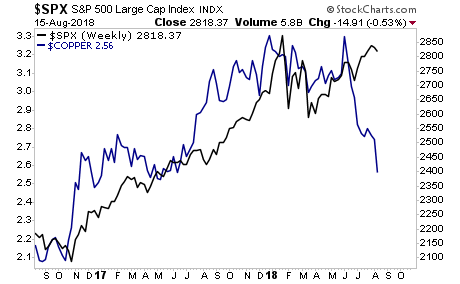

The markets are beginning to anticipate a weak $USD.

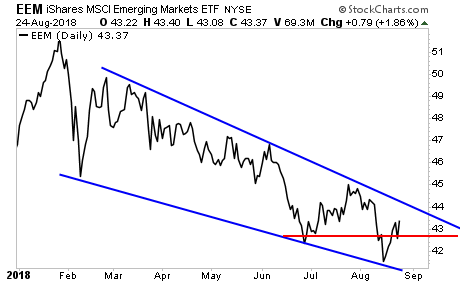

First and foremost, the Emerging Market ETF (EEM) is in the process of bottoming.

EEM was crushed by the $USD’s strength this summer. But it’s now starting to look like a major turn is approaching: EEM has just broken above major resistance and is in the process of preparing for an assault on the top trendline of its descending wedge formation.

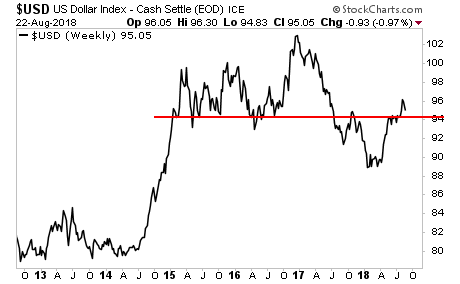

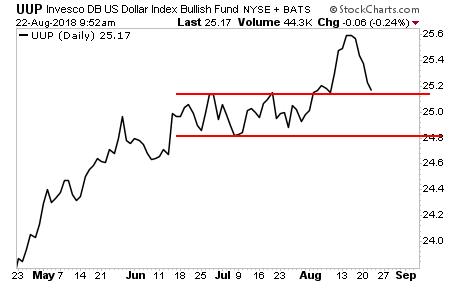

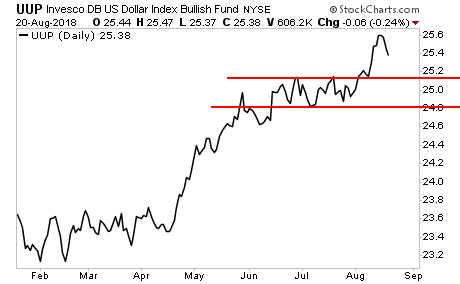

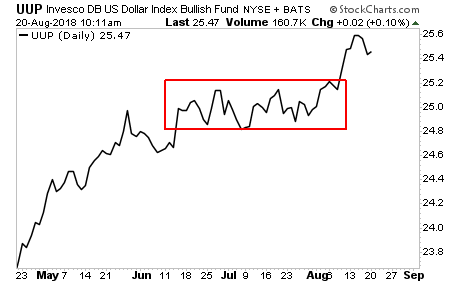

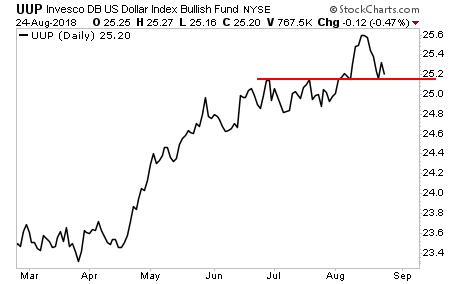

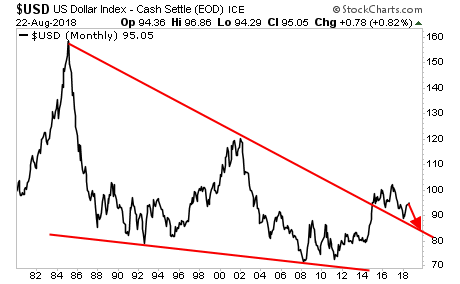

Elsewhere in the markets the $USD has reversed hard and is about to break through support. This is looking more and more like a “false breakout.” And the thing about false breakouts is that they usually result in VIOLENT declines.

What does all of this mean?

The financial markets are beginning to anticipate a WEAK $USD. The most likely reason for this is that the Fed is in fact MUCH closer to ending its hawkishness/ rate hikes that most realize.

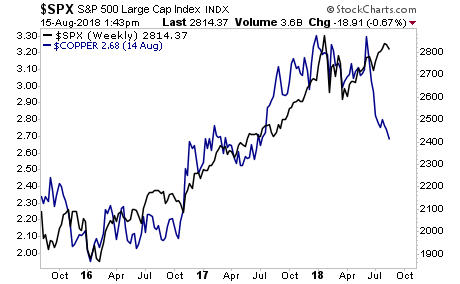

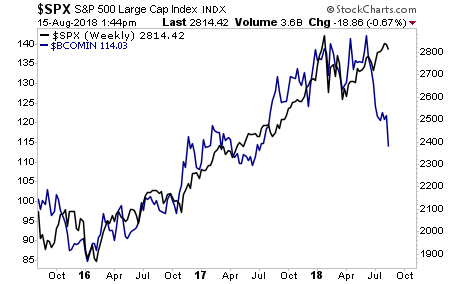

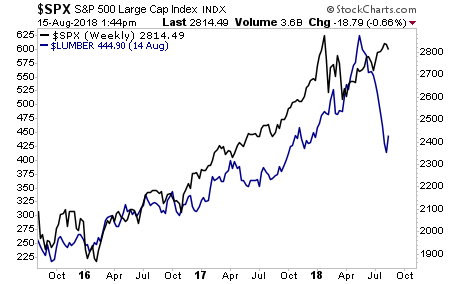

This will lead to the $USD dropping hard as inflationary/reflationary trades soar higher.

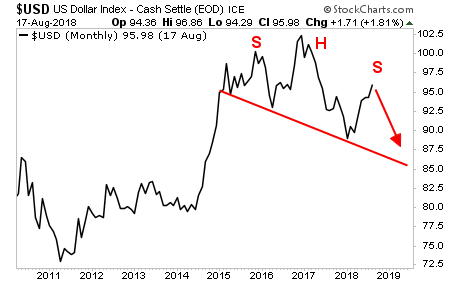

The long-term chart paints a nice picture for what I’m expecting. The $USD has in fact been forming a series of lower lows since 2014. The next low will take us to the mid’80s (see the red arrow).

That’s a heck of a “tell” from the markets. And it’s “telling” us that we’re about to see a major inflationary move as the $USD drops hard.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm

We are making just 99 copies available to the public.

There are just 17 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research