The Fed has a HUGE problem on its hands.

Fed officials are well aware that stocks have become totally disconnected from reality. However, they cannot simply come out and discuss ending stimulus efforts outright because it would cause a market collapse. Remember, the single most important role for the Fed post-2008 is to maintain confidence in the system. So they cannot risk any explicit statement that they will be pulling the punchbowl.

Consequently, Fed officials have begun a careful process of managing down expectations regarding future stimulus.

Federal Reserve Bank of St. Louis President James Bullard gave remarks Thursday on “U.S. Monetary Policy: Easier Than You Think It Is,” at a special banking forum sponsored by Mississippi State University’s Department of Finance and Economics.

Bullard discussed four considerations for QE3 going forward. First, while substantial labor market improvement is a condition for ending the program, Bullard said that “the Committee could consider many different aspects of labor market performance when evaluating whether there has been ‘substantial improvement.’” These include the unemployment rate, employment, hours worked, and Job Openings and Labor Turnover Survey (JOLTS) data.

Second, “Without an end date, the Committee may have to alter the pace of purchases as news arrives concerning U.S. macroeconomic performance,” Bullard said, noting that “substantial labor market improvement” does not arrive suddenly. “This suggests that as labor markets improve somewhat, the pace of asset purchases could be reduced somewhat, but not ended altogether,” he explained. “This type of policy would send important signals to the private sector concerning the Committee’s judgment on the amount of progress made to that point.”

A third consideration for the QE program is inflation and inflation expectations, Bullard said. Current readings on inflation are rather low, which he said may give the FOMC some leeway to continue asset purchases for longer than otherwise. Although worries about rising inflation have so far been unfounded, “the lesson from QE2 is that inflation and inflation expectations did trend higher,” he said, adding that it is too early to know if that will happen with the current QE program.

Finally, he said, “The size of the balance sheet could inhibit the Committee’s ability to exit appropriately from the current very expansive monetary policy.” He explained that when interest rates rise, asset values will fall, which could possibly complicate monetary policy decisions.

http://www.stlouisfed.org/newsroom/displayNews.cfm?article=1669

Note that Bullard, like the December Fed FOMC, mentions “inflation expectations.” The Fed cannot ever openly admit that inflation is a problem because doing so would inevitably lead to the realization that the Fed is in fact the primary cause of inflation in the financial system.

Consequently the Fed must use coded terms such as “inflation expectations” to discuss the presence of inflation (note that “inflation expectations” moves the blame for prices to investors who expect inflation as opposed to the Fed which has created inflation).

The fact that this phrase (inflation expectations) pops up in both Bullard’s speech and the Fed’s FOMC minutes indicates that the Fed is well aware that it is causing inflation to spiral out of control. This is a big reason why the Fed is beginning to manage down expectations of future stimulus.

Indeed, Bullard is not the only Fed official to be talking down QE.

Federal Reserve Bank of Cleveland President Sandra Pianalto said the gains from the Fed’s $85 billion in monthly bond purchase may fade.

“Over time, the benefits of our asset purchases may be diminishing,” Pianalto said today in a speech at Florida Gulf Coast University in Fort Myers, Florida.

“Given how low interest rates currently are, it is possible that future asset purchases will not ease financial conditions by as much as they have in the past,” she said. “It is also possible that easier financial conditions, to the extent they do occur, may not provide the same boost to the economy as they have in the past.”

Fed officials are debating how long they should continue their bond buying, designed to foster economic growth and reduce 7.9 percent unemployment. The Federal Open Market Committee last month kept the monthly purchase pace unchanged at $40 billion in mortgage-backed securities and $45 billion in Treasury purchases.

The central bank has said the purchases will continue until the labor market improves “substantially.”

http://www.bloomberg.com/news/2013-02-15/pianalto-says-benefits-of-fed-securities-purchases-may-wane.html

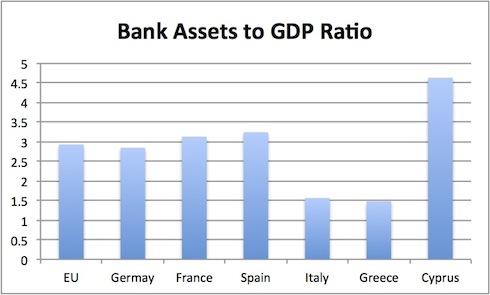

Inflation is on the rise in the financial system in a big way thanks to the Fed and other Central Banks’ money printing. However, the Fed has now realized that things are beginning to spiral out of control. As a result it is managing down expectations for further stimulus. This will not contain inflation in any real way. However, it will have a major impact on asset prices, particularly stocks which are now in a bubble, closing in on all-time highs despite earnings falling, the global economy rolling over, a banking crisis in Europe, a sovereign debt crisis in Europe, China slowing its liquidity injections and more.

This will end very badly. The Fed has set the stage for another Crash. And this time around its hands will be tied as it has used up all of its tools just creating this bubble.

THIS is the reason the Fed is beginning to shift its tone. It realizes it has blown another bubble and that we’re likely headed for another Crash. And this time around the Fed will be totally out of ammo to stop it. Unlike 2008 which was just a warm-up, this will be the REAL CRISIS featuring full-scale systemic failure.

So if you have not already taken steps to prepare for systemic failure, you NEED to do so NOW. We’re literally at most a few months, and very likely just a few weeks from the economy taking a massive downturn, potentially taking down the financial system with them. Think I’m joking? The Fed is pumping hundreds of BILLIONS of dollars into financial system right now trying to stop this from happening.

I’ve already alerted Private Wealth Advisory subscribers to 6 trades that will all produce HUGE profits as this mess collapses.

We’ve also taken steps to prepare our loved ones and personal finances for systemic risk with my Protect Your Family, Protect Your Savings, and Protect Your Portfolio Special Reports.

With a total of 20 pages, these reports outline:

1) how to prepare for bank holidays

2) which banks to avoid

3) how much bullion to own

4) how much cash is needed to get through systemic crises

5) how much food to stockpile, what kind to get, and where to get it

And more…

I can do the same for you. All you need to do is take out a subscription to my Private Wealth Advisory newsletter.

You’ll immediate be given access to the Private Wealth Advisory archives, including my Protect Your Family,Protect Your Savings, and Protect Your Portfolio reports.

You’ll also join my private client list in receive my bi-weekly market commentaries as well as my real time investment alerts, telling you exactly when to buy and sell an investment and what prices to pay.

So you get my hard hitting market insights, actionable investment recommendations, and real time trade alerts, for one full year, for just $299.99.

To take out an annual subscription to Private Wealth Advisory now and start taking steps to insure your loved ones and personal finances move through the coming storm safely…

Click Here Now!!!

Best Regards,

Graham Summers