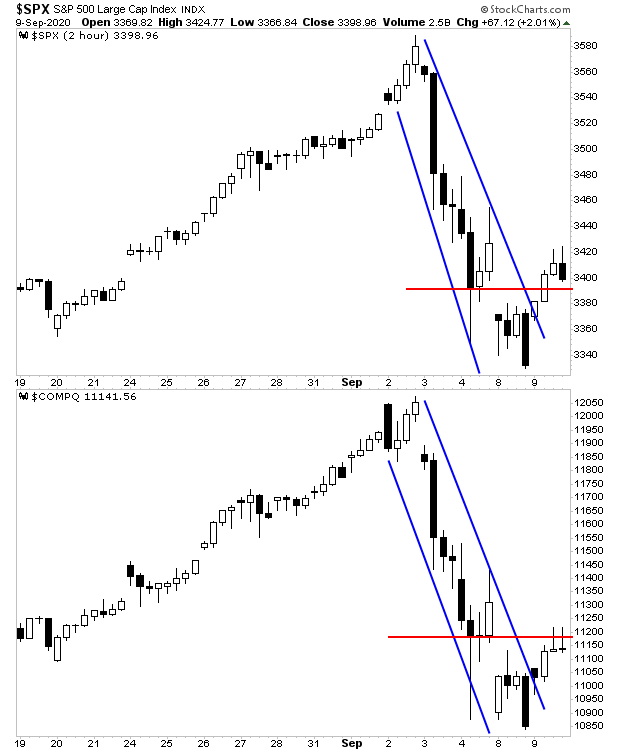

Stocks began to bounce yesterday. The question now is if this bounce has legs or if it’s just a blip in a new downtrend.

Both the S&P 500 and the NASDAQ have broken the downward channels (blue lines) established by the recent correction. However, thus far only the S&P 500 has broken above resistance (red line). So, this is something of a tossup.

The above chart tells us that there was little if any real organic buying yesterday. If real buyers had stepped in, tech stocks should have taken out resistance with little issue. The fact they didn’t tell us that day traders came in and then were forced to unload their longs before the session ended, hence why the NASDAQ put in those two weak candles in the last half of the session.

Based on this alone, we need to see some follow through to the upside today to issue an “all clear” for a significant bounce. Again, I’d not pile into stocks just yet.

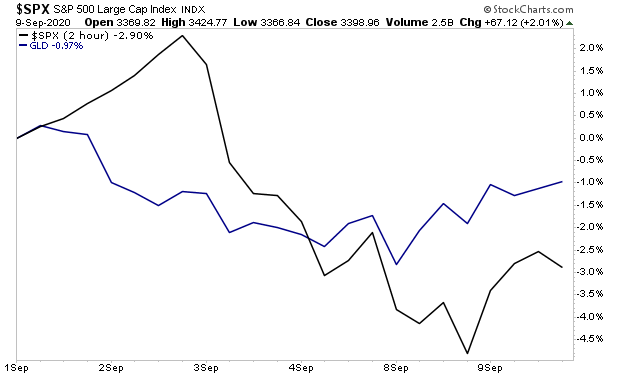

Having said that, there are some interesting developments in gold.

Gold has held up remarkably well while stocks plunged 10% in just three days. Normally you’d expect to see gold be liquidated. Instead, it’s actually fallen LESS than stocks!

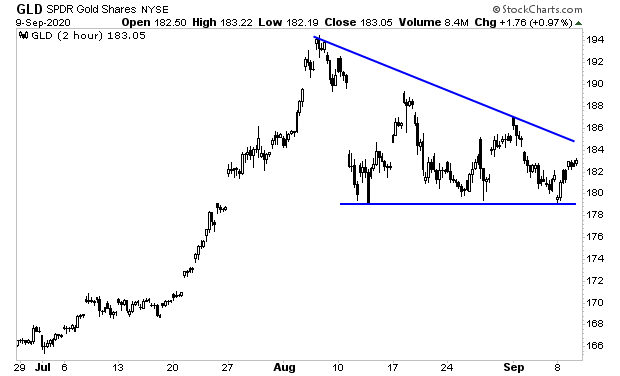

The chart shows a clear formation with support holding multiple times.

This suggests pressure is building to the upside. Gold may be ready for its next leg up.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make precious metals pay you as inflation rips through the financial system in the months ahead.Paragraph

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We have made 100 copies available to the general public.

As I write this, there are only 29 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research