There is no recession.

The investment herd bought heavily into the “a recession is about to hit” narrative earlier this year.

They did this based on:

1) A sharp dip in economic activity in the first half of 2019.

2) A yield curve inversion in the Treasury market.

3) Hatred of the Trump administration and hopes that a recession would increase the odds of him losing the 2020 election.

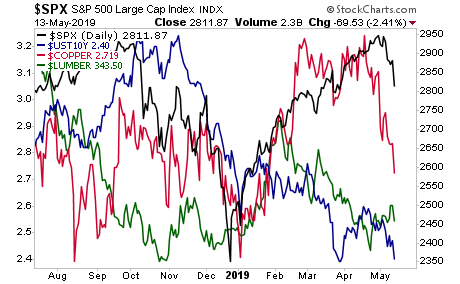

Regarding #1, it’s now clear that the dip in economic activity is rebounding. Both US manufacturing and service sectors PMIs both surprised to the upside in October. We also saw a sharp rebound in consumer confidence and existing home sales.

Bottom-line: the data is rebounding.

Regarding #2, countless pundits noted that the Treasury yield curve inverted earlier this year. For those unfamiliar with this idea, a yield curve inversion is when short-term Treasuries yield more than long-term Treasuries. It’s happened before most recessions in the last 50 years. And so the investment herd assumed that this time it was the same.

Except it’s not.

Central banks effectively cornered the bond market from 2008-2017 with over 600 interest rate cuts and $14 trillion in QE. Never before in history have we seen a coordinated attempt to control the bond market like this. And it has rendered historical comparisons weak if not useless.

Put simply, any analysis of the bond market that doesn’t account for the fact that the bond market is now artificial is not worth the paper it’s written on. For this reason alone, the yield curve inversion is no longer a guaranteed indicator of a looming recession.

Regarding #3, I don’t have anything to add. Politics is a toxic topic and frankly if you hate a political figure so much that you hope millions of Americans will lose their jobs so that he or she will lose an election you need professional help. And if you’re investing based on this kind of thinking, you’re going broke.

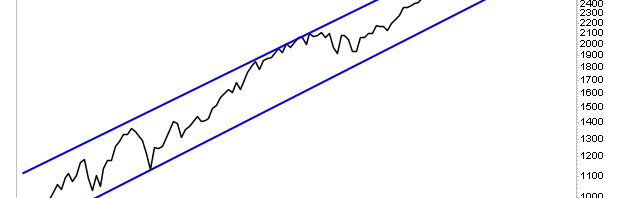

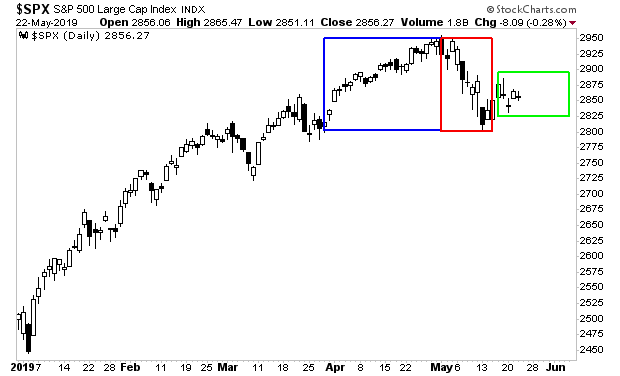

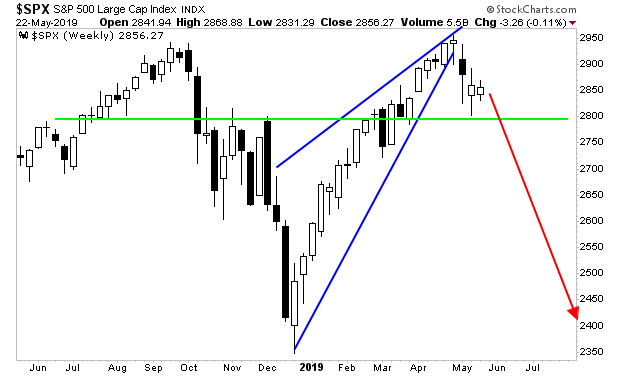

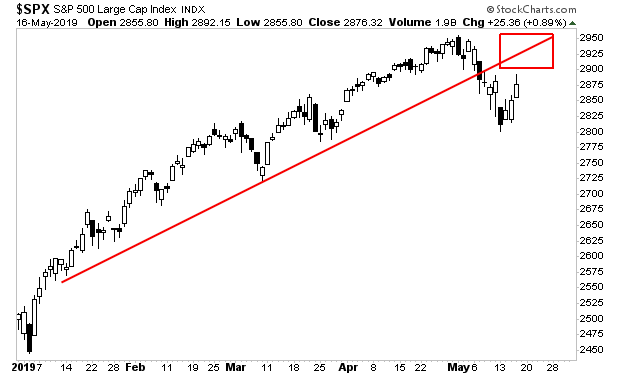

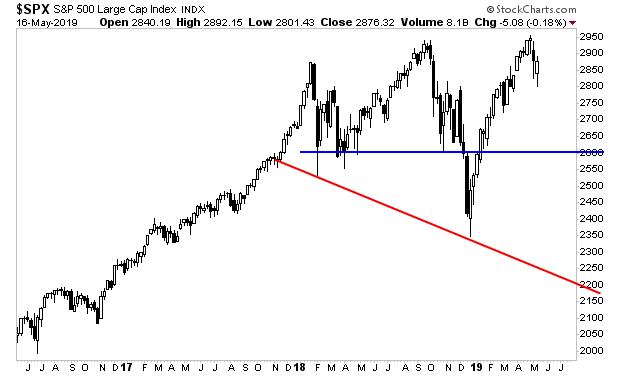

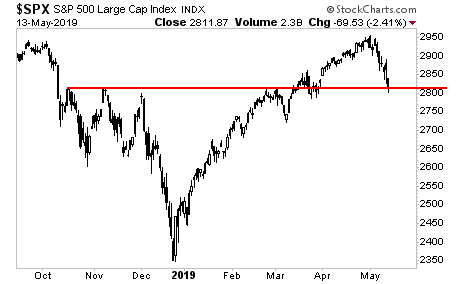

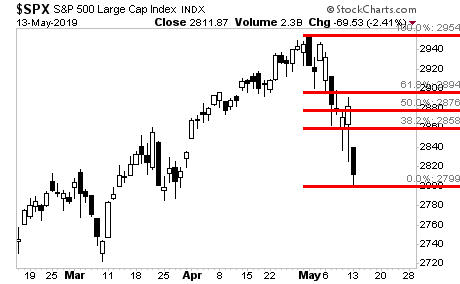

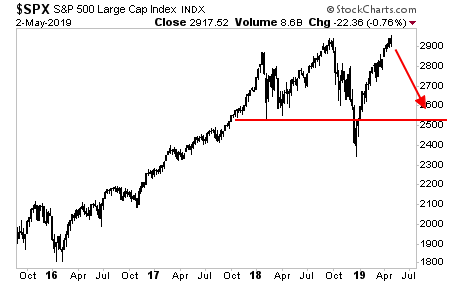

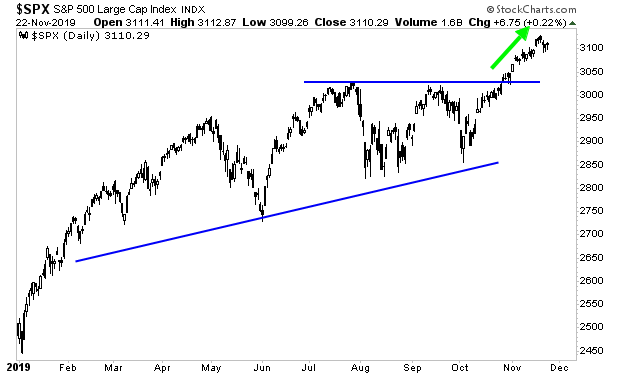

Add it all up and the “a recession is coming” crowd is dead wrong. Stocks have known this for some time, which is why they’ve broken out to the upside of their consolidation range.

Mind you, this happened at a time when investors were sitting on $3.4 trillion in cash.

So what happens when hedge funds who are desperate to improve their 2019 performance to halt redemptions… and individual investors who went “into cash” based on recession forecasts, both realize that they were wrong?

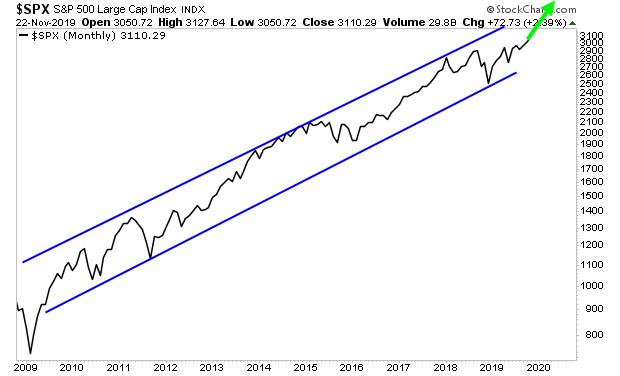

We get 4,000 on the S&P 500.

Again, the market has already signaled this is coming.

With that in mind, we’ve just published an investment report titled Triple Your Money With the Mother of All Bubbles.

It outlines how the market is entering yet another bubble, driven by funny money from the Federal Reserve.

It also outlines a unique investment that could easily triple as the Fed unleashes a tsunami of liquidity pushing stocks to nosebleed levels.

The last time the Fed began an easing cycle, this investment rose over 1,439%. And this time around we could see similar gains.

To pick up your copy of Triple Your Money With the Mother of All Bubbles go to:

https://phoenixcapitalmarketing.com/MOAB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research