By Graham Summers, MBA

Yesterday’s market action could not have illustrated the current market rotation any better.

As I recently outlined:

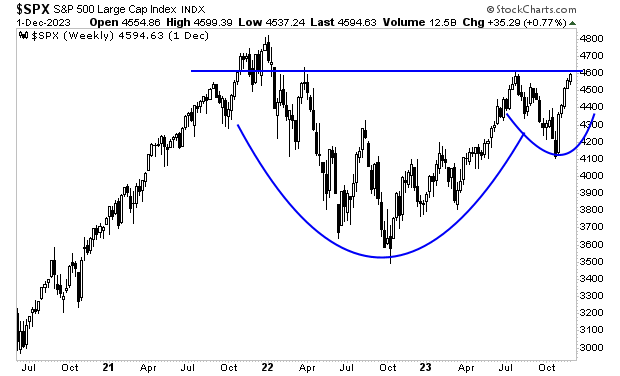

1) The S&P 500 is currently consolidating after one of its best monthly performances in 30 years.

2) This consolidation has consisted of large tech correcting while laggard sectors and indices (small caps/ the Russell 2000, industrials/ the Dow Jones Industrial Average) catch a bid.

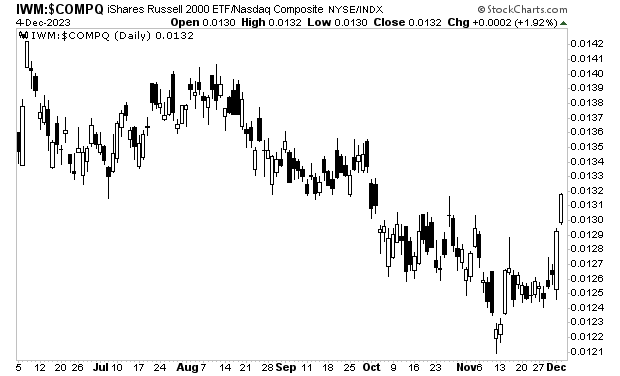

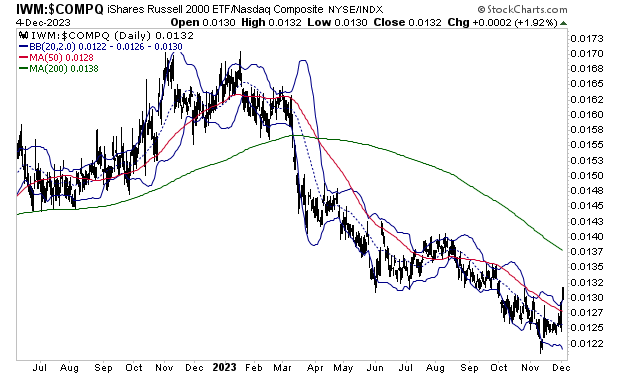

Yesterday’s price action illustrated this perfectly: microcaps (the Russell 2000) caught a major bid relative to tech (the NASDAQ) as the Russell 2000 ROSE over 1% while the NASDAQ fell nearly 0.9%.

If you heeded yesterday’s missive you did quite well! Again, you CAN outperform the overall market, but it takes a lot of work and insight!

This trend is likely to play out over the next two weeks until the Russell 2000/ NASDAQ ratio reaches its 200-day moving average (DMA) sometime around the Fed’s next FOMC (December 12th-13th).

At that point the overall market should complete its consolidation/ correction and begin its next leg up. I’ve said previously that the S&P 500 will hit 5,000 sometime in the 1Q24. The setup is clear in the longer-term Cup and Handle formation.

For more market insights and analysis, join our free daily market commentary Gains Pains & Capital. You’ll immediately start receiving our Chief Market Strategist Graham Summers, MBA’s briefings to your inbox every morning before the market’s open.

And if you sign up today, you’ll also receive a special investment report How to Time a Market Bottom that the market set-up that has caught the bottoms after the Tech Crash, Housing Bust, and even the 2020 pandemic lows.Even more importantly, you’ll find out what this trigger says about the market today!This report usually costs $249, but if you join Gains Pains & Capital today, you’ll receive your copy for FREE.To do so…https://phoenixcapitalmarketing.com/TMB.html