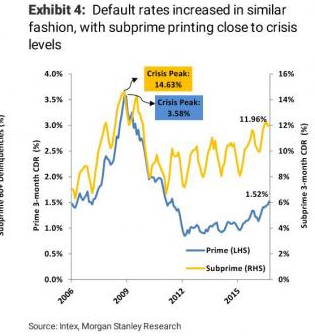

SubPrime 2.0 is proving far worse than even we suspected.

If you’ve not been following this story, our view is that the auto-loan industry is Subprime 2.0: the riskiest, worst area in a massive debt bubble, much as subprime mortgage lending was the riskiest worst part of the housing bubble from 2003 to 2008.

In both instances, these lending industries were rife with fraud, terrible due diligence, and the like. So when the debt bomb blew up, they were the first to implode.

However, it would appear now that the Subprime 2.0 was even worse than Subprime 1.0 in terms of verifying income.

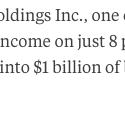

Santander Consumer USA Holdings Inc., one of the biggest subprime auto finance companies, verified income on just 8 percent of borrowers whose loans it recently bundled into $1 billion of bonds, according to Moody’s Investors Service.

The low level of due diligence on applicants compares with 64 percent for loans in a recent securitization sold by General Motors Financial Co.’s AmeriCredit unit. The lack of checks may be one factor in explaining higher loan losses experienced by Santander Consumer in bond deals that it has sold in recent years…

Source: Bloomberg

Santander only verified income on just 8% of autoloans. Put another way, on more than 9 out of every 10 autoloans, Santander didn’t even check if the person had a job.

Pretty horrific.

However, the story also notes that even the more diligent lender AmeriCredit verified income on only 64% of loans.

So… two of the largest autoloan lenders basically were signing off on loans without proving the person even had a JOB either roughly half the time or roughly ALL the time.

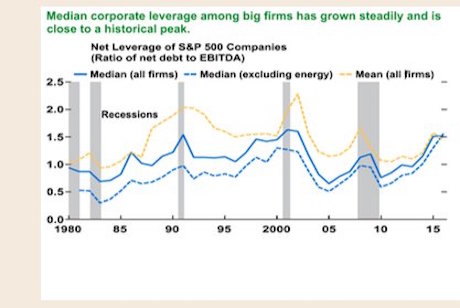

And this is on a $1.0 TRILLION debt bubble.

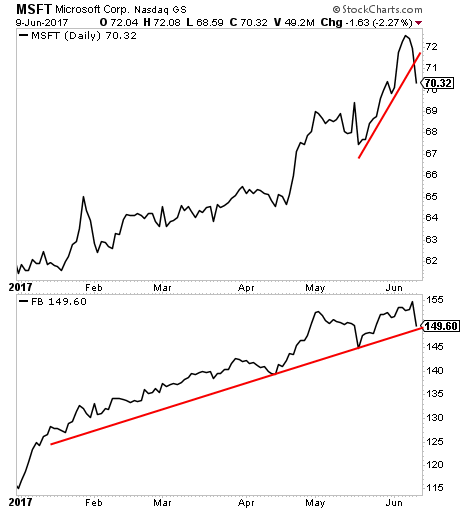

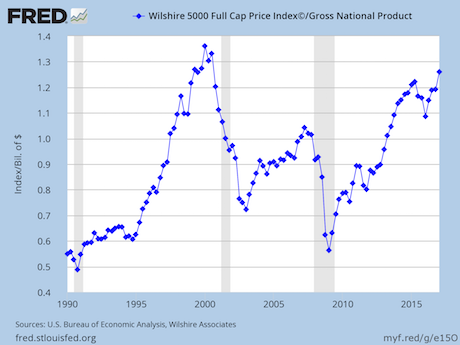

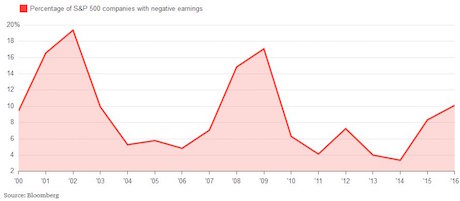

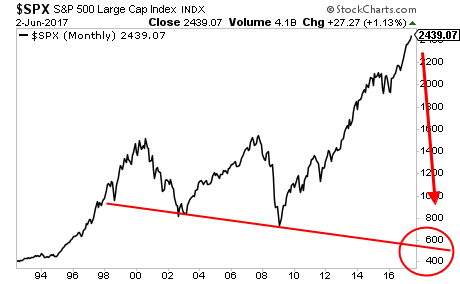

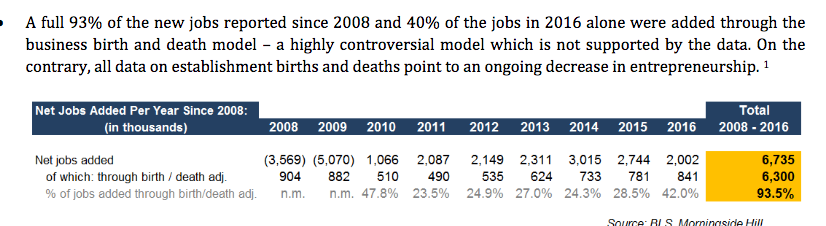

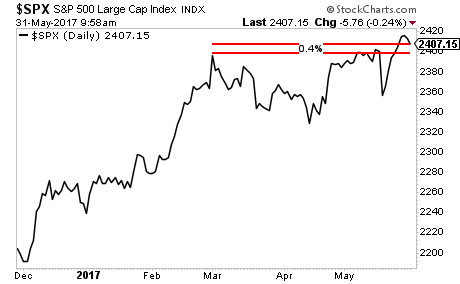

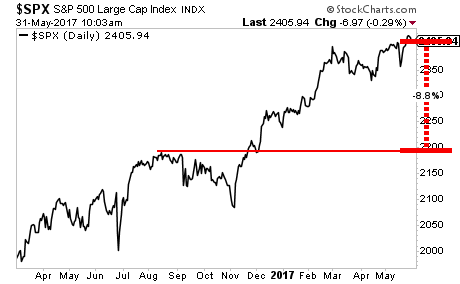

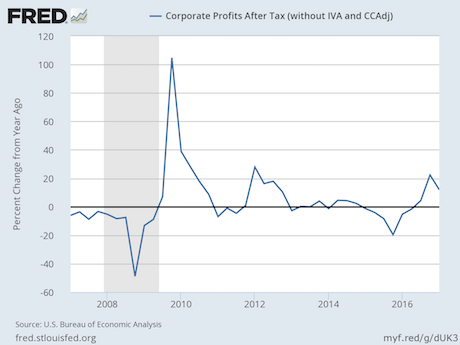

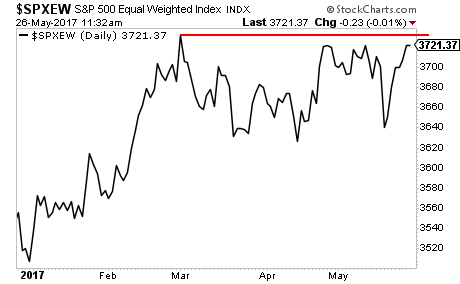

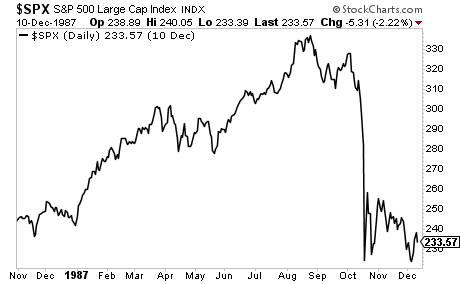

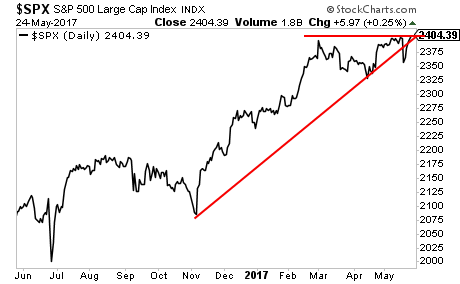

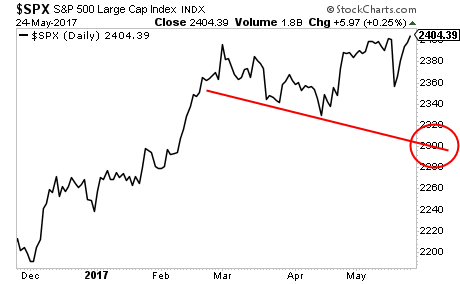

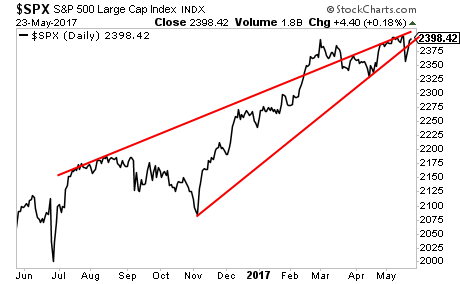

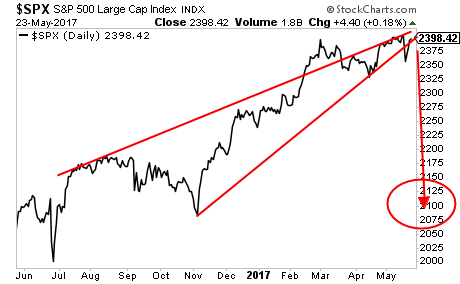

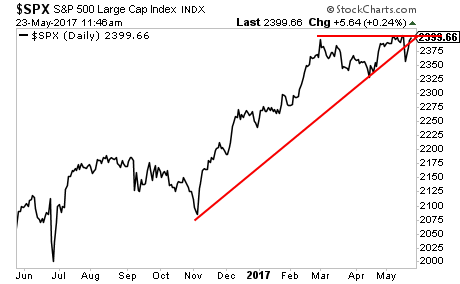

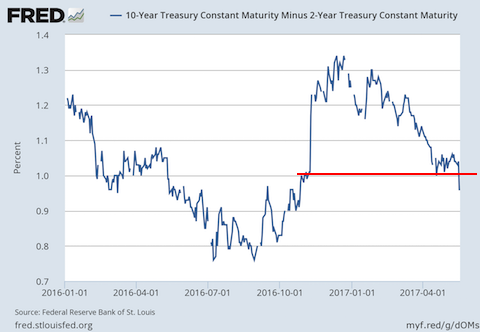

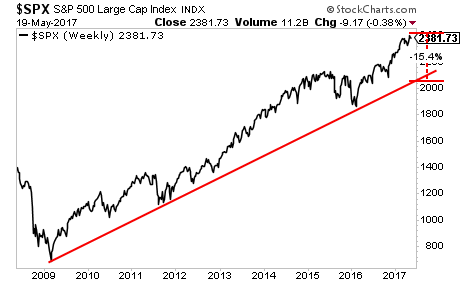

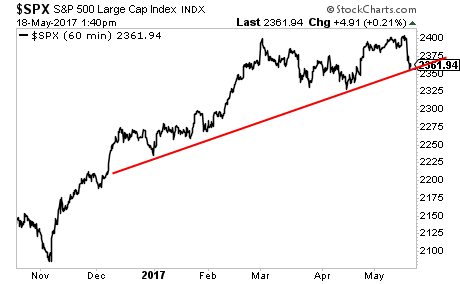

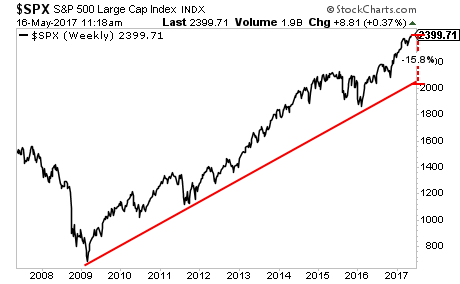

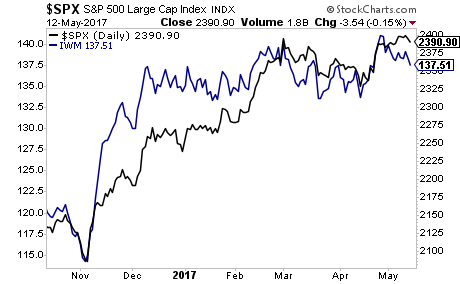

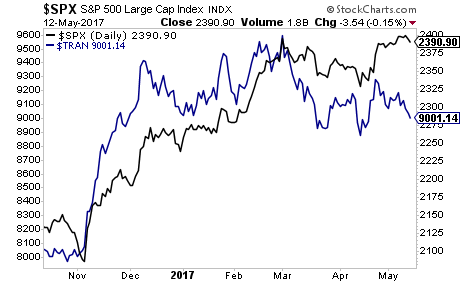

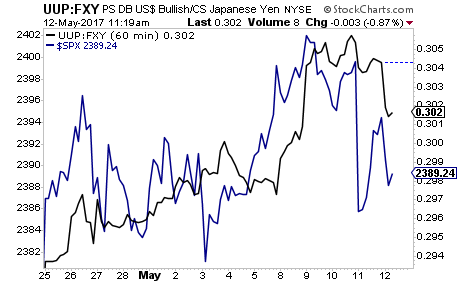

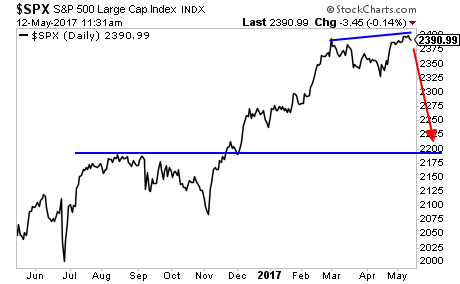

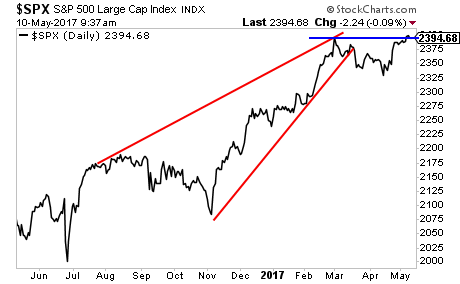

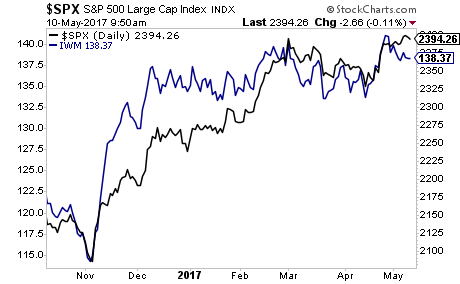

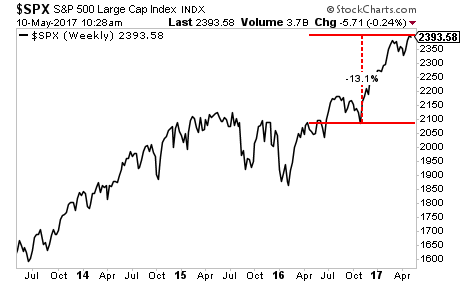

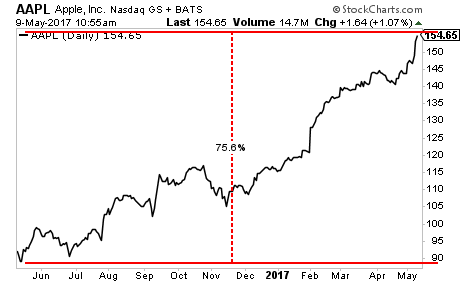

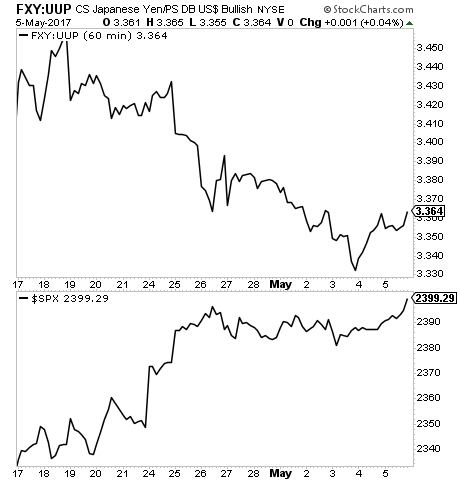

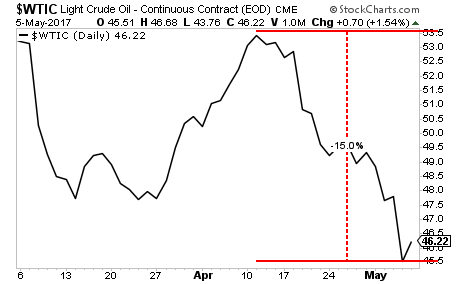

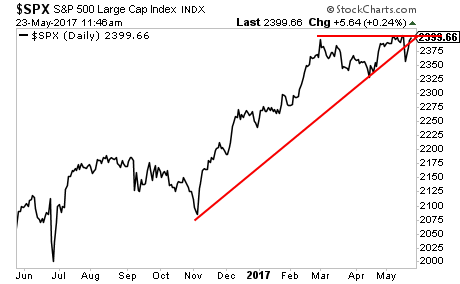

Meanwhile, stocks are flirting with all time highs.

Sounds a bit like late 2007 doesn’t it?

A Crash is coming… it’s going to horrific.

And smart investors will use it to make literal fortunes from it.

If you’re looking for a means to profit from this we’ve already alerted our Private Wealth Advisory subscribers to FIVE trades that could produce triple digit winners as the market plunges.

As I write this, ALL of them are up.

And we’re just getting started.

If you’d to join us, I strongly urge you to try out our weekly market advisory, Private Wealth Advisory.

Private Wealth Advisory uses stocks and ETFs to help individual investors profit from the markets.

Does it work?

Over the last two years, we’ve maintained a success rate of 86%, meaning we’ve made money on more than EIGHT out of every ten trades we make.

Yes, this includes all losers and every trade we make. If you followed our investment recommendations, you’d have beaten the market by a MASSIVE margin.

However, if you’d like to join us, you better move fast…

… because tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Click Here Now!!!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research