I realize that my recent call for a “blow off top” might sound odd, particularly since I’ve been warning that stocks are in a bubble for some time. So let me provide some BIG Picture analysis for what I see happening here.

Calling the precise top of a bubble is all but impossible. This is particularly true for this current bubble because it is an Everything Bubble: a situation in which sovereign bonds (the bedrock of the financial system) are in a bubble, which in turn has resulted in EVERY asset class getting bubbly.

With that in mind, I DO believe that some bubbles are currently bursting while others are entering the “blow off top” phase.

Indeed, my current blueprint for what’s to come this year is as follows:

1) The Tertiary Bubbles burst (has already happened).

2) The Secondary Bubbles burst (coming later this year likely during the summer).

3) The Primary Bubbles burst (late 2018/ early 2019).

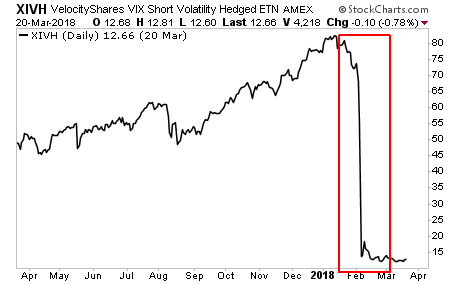

The Tertiary Bubbles were bubbles based on particular investing strategies in stocks. I’m talking about “shorting volatility” and “risk parity” fund strategies.

That bubble has blew up in February, erasing years’ worth of gains in a matter of days.

—————————————————————-

This Might Be the Single Most Profitable Options Trading Service on the Planet

Want to CRUSH the market without spending hours trading per day?

Our proprietary options trading system trades just ONE trade, ONCE per week…

And our portfolio is already 20% this year.

Yes, 20%. And we’re just four months in to 2018!

Normally a service like this costs $5,000 just to try…

But you can get a YEAR’s worth of our trades for just $499.

This offer expires tonight at midnight. Based on our track record, we’re raising the price to $1,000.

To lock in the discount rate…

—————————————————————-

While this DID represent a significant “risk off” development, this did not mark the end of the Everything Bubble. All told, Short Volatility strategies/ Risk Parity Funds manage $2 trillion.

The Bond Bubble, by way of contrast, is over $200 trillion in size. And the irony of the recent stock sell-off is that it has forced capital INTO bonds, which has resulted in bond yields falling, which has kept the Bond Bubble intact (see the blue square in the chart below).

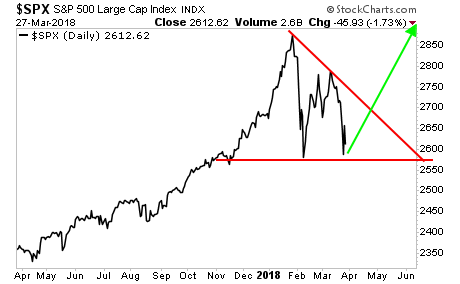

Put simply, when the Secondary Bubble (stocks) began to get into danger, it saved the Primary Bubble (bonds). By doing this, it allowed the financial system to rebalance itself for a final push in all risk assets.

In the case of stocks, this will feature a Blow Off Top that will take the S&P 500 to 3,000 sometime this summer.

Suffice to say, the opportunity to make MASSIVE gains from this trend is HUGE.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research