Whatever little credibility the Powell Fed still had has been permanently shredded.

Throughout the last 15 months, the Powell Fed has maintained that it would be able to normalize Fed policy. This meant interest rates at historic norms (above 3%) and the Fed balance sheet back at pre-Crisis levels (~$1 trillion).

The Fed pushed this narrative hard throughout 2018, to the point of explicitly stating it would not reverse policy unless the financial system experienced a crisis so dramatic that it damaged consumer spending.

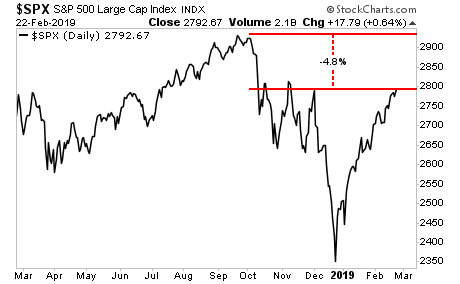

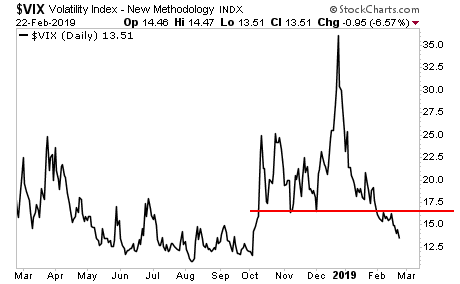

Then came the October-December stock market meltdown, and the Powell Fed abandoned ALL of its hawkishness regarding rate hikes in a matter of weeks.

However, it wasn’t until late last month that the Fed began to talk about abandoning its balance sheet reduction too. Starting in late-January, one by one, Fed officials began talking about ending the Fed’s balance sheet reduction early.

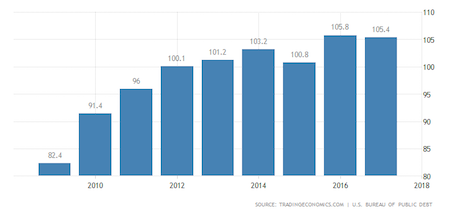

Fast forward to yesterday and Jerome Powell stated on record to Congress that the Fed would STOP shrinking its balance sheet when it (the balance sheet) reached 16%-17% of GDP (roughly $3.3-$3.5 trillion).

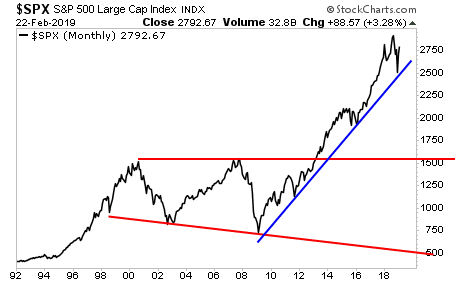

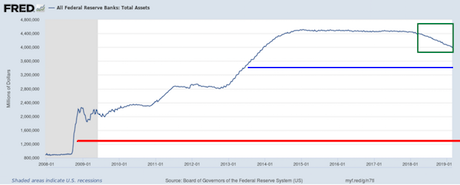

I realize these numbers are hard to picture, so consider the below chart. For a year, the Fed CLAIMED that it was 100% certain it could shrink its balance sheet to the red line.

Now it is claiming it will stop at the blue line. And all it took for the Fed to give up on its plans was the damage caused to the markets by the dip in the green box.

Anyone who continues to believe the Fed has a clue what it’s talking about in terms of forecasting or the impact of its monetary policy on the financial system is insane.

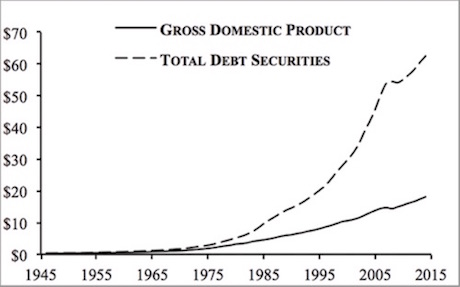

However, the fact remains that the underlying issues in the financial system are still in place. Those issues are:

1) Too much debt/ leverage.

2) Too little capital.

And if the Fed is not going to be able to normalize policy to reduce leverage in the system, then the Political elite will need to come up with other sources of capital to do so.

With that in mind, the current political agenda to push for Wealth Taxes, cash grabs and other means of raising capital all makes sense.

Consider the following:

- The IMF has already called for a wealth tax of 10% on NET WEALTH.

- More than one Presidential candidate for the 2020 US Presidential Race has already openly called for a wealth tax in the US.

- Polls suggest that the majority of Americans support a wealth tax.

And if you think this will stop with the super wealthy, you’re mistaken. You could tax 100% of the wealth of the top 1% and it would finance the US deficit for less than six months.

Which means…

Cash grabs, wealth taxes, and more will soon be coming to Main Street America.

Indeed, we’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research