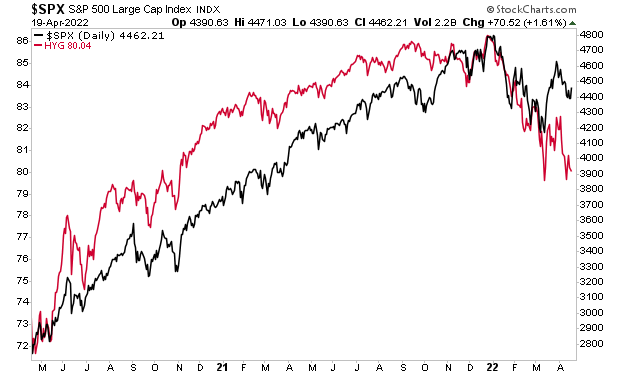

The bond market is blowing up.

As I outlined several weeks agothe financial system is now experiencing its first coordinated central bank tightening in over a decade.

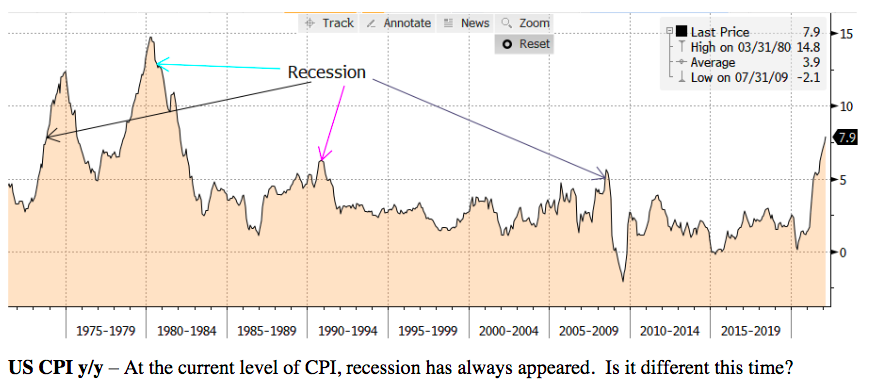

The reason for this tightening is inflation. Inflation is a global phenomenon. Once it appears, it is everywhere. That is the case today.

Our current financial system is based on debt. Sovereign bonds, particularly U.S. Treasuries, are the bedrock of the financial system. These are the senior-most assets owned by large financial institutions. And the yields on these bonds represent the “risk free” rate of return against which all assets (stocks, commodities, real estate, etc.) are valued.

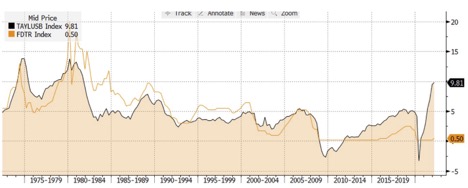

The yields on bonds have been spiking due to inflation. This is what forced central banks to begin tightening monetary policy. But thus far, they are failing to slow, let alone kill inflation.

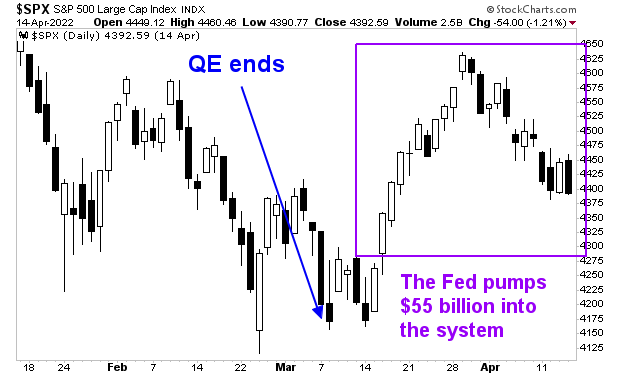

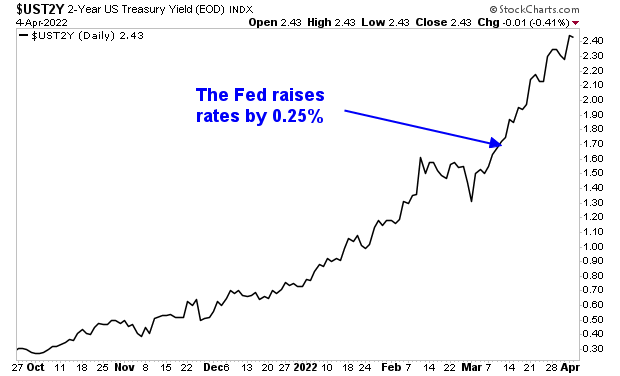

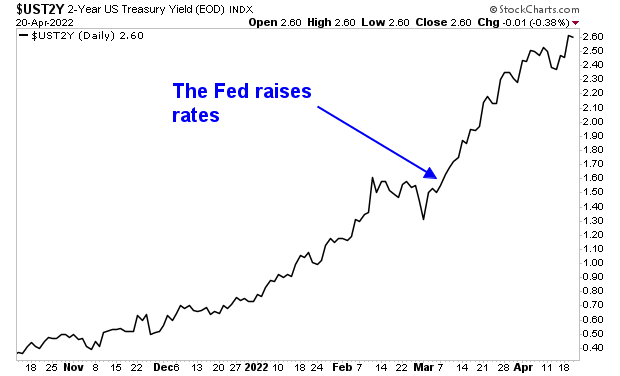

The U.S. central bank, the Federal Reserve (or Fed) raised rates by 0.25% in March. It was supposed to have ended its Quantitative Easing (QE) program that same month, but for whatever reason, chose to print another $55 billion during that time.

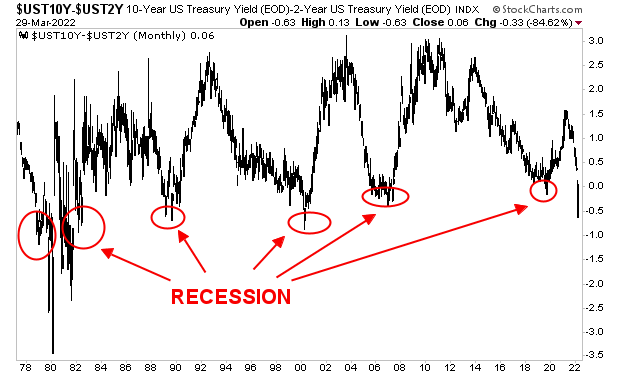

The yield on the 2-Year U.S. Treasury, has since spiked from 2.0% to 2.6%. That is a MASSIVE move for one of the most important bonds in the world (chart on the next page).

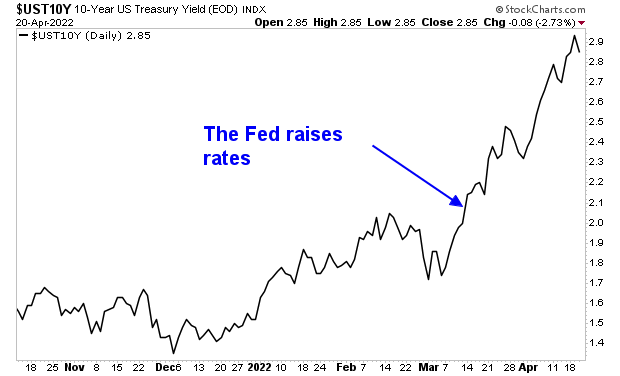

A similar move has taken place with the 10-Year U.S. Treasury, which is the single most important bond in the world. The yield on this bond has spiked from 2.1% to 2.9%.

To put these moves into context, bonds, particularly, sovereign bonds, are NOT like stocks. A 2% move is a BIG move for bonds. And we are talking about a 5% move in the most important bonds in the world over the span of four weeks… when the Fed is tightening.

This means that the Fed is now MORE behind the curve on inflation than it was four weeks ago. That is a huge freaking deal. It means the bond market doesn’t believe the Fed is going to kill inflation yet. The Fed will need to be MUCH more aggressive to do so.

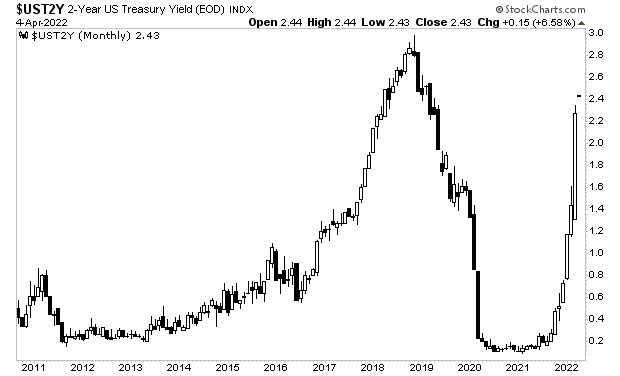

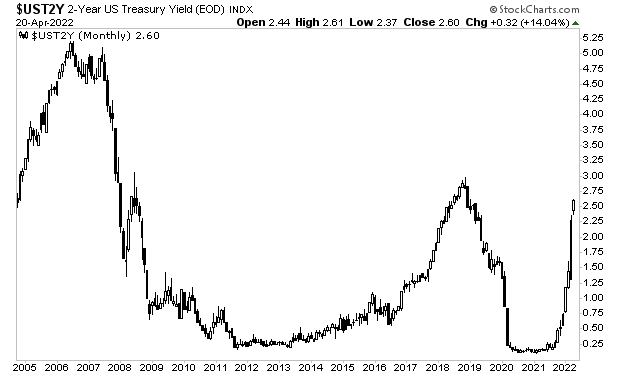

It is difficult to express the severity of what is happening right now in bonds. So let me provide some longer-term charts to help you visualize this.

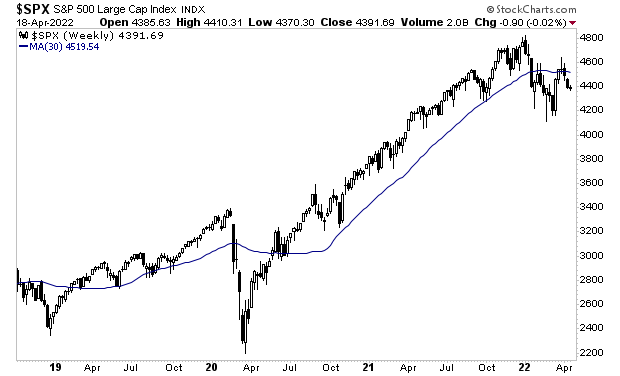

Look at the speed of this rise in yields relative to what bonds have done over the last 20 years. From 2003 to 2006 the yield on the 2-Year U.S. Treasury rose from 1.00% to 5.00%. This represents a quintupling in yield. And it occurred when the Fed was raising rates continuously for three years straight during a major economic expansion.

By way of contrast, the yield on the 2-Year U.S. Treasury has just gone from 0.25% to 2.6% in the span of six months.

That too is a quintupling in yield. And it took place at a time when the economy is faltering, and the Fed has barely begun tightening policy.

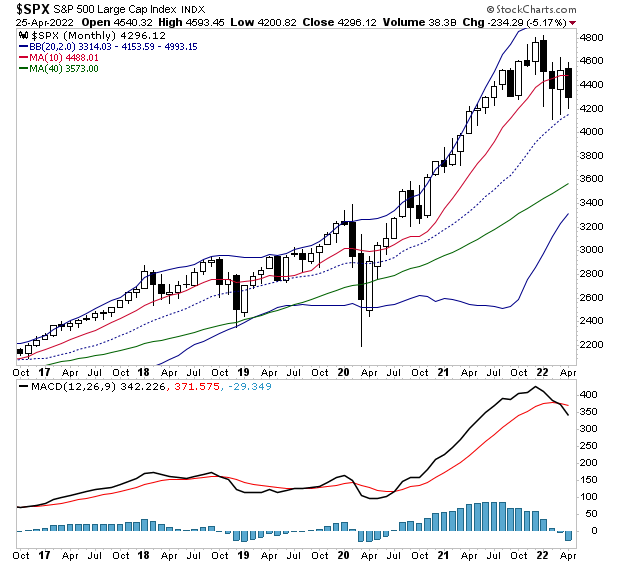

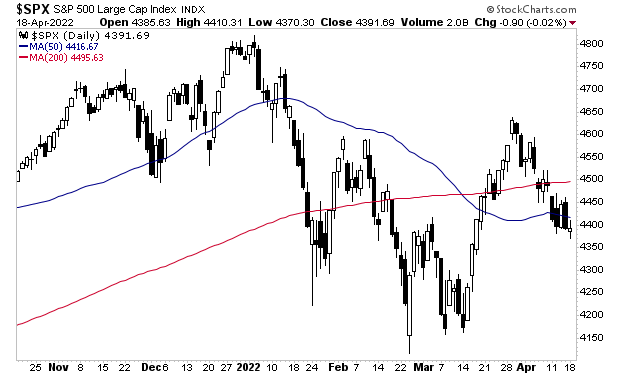

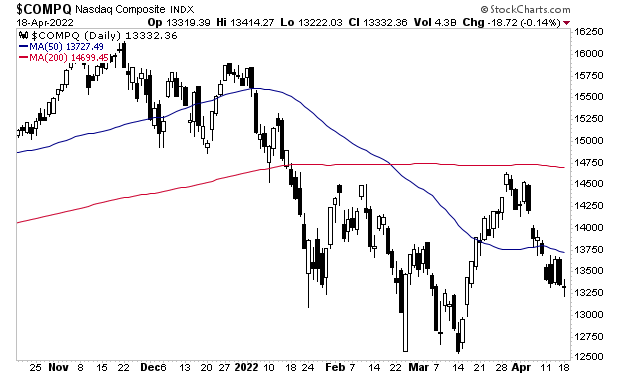

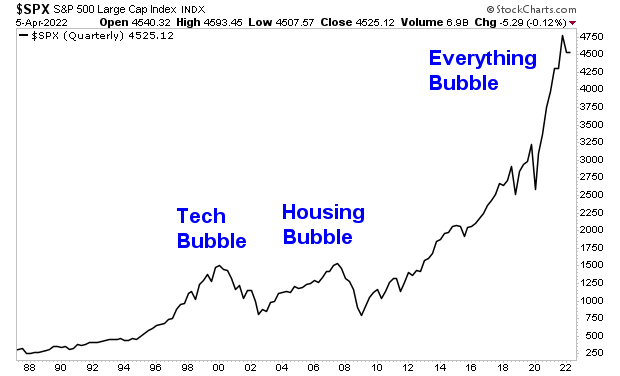

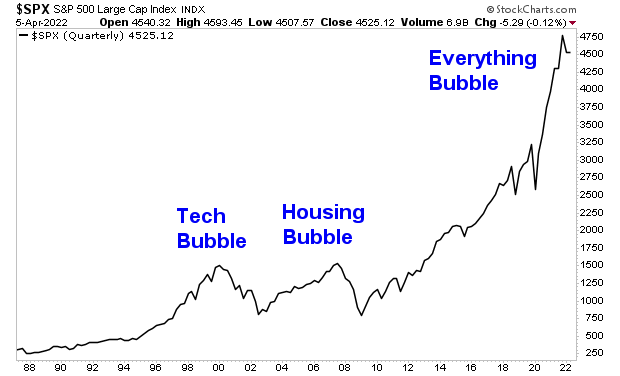

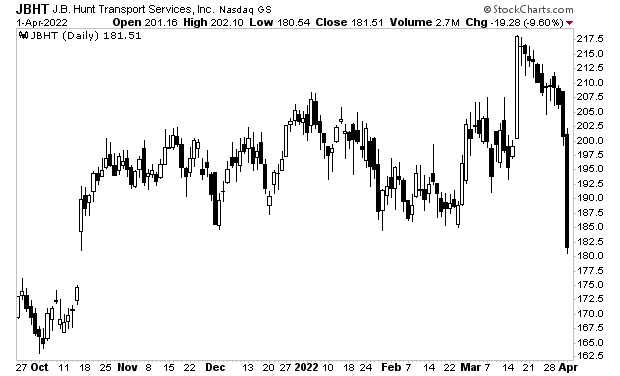

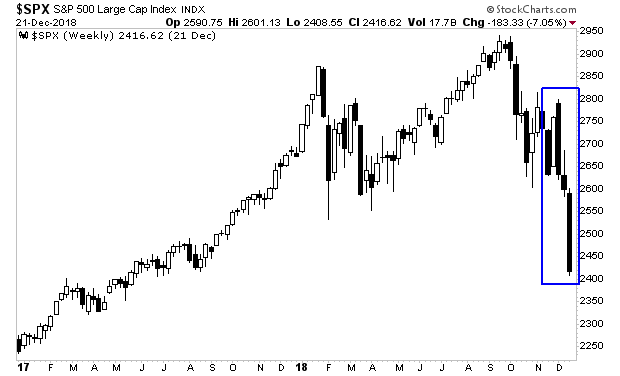

You can now see why this is a HUGE deal. The entire financial system will now need to reprice based on this different rate of return. The last time we saw this occur was in 2018. That’s when stocks did this:

Put simply, another collapse is coming. It might not be today or Monday… but it’s coming.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html