Last week the Fed announced it intends to hike rates another two times this year, with three more hikes next year. The Fed also announced that it will continue to increase its QT program with the goal of eventually withdrawing $50 billion in liquidity per month, or some $600 billion per year.

The market didn’t like this announcement, with stocks in a sea of red. This has raised the question… “is the Fed going to trigger a market meltdown?”

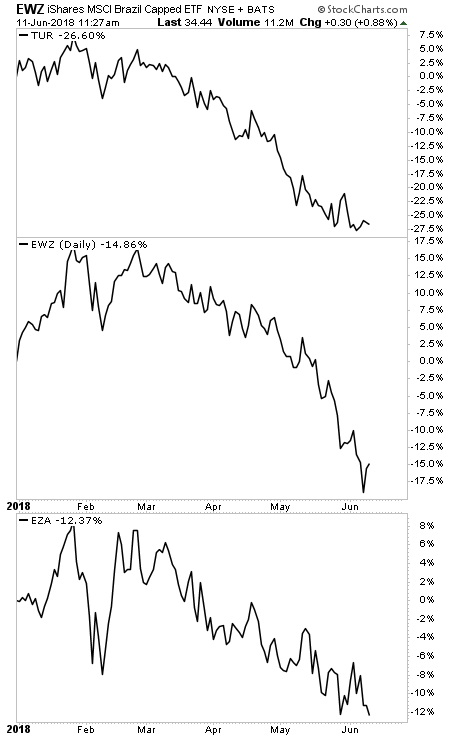

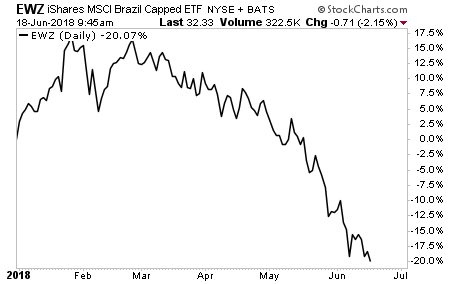

How you answer that depends on who you ask. If you ask an investor in many of the emerging markets, the answer is… “The Fed already has.” The Emerging Market ETF is down 15% from its recent peak, while other specific emerging markets such as Brazil are down 20% year to date.

—————————————————————-

That Makes NINE Straight Double Digit Winners!

Our options trading system is on a HOT streak, having locked in NINE double digit winners in the last four weeks.

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 41% this year alone.

In fact, we haven’t had a losing trade APRIL 2018.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

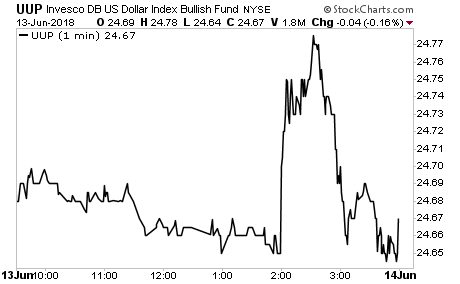

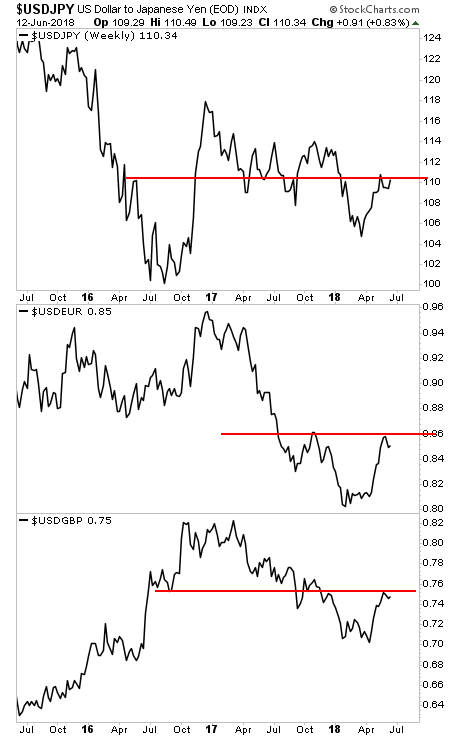

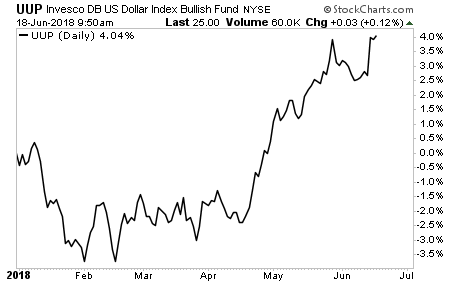

All of this can be squarely set on the Fed’s shoulders. Both the ECB and the BoJ are tapering their QE programs. The former will end its QE program in December, the latter… who knows? The point is, both are easing, while the Fed is hiking rates 3-4 times per year AND withdrawing liquidity to the tune of $30 billion per month.

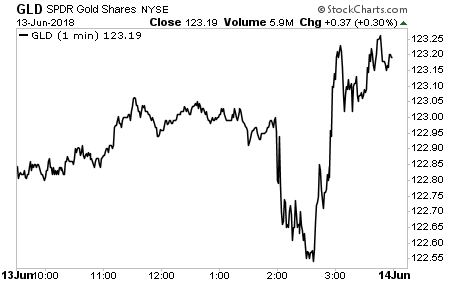

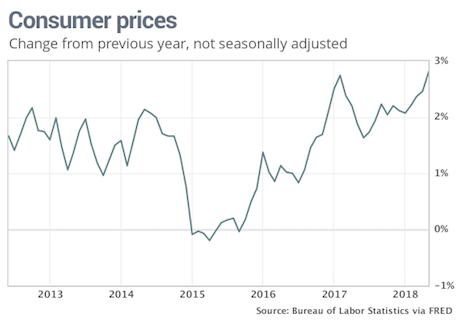

My point is that while most Central Banks are easing, the Fed is TIGHTENING as if it’s dealing with runaway inflation. This is forcing the US Dollar higher which in turn is putting the highly $USD leveraged system under duress.

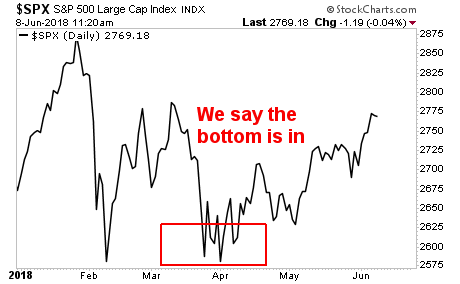

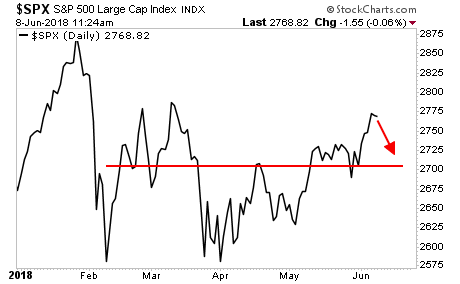

If the Fed doesn’t figure this out soon, we could very well see the carnage of the Emerging Markets space spread into the S&P 500. I remain VERY bullish in the intermediate term, but the Fed could make things NASTY in the short-term if it doesn’t fix this,

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE by one week. But this week is the last time this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research