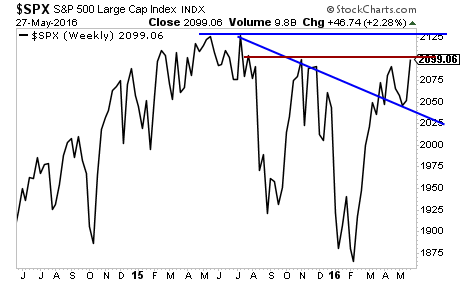

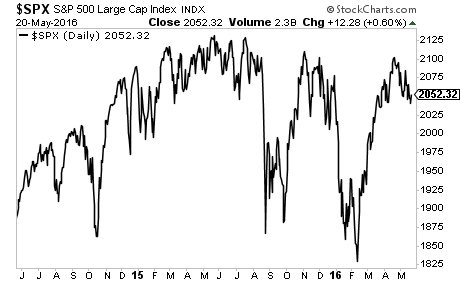

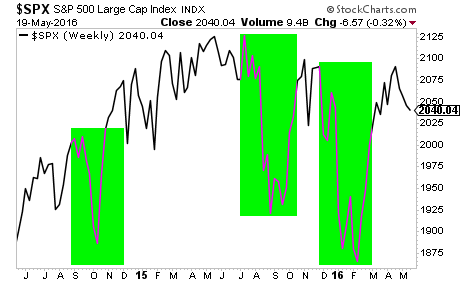

Traders gunned the market higher last week thanks to extremely low volume (most of Wall Street left early for the holiday weekend) and the usual performance (many funds have to record results at month end).

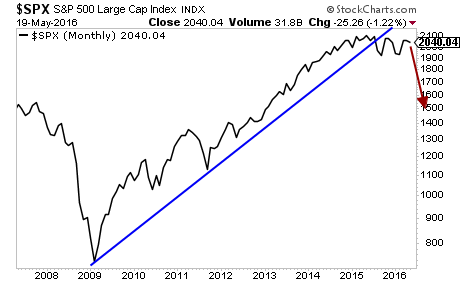

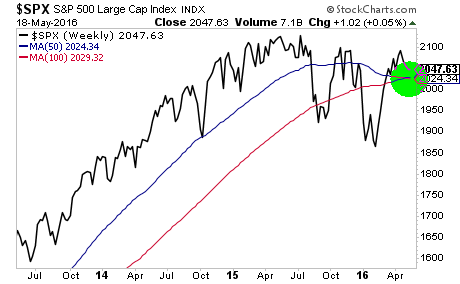

The S&P 500 has now slammed up against overhead resistance (red line). We are once again within spitting distance of the all-time highs.

———————————————————————-

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 172% return on invested capital thus far in 2016.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER...

———————————————————————–

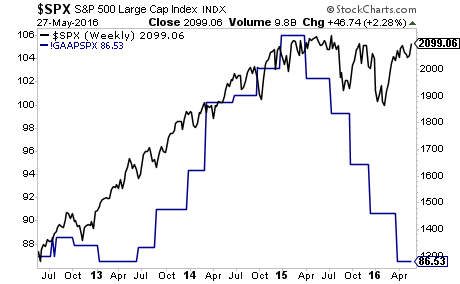

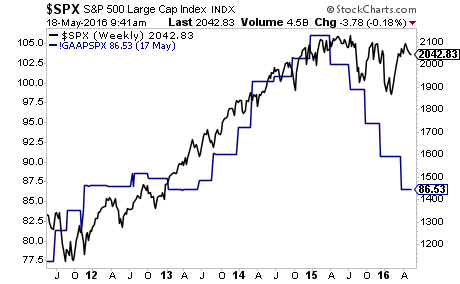

Against this backdrop, earnings are in a free-fall. EPS are back at 2012 levels, while the S&P 500 is 70% higher than then:

This divergence is only getting worse. Of the 111 companies that have issued guidance for 2Q16, an incredible 80% are NEGATIVE.

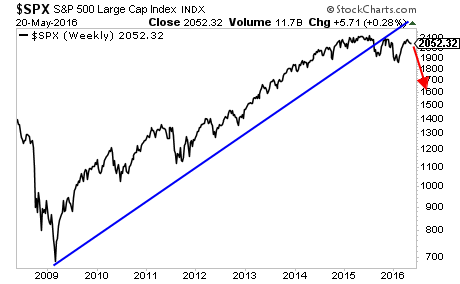

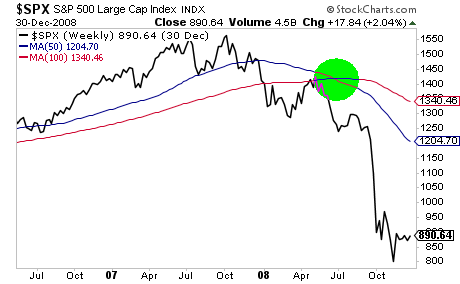

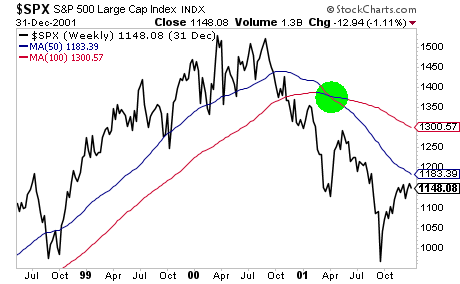

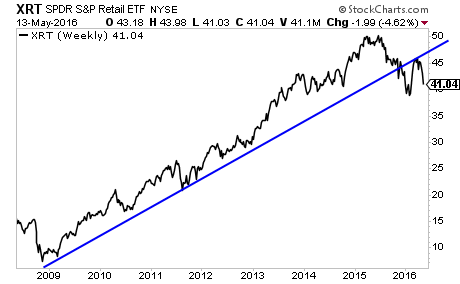

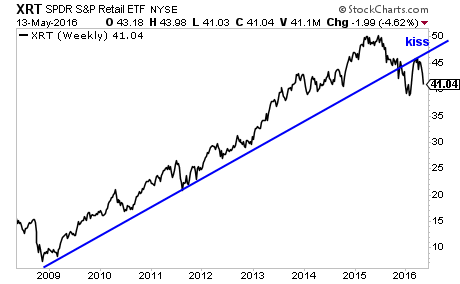

More and more this environment feels like late 2007/ early 2008: when the economy was in collapse but stocks held up on hopes that the Fed could maintain the bubble.

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 Crash back in late 2007? We did, and our clients made triple digit returns when the markets imploded.

We’re currently preparing for a similar situation today.

Indeed, subscribers of my Private Wealth Advisory newsletter just closed out THREE more winners last week: gains of 10%, 12% and 15% produced in just a few weeks’ time.

This brings our winning trade streak to 81 straight winning trades.

Indeed, we haven’t closed a single loser since November 2014.

81 straight winners… and not one closed loser… in 18 months.

However, I cannot maintain this kind of track record with thousands of investors following our recommendations.

So we are going to be raising the price on a Private Wealth Advisory subscription from $199 to $249 at the end of the month.

However, you can try Private Wealth Advisory for 30 days today, for just 98 cents.

If you find that Private Wealth Advisory is not for you, just drop us a line and you won’t be charged another cent.

To take out a 30 day trial to Private Wealth Advisory for just 98 cents…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit