The vast majority of investors think the Fed will cut rates at its meeting this Wednesday.

Maybe it will, maybe it won’t.

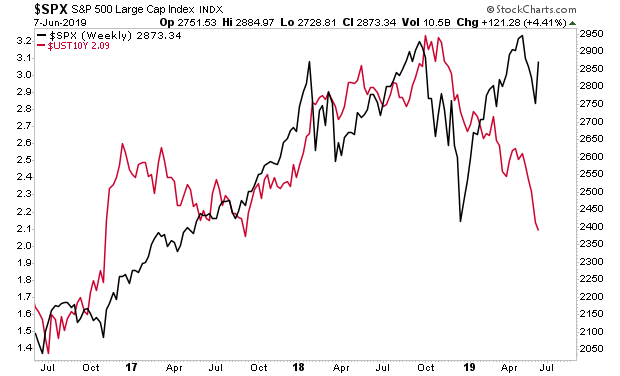

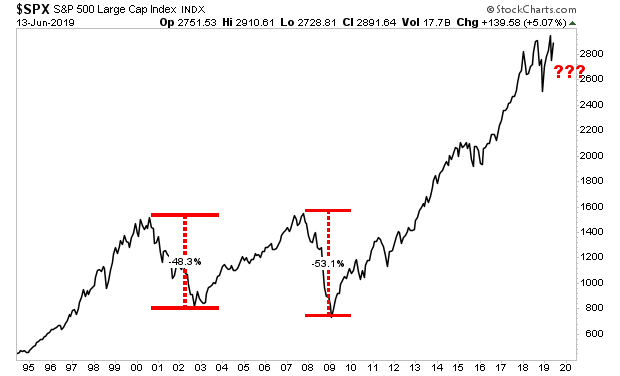

The reality is what the Fed does now doesn’t really matter. Globally the economy is contracting… and the last two times the Fed started cutting rates into a slowing economy didn’t work out so well for stocks.

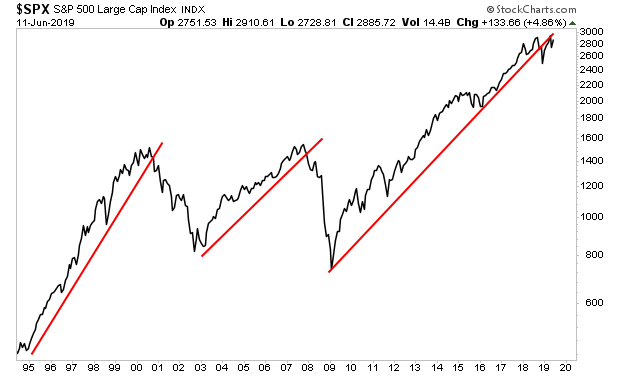

Those times were early 2000 and late 2007… both times the stock market subsequently plunged 50%.

Will this time prove different?

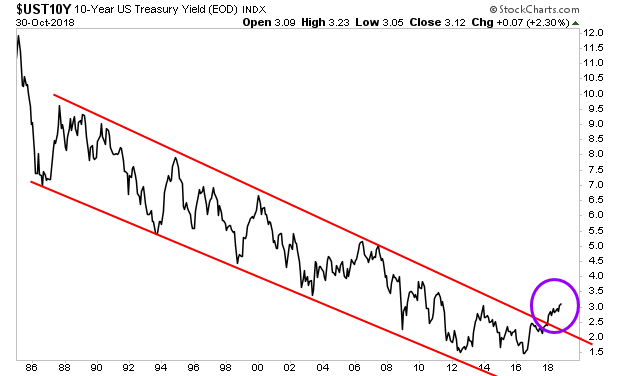

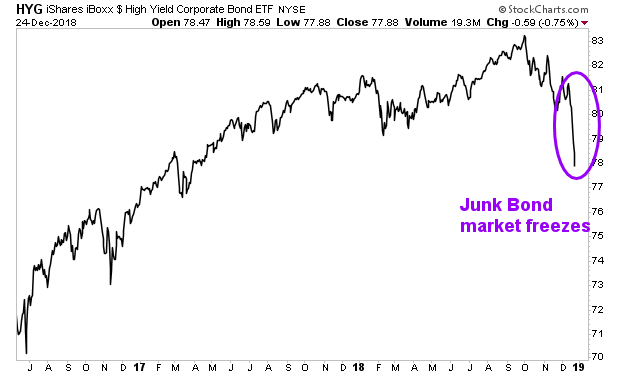

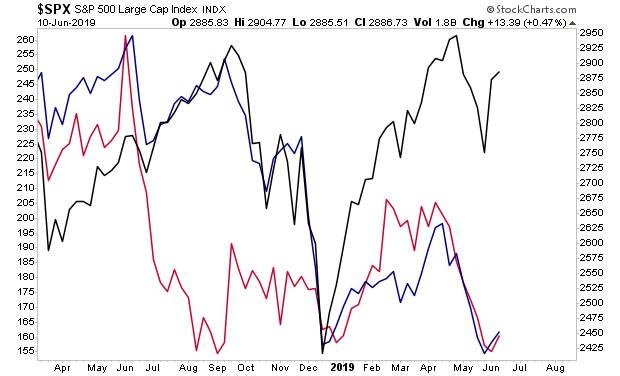

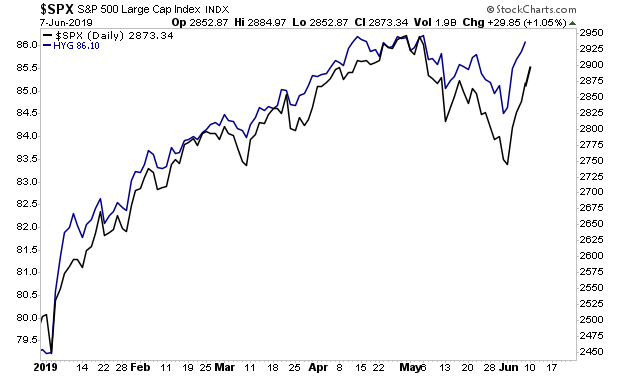

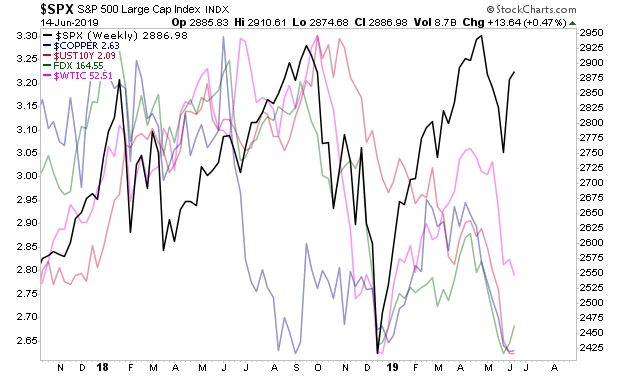

Copper, Treasuries, Fed Ex and Oil all say “NO”… they are all forecasting that fair value for the S&P 500 is at 2,500 or lower.

Bear in mind… this is based on an economic recovery hitting in the second half of this year… if a crisis hits, a 50% drop puts S&P 500 down at 1,450.

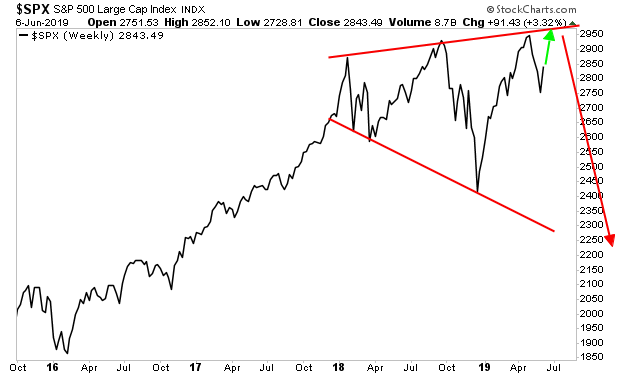

So while stocks may hold up for a little longer based on hype and hope… economic reality tells us we’re primed for a major collapse.

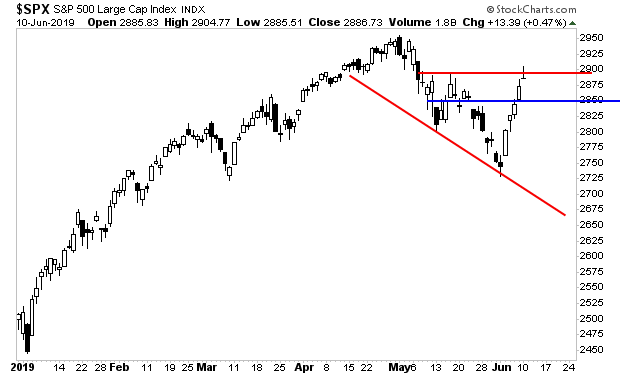

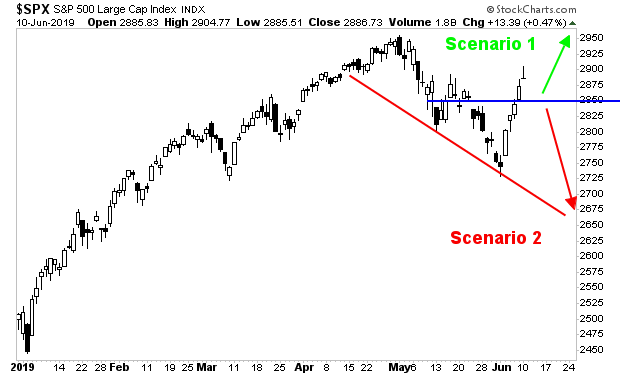

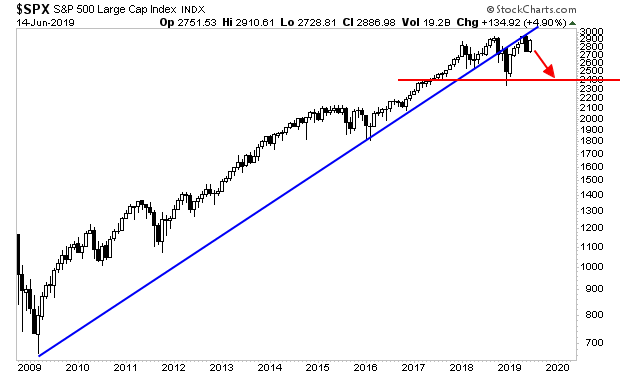

The bull market is over… we’ve had a failed backtest of the former trendline. The next move is DOWN.

Those investors who take the right steps to prepare for this, will make literal fortunes.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research