By Graham Summers, MBA

Thus far this week, we’ve been noting an extremely odd development. And it’s left strategic investors feeling uneasy to say the least.

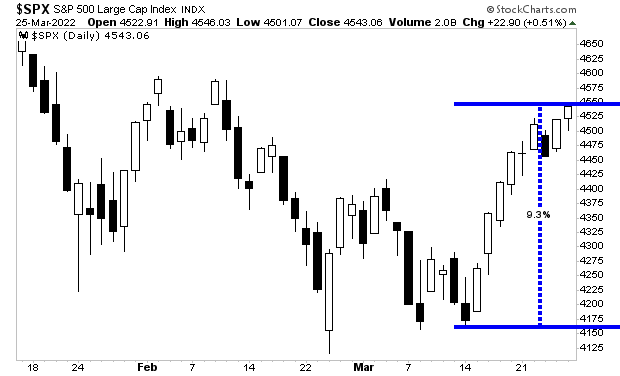

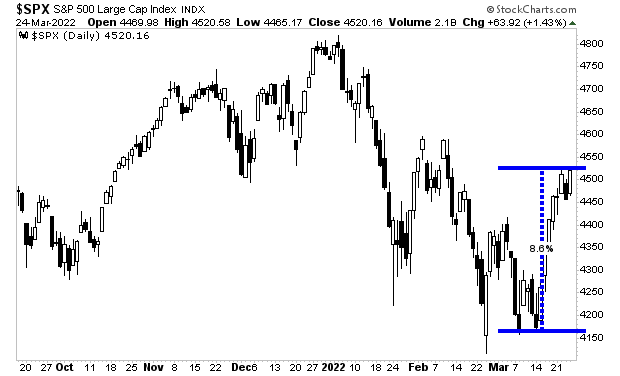

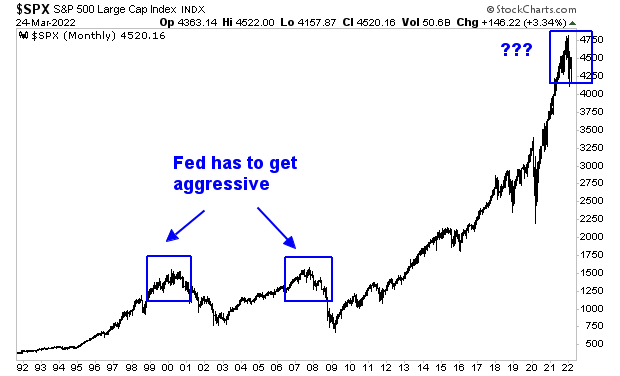

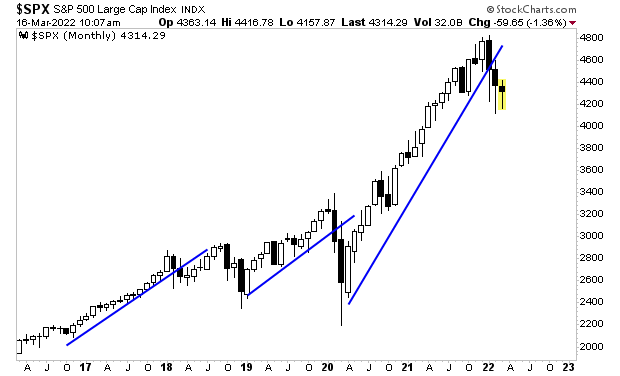

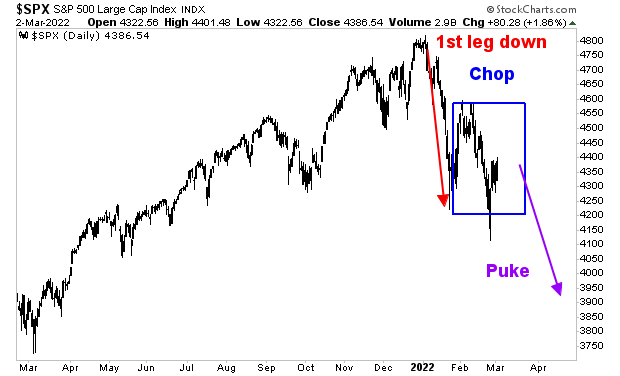

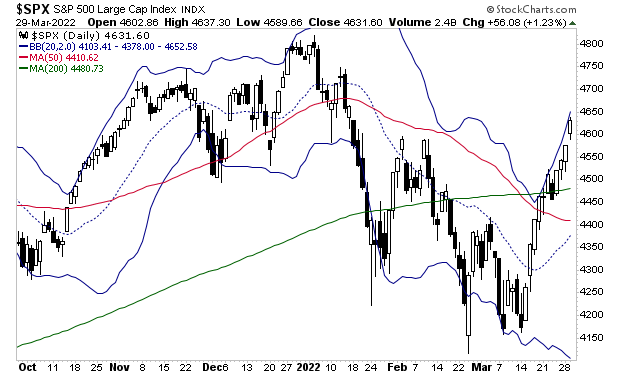

Stocks, the asset class most investors pay attention to, have erupted higher. Indeed, if you only look at stocks by themselves… everything looks great right now.

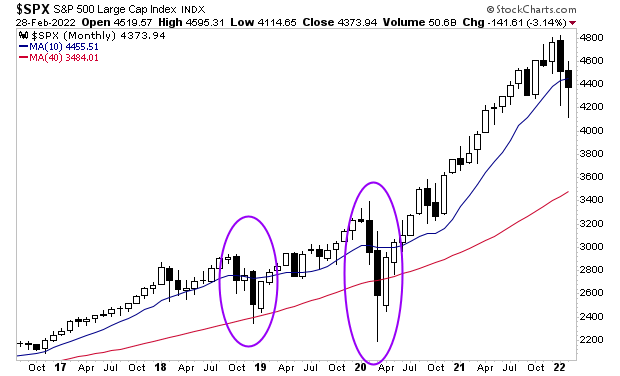

The S&P 500 has gone straight up, rising well above both its 50-day moving average (DMA) and its 200-DMA. And who would have thought we’ve be within 4% of new all time highs!

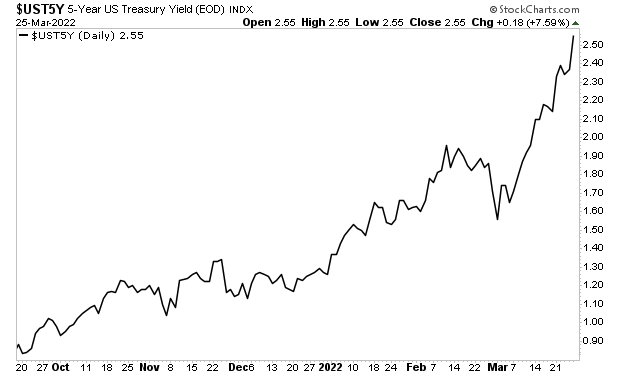

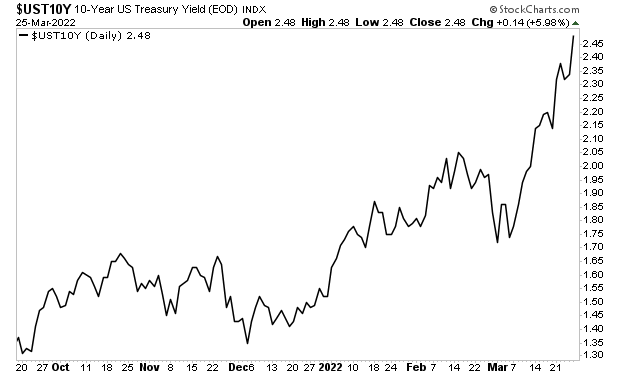

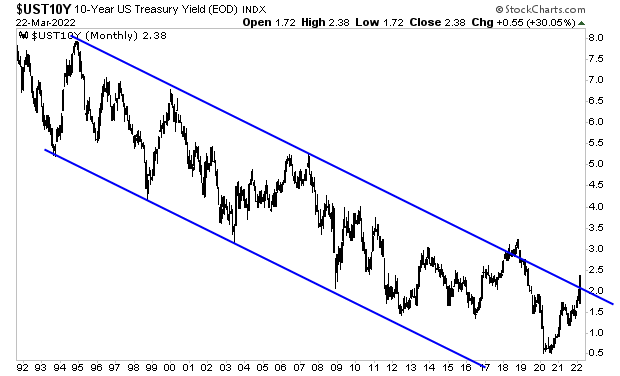

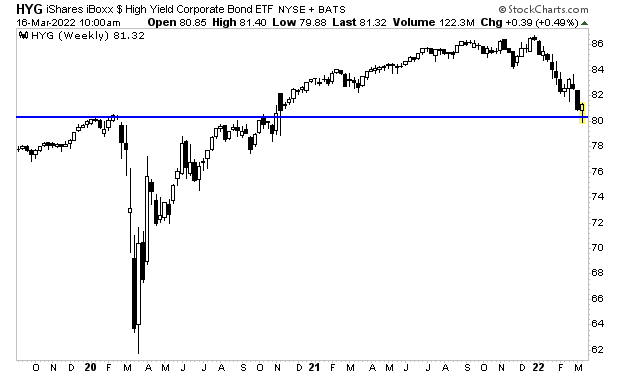

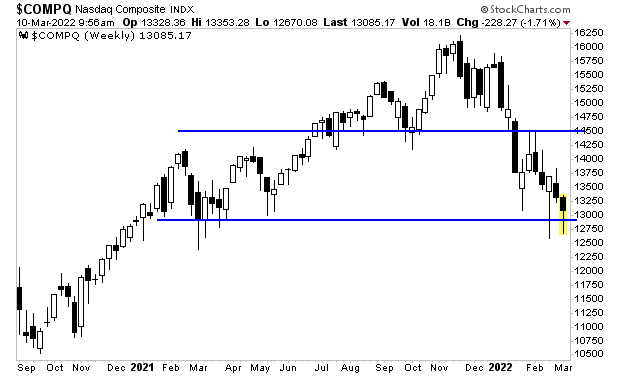

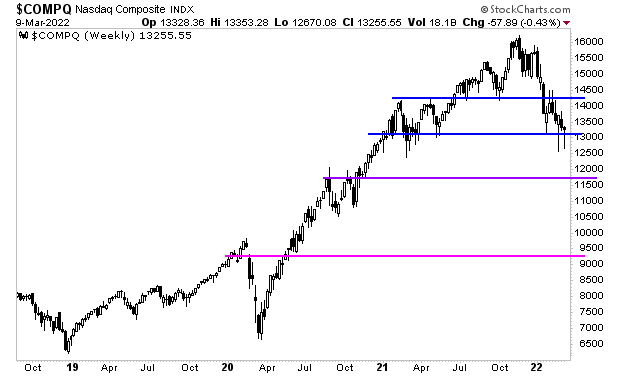

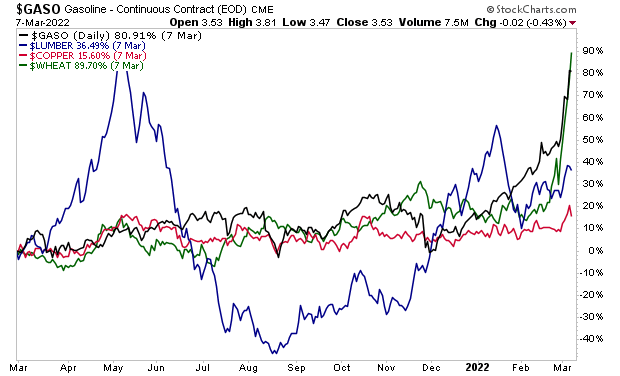

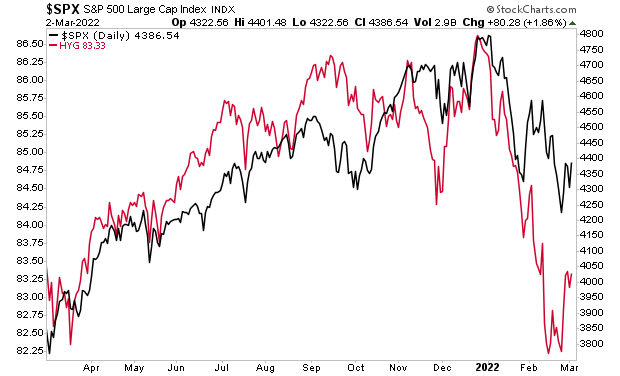

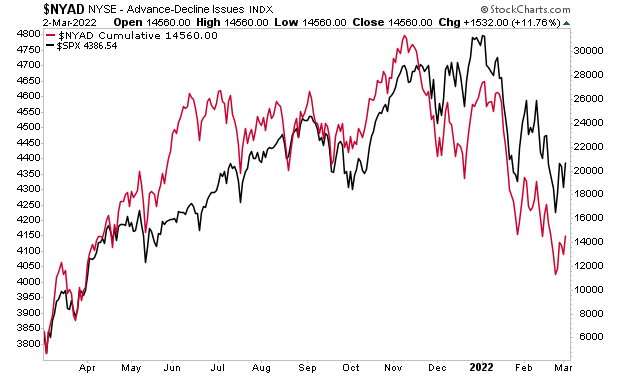

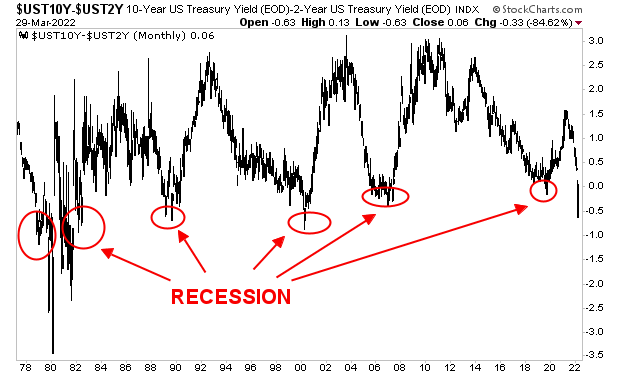

Meanwhile, beneath the surface, the bond market is flashing major warning signs.

“So what?” thinks the stock investor, “bonds are boring. They only rally 2% on a big day. Stocks are up 10% and some stocks as much as 50% in a week!”

Bonds are the bedrock of our current financial system. Their yields represent the “risk free rate” of return against which every asset class, including stocks, are valued. So if bonds are signaling trouble, the entire financial system is in trouble.

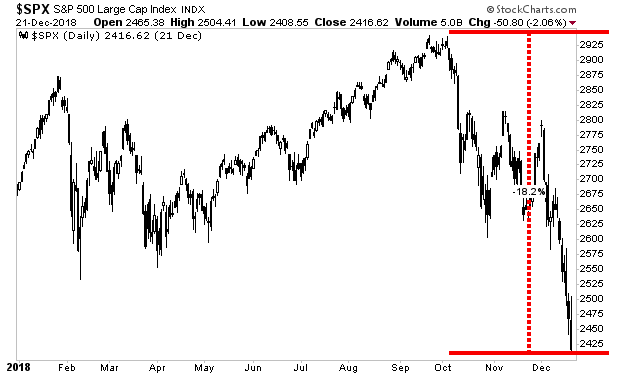

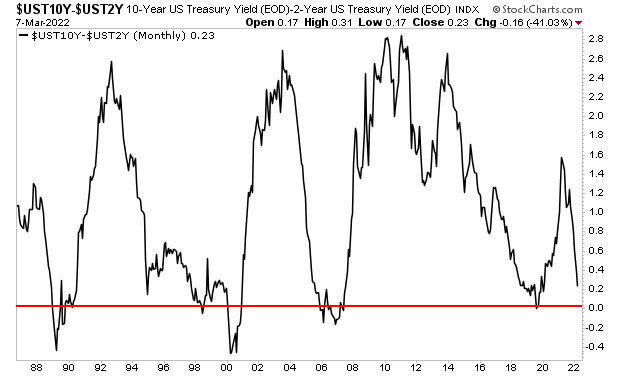

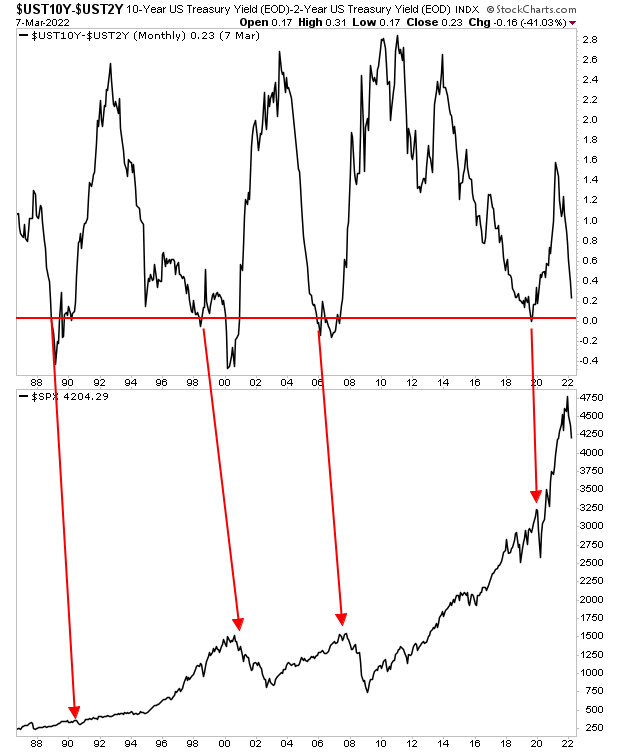

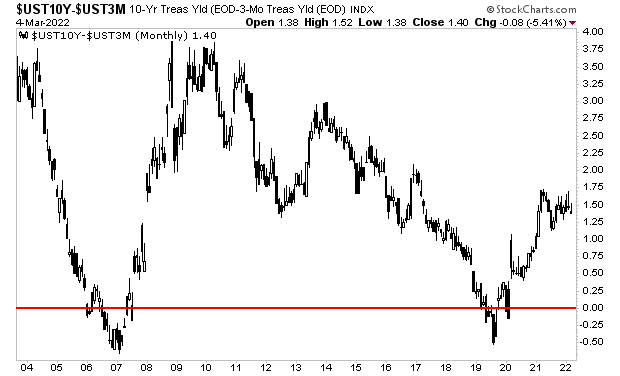

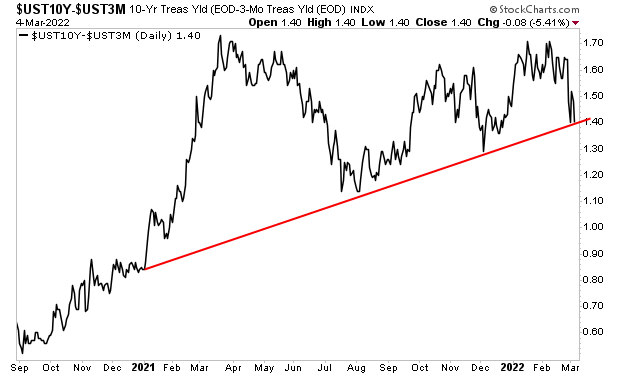

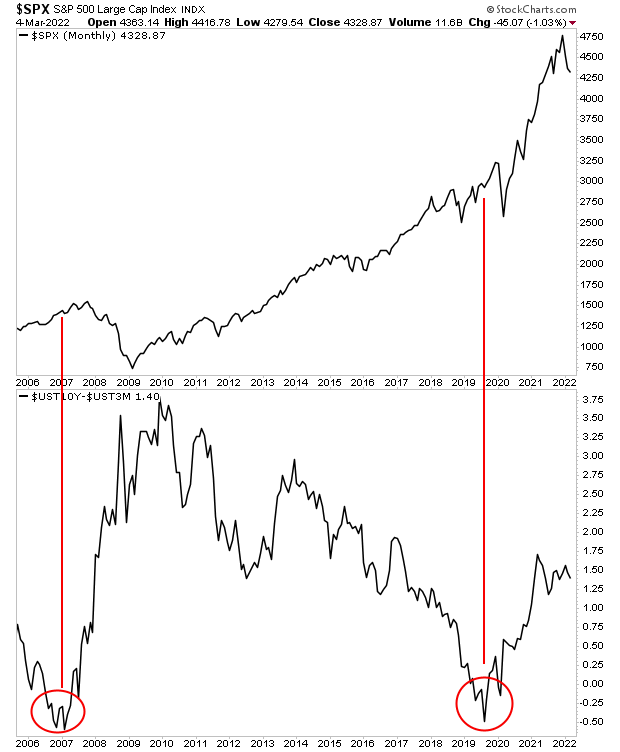

The yield curve, which is a means of measuring risk in the bond market, is now inverted. This is a MAJOR recession signal that has predicted every recession since the mid-1970s. This includes the brief, but horrific C.O.V.I.D.-19 recession of 2020. And yes, bonds somehow “knew” about that in advance.

Again, this trigger has hit before every recession going back 50 years. And it just hit again.

What are the odds it’s different this time?

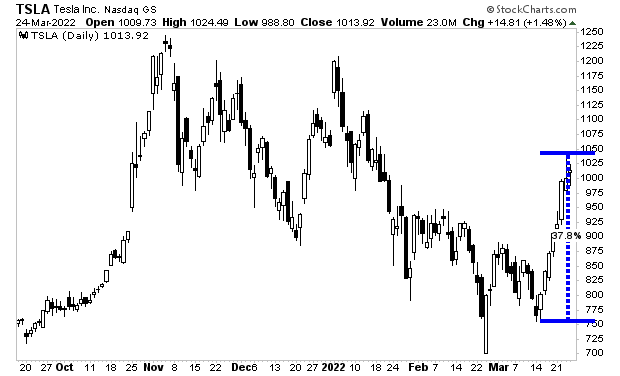

Look, I get it, stocks are up… a lot. Some stocks like Tesla (TSLA) or AMC Entertainment Holdings (AMC) are up 50% or more in just a week! So who cares about boring old bonds?

Everyone should… especially after bonds predicted the 2020 recession and crash… something fewer than 1% of investors got right. And the fact so few investors are payng attention to bonds today is enough to make you wonder if another, equally ugly situation is about to unfold.

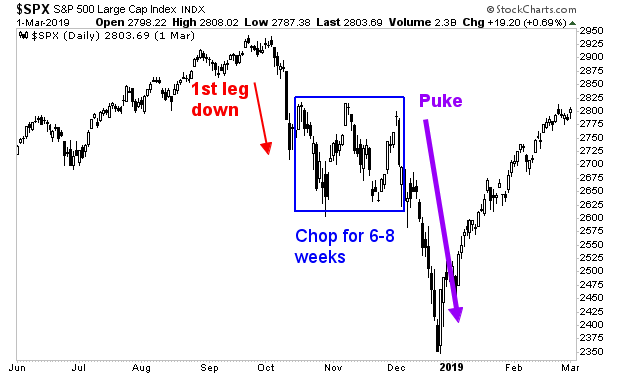

Bonds terrified, but stocks in la la land? This is the kind of environment in which crashes happen.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html