Time for a pullback.

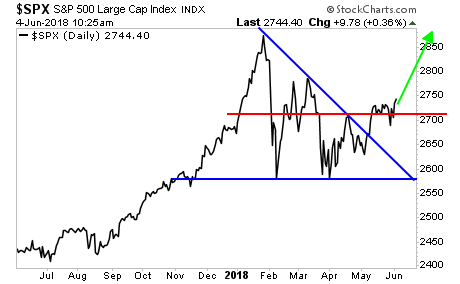

As a brief refresher on our track record thus far in 2018, in February and early March when the S&P 500 was at 2770, we warned that stocks would revisit the lows.

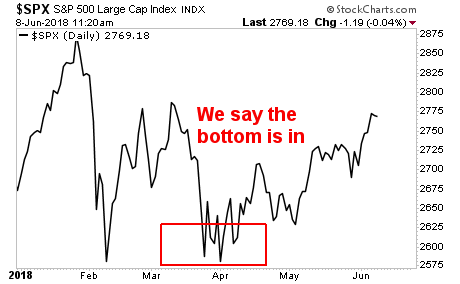

Then in late March/ early April when the S&P 500 was at 2,600, we said the bottom was in and that we would soon breakout to the upside.

—————————————————————-

That Makes NINE Straight Double Digit Winners!

Our options trading system is on a HOT streak, having locked in NINE double digit winners in the last four weeks.

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 41% this year alone.

In fact, we haven’t had a losing trade APRIL 2018.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

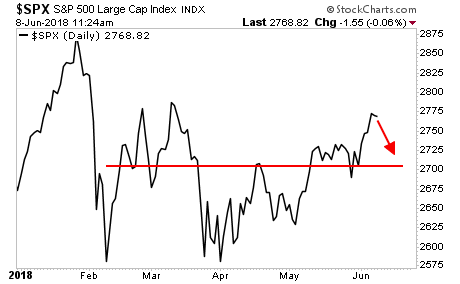

We’re now calling for a correction. Nothing goes straight up or straight down in the markets, and stocks are EXTREMELY overbought today. The pullback is to a target zone around 2,700.

This is needed to change sentiment around. Once we start seeing the permabears and doom/gloom crowd out claiming that “the next collapse is here” it’ll be time to go long again in preparation for the final run to new highs (3,000 on the S&P 500).

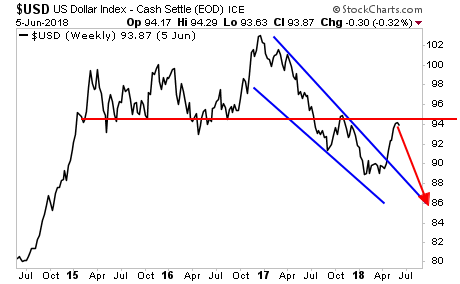

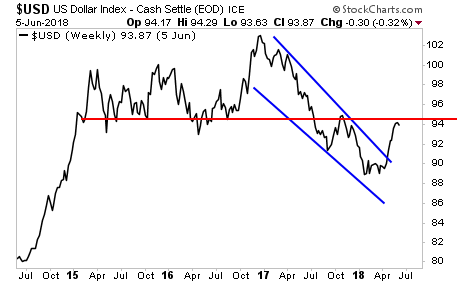

The financial media will find some “story” to justify this move. It’ll probably be something like “emerging market currencies are imploding” or “the G7 meeting was a disaster and President Trump is now isolated” but the reality is that the market is simply overbought and needs to shake out the “hot money”/ momentum players.

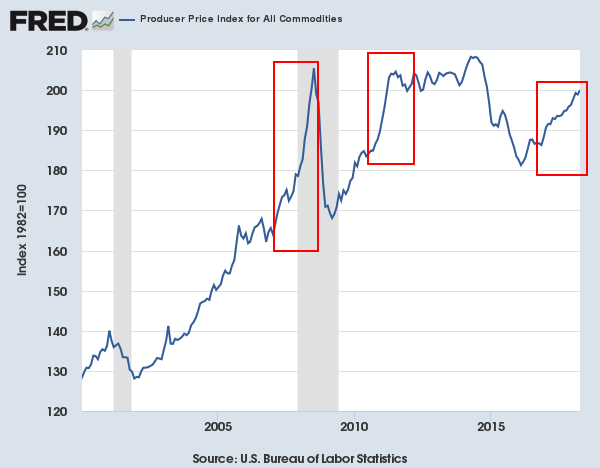

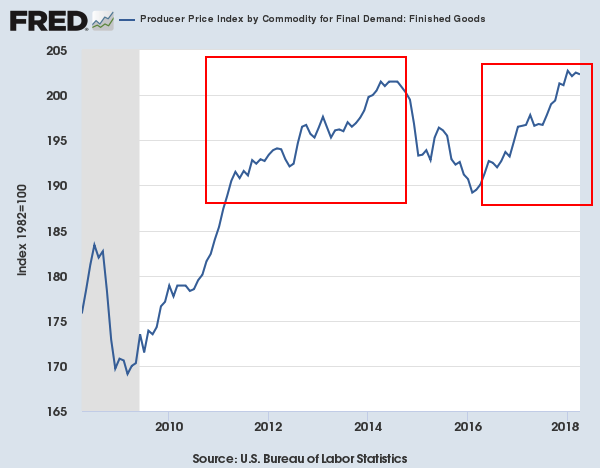

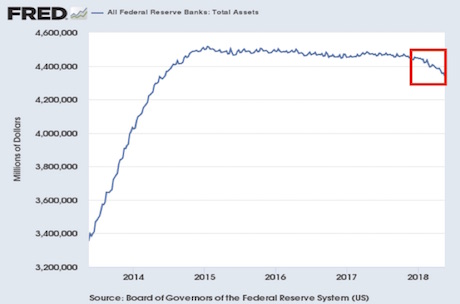

Once this move is over, we will crash up in a blow off top as inflation rips through the financial system.

This is the “White Swan” I’ve been forecasting since end of March 2018. It will mark THE blow-off top for the markets. Yes, I mean THE top will be in for years to come.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

`

`