Warren Buffett once noted, Gold doesn’t do anything “but look at you.” It doesn’t pay a dividend or produce cash flow.

However, the fact of the matter is that Gold has dramatically outperformed the stock market for the better part of 40 years.

I say 40 years because there is no point comparing Gold to stocks during periods in which Gold was pegged to world currencies. Most of the analysis I see comparing the benefits of owning Gold to stocks goes back to the early 20th century.

However Gold was pegged to global currencies up until 1967. Stocks weren’t. Comparing the two during this time period is just bad analysis.

However, once the Gold peg officially ended with France dropping it in 1967, the precious metal has outperformed both the Dow and the S&P 500 by a massive margin.

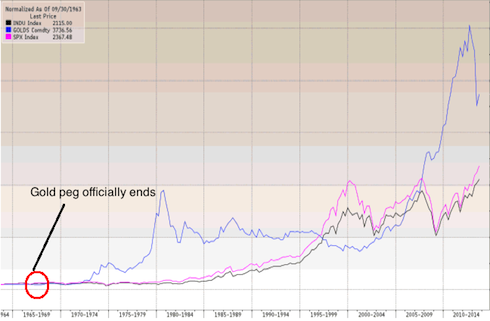

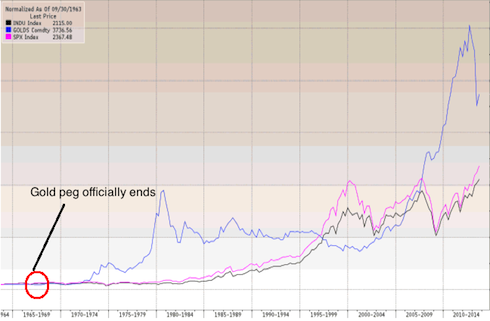

See for yourself… the below chart is in normalized terms courtesy of Bill King’s The King Report.

According to King, Gold has risen 37.43 fold since 1967. That is more than twice the performance of the Dow over the same time period (18.45 fold). So much for the claim that stocks are a better investment than Gold long-term.

Indeed, once Gold was no longer pegged to world currencies there was only a single period in which stocks outperformed the precious metal. That period was from 1997-2000 during the height of the Tech Bubble (the single biggest stock market bubble in over 100 years).

In simple terms, as a long-term investment, Gold has been better than stocks.

Now, let’s compare Gold to the US Dollar.

Every asset in the financial system trades based on relative value. Ultimately, this value is denominated in US Dollars because the Dollar is the reserve currency of the world.

However, even the US Dollar itself trades based on relative value. Remember the Dollar is merely a sheet of linen and cotton that is printed by the Fed and is backed by the full faith and credit of the Unites States.

In this sense, the Dollar’s value is derived from the confidence investors that the US will honor its debts.

Moreover, the Dollar’s value today also derived from the Fed’s money printing. Indeed, a Dollar today, is worth only 5% of a Dollar’s value from the early 20th century because the Fed has debased the currency.

As a result of this the world has adjusted to this change in relative “value” resulting in a Dollar buying less today than it did 100 years ago.

In this sense, Gold’s value is derived from investors’ faith in the Financial System (ultimately backstopped by the Dollar) and the Fed’s actions.

If you remove this confidence, then the entire system collapses as the reserve currency is no longer perceived has having value.

The problem with this setup however is that the US, like almost every other country in the world (I’m including China which is sporting a Debt to GDP ratio north of 200% if you account for its Shadow Banking liabilities), has made promises that it cannot possibly keep.

The US “officially” owes nearly $17 trillion in debt. However, if you include unfunded liabilities this amount surges to at least over $80 trillion and likely north of $100 trillion.

These are promises the US has made. And the US Dollar’s value is based on the belief that the US will honor these promises.

The US is not isolated in this regard. Indeed, the problem of unfunded liabilities exists throughout the world.

In the case of Europe, the situation is so bad that the average EU country would need to have an amount equal to over 400% of its GDP sitting in the bank, earning interest at the government’s borrowing rate, in order to fund its unfunded liabilities.

The same goes for Japan and even China where the shadow banking system has liabilities north of 200% of China’s GDP.

These are promises that cannot be kept. And when these promises are broken confidence in the system will be broken. This will inevitably lead to a period of currency collapse. After this, ultimately there will be a need to restore confidence in the system.

The only way to do this will be by backing currencies with Gold again (or a basket of items that includes Gold).

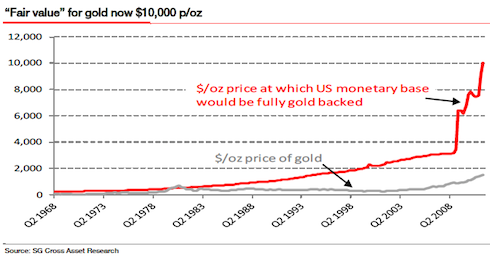

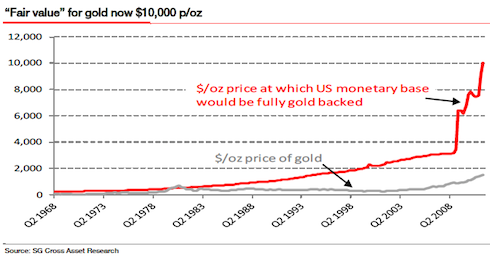

Given the limited amount of Gold in the world, (a little over 171,000 tons) and the enormous amount of US Dollars in the world, this would require a revaluation of Gold to north of $10,000. Dylan Grice formerly of Societe General lays this out beautifully in the below chart.

I cannot possibly predict when all of this would happen. All I can state with 100% certainty is that ALL fiat currencies throughout history have failed.

This failure has been based on a loss of confidence. And the only way to restore confidence is to limit the ability of Central Banks to print money.

This will inevitably lead to some form of a Gold backed currency. Gold has been used as currency for over 5,000 years. It will be considered currency again in the future. When it does, the price of Gold will be much higher (remember, Gold has risen over 34 fold in the last 40 years).

On that note, if you’re seeking investment recommendations along with laser pinpointed investment research, you should check out our paid monthly newsletter Private Wealth Advisory.

Private Wealth Advisory is a monthly investment advisory that outlines the market action and shows you how to profit from what’s to come. On that note, we currently are sitting on over 17 winners in our Private Wealth Advisory portfolio, with gains as large as 18%, 21%, even 33%… all opened in the last year.

Every Private Wealth Advisory subscription comes with a iron clad 90 day money back guarantee. So if you find Private Wealth Advisory is not for you at any point in the next three months, simply drop us a line and we’ll issue a full refund.

The reports you download and investment ideas you get between now and then are yours to keep.

To subscribe now to Private Wealth Advisory for just $179 (a 40% discount from the normal market price of $300)…

Click Here Now!

Best Regards

Phoenix Capital Research