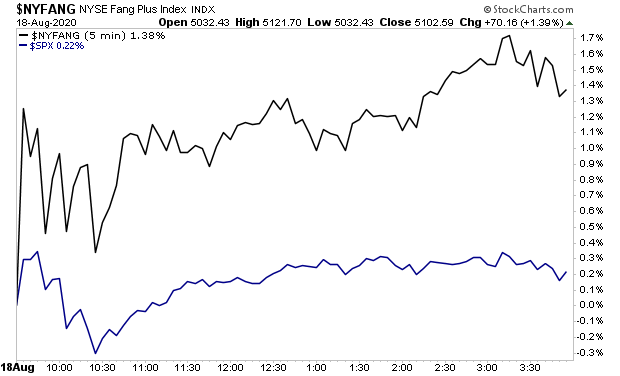

Stocks began to break down again yesterday, but “someone” stepped in and bought the big tech/ FANG stocks aggressively to hold things together.

That “someone” bought right at 10:30AM, which has become the regular time for interventions in the last few months. And once again, the big tech/ FANGs did the heavy lifting. Microsoft, Amazon, Apple, Facebook and Google.

We’ve seen this scheme time and again since the market bottom in late March: stocks start to break down, and then they suddenly turn on a dime and rally higher, lead by the FANG stocks.

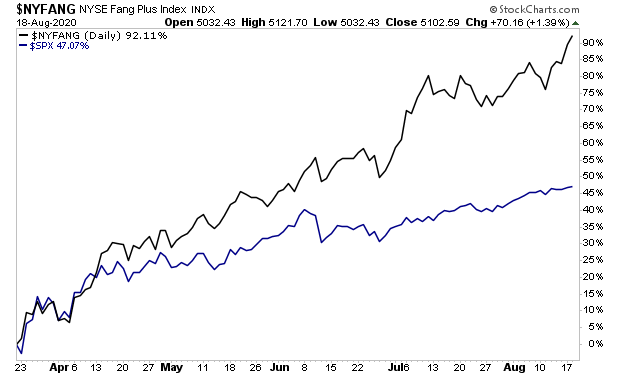

Indeed, this scheme has been so prevalent, that the big/tech FANG stocks have more than DOUBLED the performance of the S&P 500 since the market bottom.

Why are these companies outperforming/rallying so much?

Because the large tech stocks (Microsoft, Apple, Amazon, Facebook) are what central banks are buying.

Together these companies account for nearly 20% of the stock market. And if central banks can get them to rally, the rest of the market will follow.

We know the Swiss National bank buys these companies. And I strongly suspect the Fed is doing it to via some backdoor method.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research