As I outlined yesterday, the markets are currently staging a relief bounce from the initial drop that began in early May.

From a metaphoric perspective, I call this bounce the “bargaining” phase for the markets… as they work through the five stages of grief (denial, anger, bargaining, depression and acceptance) related to the US/ China trade deal.

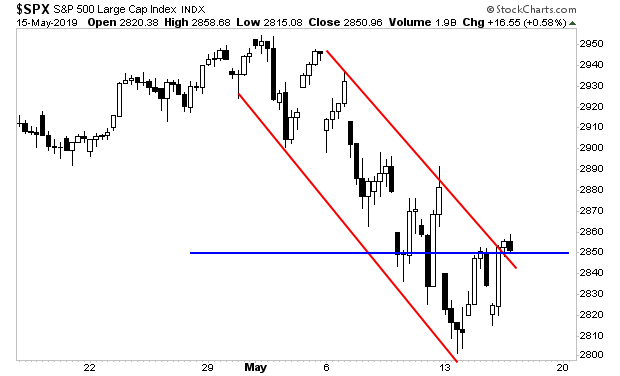

This stage will likely last a few weeks into the end of May/ early June. The S&P 500 has broken its downtrend (red lines) and retained support (blue lines).

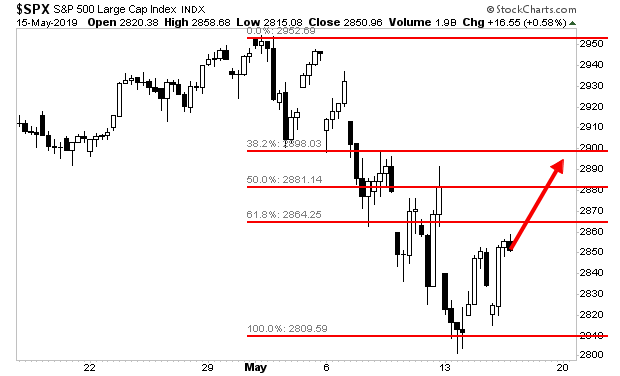

We will likely see a run to 2,900 in the next week or so. This won’t be a straight line… but more of a slow grind higher… as the market continues to “bargain” with the idea that China and the US might come to a trade agreement.

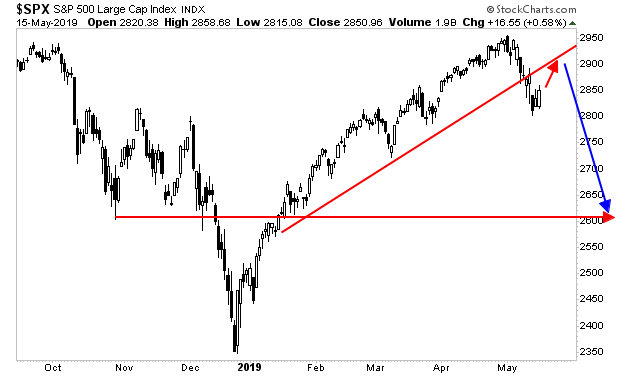

This move will represent a “backtest” of the old trendline for the rally (red line in chart below).

After that comes the “depression/ acceptance” stages… at which point stocks will drop to the 2,600s… at least (blue line in chart below).

If you’re looking for a road map to successfully trade this environment… we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research