you can see, investment grade corporate bonds have broken their bull market trendline and are now barely clinging to CRITICAL support.

By the way, these are INVESTMENT GRADE bonds… as in bonds that SHOULDN’T be in trouble.

If that blue line goes, we’re moving into a crisis as a wave of defaults will begin. With an expected $1.2 trillion in corporate debt at risk of default in the next downturn, we’re talking about SYSTEMIC risk.

Remember, the US financial system is MORE leveraged today than it was in 2007. What do you think will happen to the stock market once companies start defaulting on their bonds (hint: stockholders come LAST when it comes to liquidations).

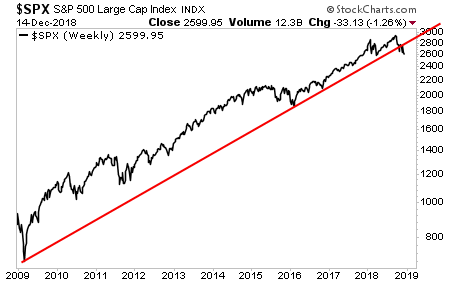

Here’s a hint.

If you are not already preparing for this, NOW is the time to do so.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research