By Graham Summers, MBA

Stocks are now in a strange time in which they do not perceive any major threats.

As a result of this, the bulls are buying stocks based on the usual “the Fed is about to pivot” nonsense. And they’re in for a world of pain.

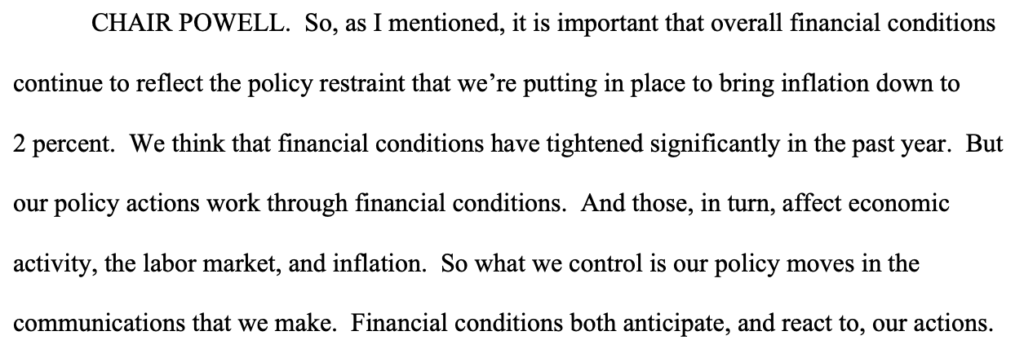

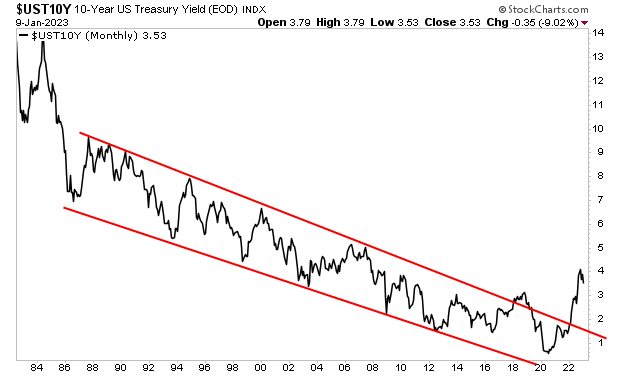

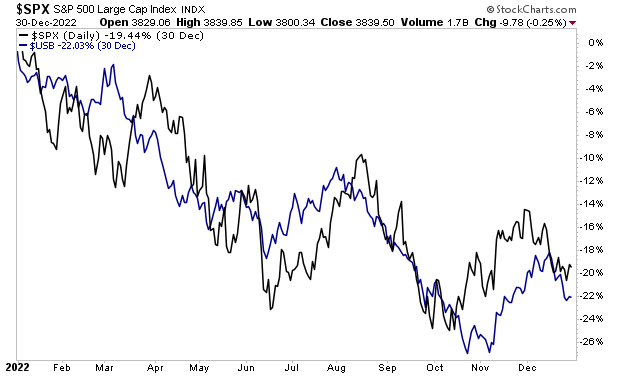

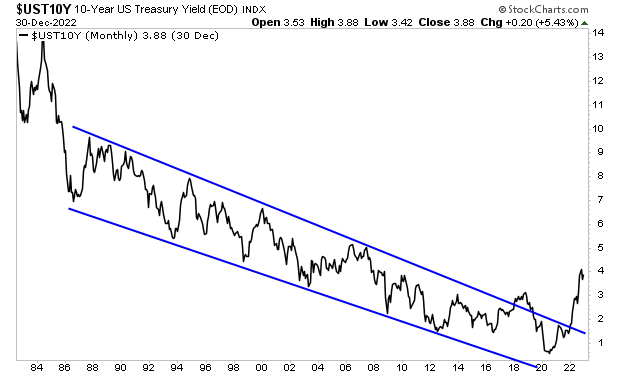

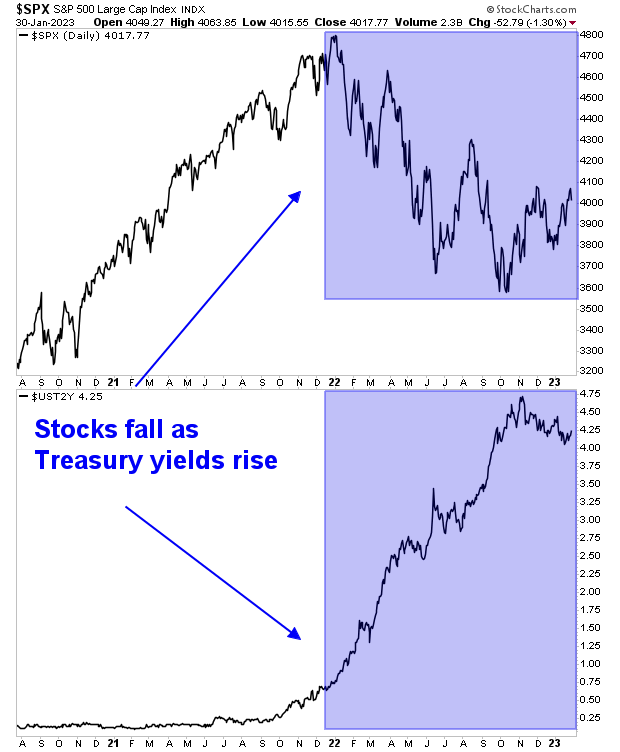

Last year (2022) the big threat was inflation. Inflation, combined with the Fed tightening monetary policy, forced Treasury yields higher. With yields hitting 4% or higher in some cases, stocks were no longer as attractive as an investment class. So the stock market was repriced downwards from 20-22 times forward earnings to 16-18 times forward earnings.

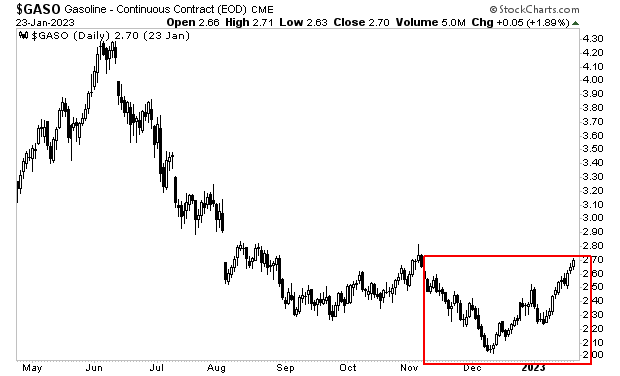

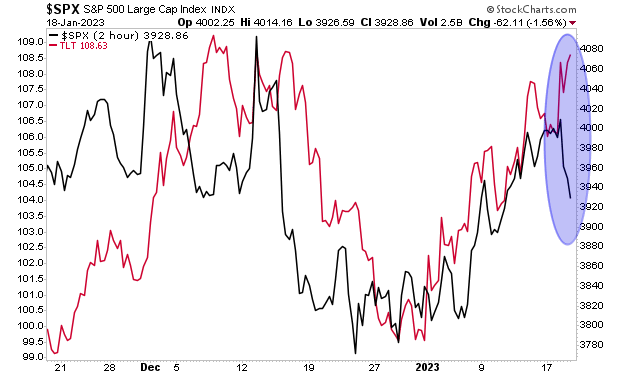

However, as the above chart shows, since October 2022, Treasury yields have stabilized. With yields no longer rising, the threat of inflation has “disappeared” as far as stocks are concerned. And so investors have begun pouring back into the stock market based on the hope that the Fed will soon end its monetary tightening.

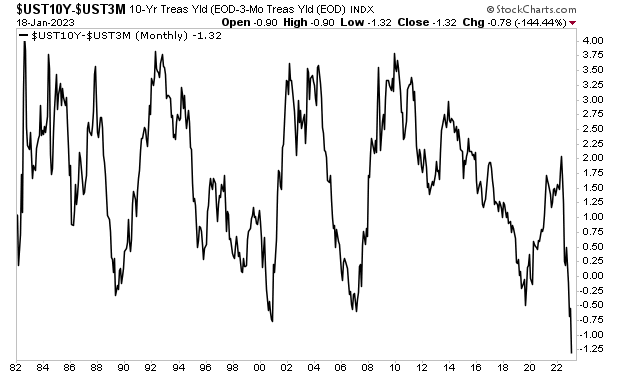

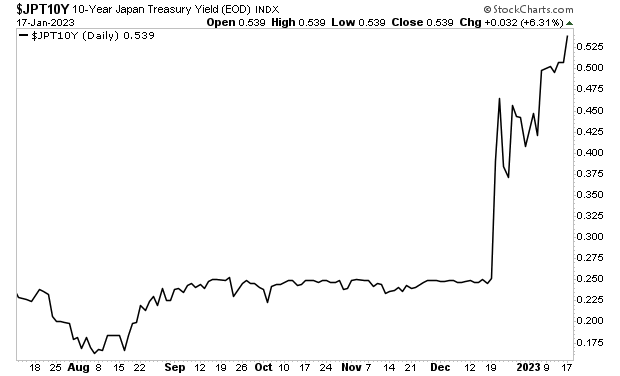

This is horribly misguided. Few things destroy an investor’s portfolio like buying stocks during a recession based on hope that the Fed will start easing monetary policy. And rest assured, the same bond market that told us inflation was out of control, is now telling us that a recession has arrived.

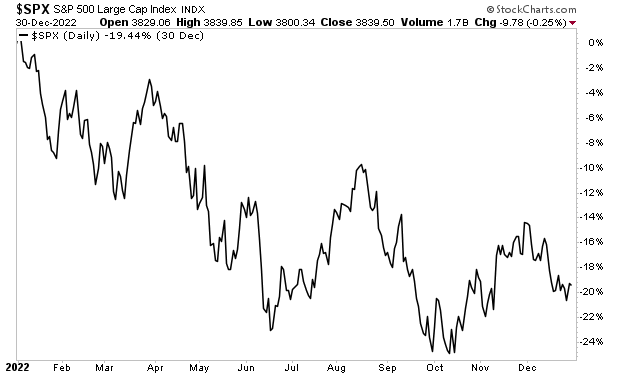

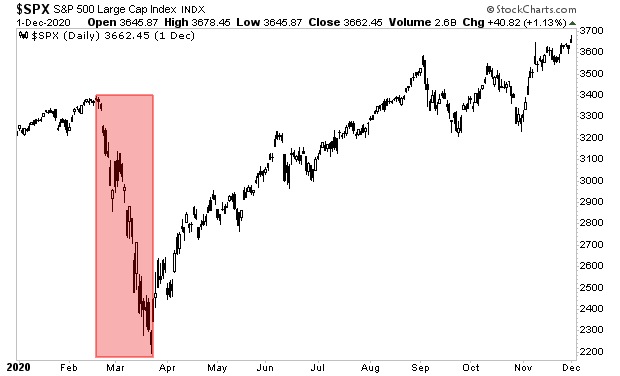

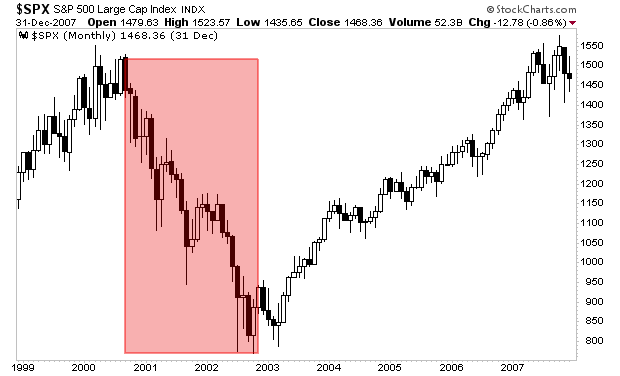

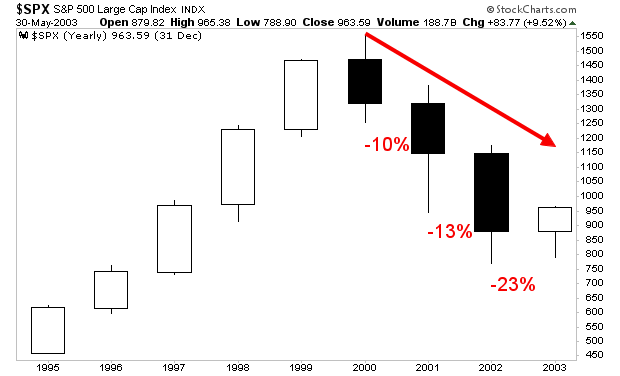

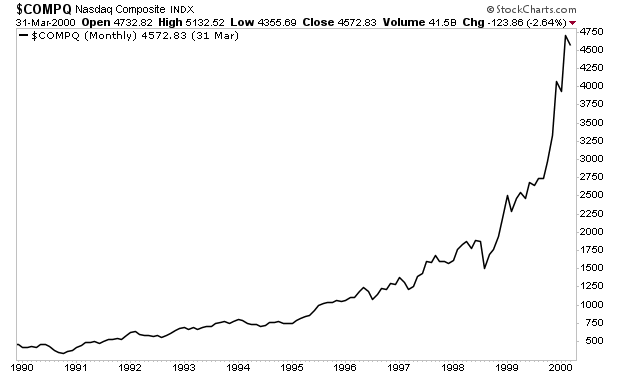

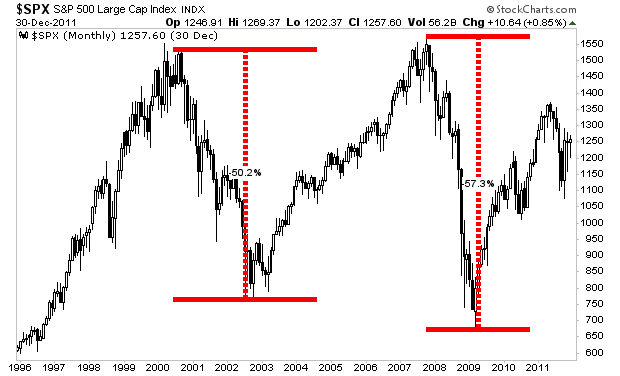

So what happens to stock bulls who buy stocks going into a recession? Well, the last two times, stocks did this:

In simple terms, the markets are setting up to deal out a load of pain to stock market bulls in the coming weeks.

But you don’t need to be one of them!

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.Paragraph

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html