Anyone who wants to get an inside look at both the European banking system and the politicians in charge of fixing it need to only look at Spain’s Bankia.

Bankia was formed in December 2010 by merging seven totally bankrupt Spanish cajas (regional banks that were unregulated). The bank was heralded as a success story and an indication that European Governments could manage the risks in their banking systems.

Indeed, in 2011, Bankia even reported a profit of €41 million. And in April 2012, it was proposing paying a dividend. Then, in the span of two weeks, the bank revised its 2011 profit to a €3.3 billion LOSS, requested a formal bailout from Spain, and had to be nationalized.

What’s striking about this sequence of events is that throughout it, Spain’s Prime Minister Mariano Rajoy was claiming that Spain’s banks were in great shape. Indeed, on May 28 2012, (after Bankia had already requested a €19 billion bailout, the single largest bailout in Spanish history), Rajoy stated , “there will be no rescue of the Spanish banking sector.”

Bear in mind, Spain itself was just days away from requesting outside aid from the EU.

The timeline says it all:

- May 9th: Bankia requests €4.5 billion loan, Spanish Government states that the bank is “solvent.”

- May 21st: Spain meets Bankia’s request for loan and takes a 45% stake in the bank thereby instigating a partial nationalization.

- May 23rd: Bankia’s bailout needs grows to €11 billion/ Rajoy retorts to France’s Hollande, “Hollande does not know the state of Spanish banks.”

- May 24th: Bankia’s bailout needs grow to €15 billion

- May 25th: Bankia’s bailout needs are now €19 billion (2011 profits revised to €4 billion loss)… the Spanish Bailout Fund has just €5 billion in cash.

- May 28th: Rajoy comments, “there will be no rescue of the Spanish banking sector.”

- Weekend of June 8-10th: Rajoy texts to his finance minister: “Aguanta, we are the fourth European power. Spain is not Uganda… If they want to force the rescue of Spain, they need to start getting ready €500 billion and another €750 billion for Italy, which will have to be rescued afterwards.”/ Spain informally asks for €100 billion bailout/ EU Finance Ministers OK the bailout.

- Sunday June 10th: Rajoy states that the bailout is a “victory” before commenting, “This year is going to be a bad one: Growth is going to be negative by 1.7 percent, and also unemployment is going to increase.”

Thus, in just one month’s time, Spain implements the largest bank nationalization in its history and requests €100 billion from the EU to recapitalize its banks. And yet, throughout this time, Spanish politicians maintain that Spain’s banking system is “solvent” or in great shape… right up until they get the €100 billion at which point the truth comes out: “This year is going to be a bad one.”

Also note that Rajoy sealed the deal and which he proclaimed a “triumph” (along with the above statement about 2012 being a bad year) before hopping a plane to watch Spain’s soccer team play Poland.

Fast forward to December 2012, and Bankia is again in the news, this time with Spain revealing that despite receiving the largest bailout in Spanish history, the bank still had a NEGATIVE value.

Bankia’s shareholders have received a nasty new year’s surprise. They may lose most of their investments or even all of them says the Spanish bank rescue fund in its latest report.

According to FROB, the Fund for Orderly Bank Restructuring, Bankia has a negative value of 4.2 billion euros, and its parent group BFA is 10.4 bn in the red.

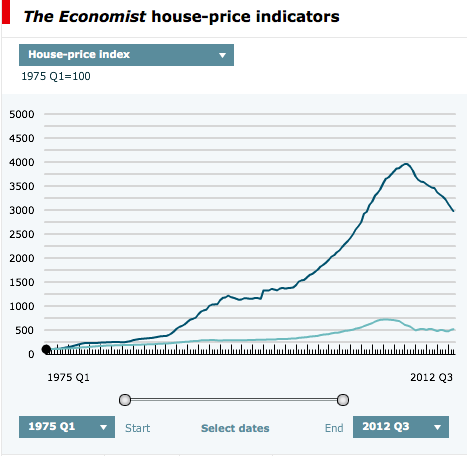

Valuation is key in the recapitalisation of Spain’s banking system, weighed down by massive bad loans accumulated in a property bubble that burst in 2008. Bankia/BFA is set to receive 18 bn euros of European aid, and become the country’s biggest bailout recipient.

http://www.euronews.com/2012/12/27/bankia-worthless-says-new-report/

At this point the following is obvious:

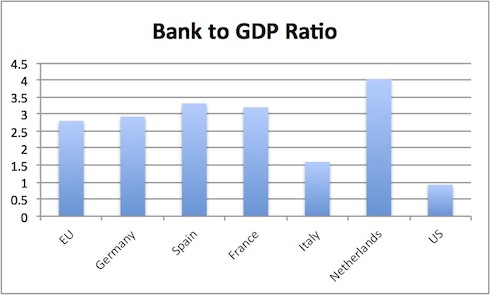

1) Europe’s banks are in far far worse shape than anyone publicly admits

2) The political class in Europe has no idea how to solve this mess

3) No one has quantified the bank’s actual losses or their capital needs

4) Everyone is lying about just about everything related to Europe’s financial system

You could honestly end the story here and know everything you need to about Europe. But then you’d be missing out on Bankia’s newest achievement: setting the record for corporate losses in Spanish history.

Nationalised Spanish lender Bankia is expected to reveal a €19bn loss next week, the largest in the country’s corporate history.

On Thursday Bankia will report full-year earnings, including a €12.6bn provision taken at the end of last year. The writedown is a result of the lender moving assets into Spain’s “bad bank” at heavy discounts.

Bankia, which is seen as a symbol of Spain’s financial woes, was created through the merger of seven smaller savings banks before being listed on Madrid’s stock exchange. When the company failed, hundreds of thousands of people who had been sold shares saw their savings wiped out. The collapse forced Spain to ask Europe for a bailout for its banking sector, which has meant the lender is subject to tight controls.

It’s a little known fact about the Spanish crisis is that when the Spanish Government merges troubled banks, it typically swaps out depositors’ savings for shares in the new bank.

So… when the newly formed bank goes bust, “poof” your savings are GONE. Not gone as in some Spanish version of the FDIC will eventually get you your money, but gone as in gone forever (see the above article for proof).

This is why Bankia’s collapse is so significant: in one move, former depositors at seven banks just lost virtually everything.

And this in a nutshell is Europe’s financial system today: a totally insolvent sewer of garbage debt, run by corrupt career politicians who have no clue how to fix it or their economies… and which results in a big fat ZERO for those who are nuts enough to invest in it.

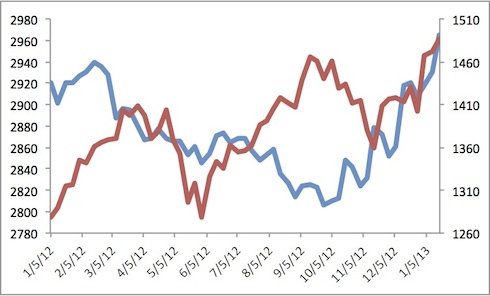

Be warned. There are many many more Bankias coming to light in the coming months. So if you have not already taken steps to prepare for systemic failure, you NEED to do so NOW. We’re literally at most a few months, and very likely just a few weeks from Europe’s banks imploding, potentially taking down the financial system with them. Think I’m joking? The Fed is pumping hundreds of BILLIONS of dollars into EU banks right now trying to stop this from happening.

I’ve already alerted Private Wealth Advisory subscribers to 6 trades that will all produce HUGE profits as this mess collapses all of them have soared this week. And I expect BIG GAINS in the coming months.

We’ve also taken steps to prepare our loved ones and personal finances for systemic risk with my Protect Your Family, Protect Your Savings, and Protect Your Portfolio Special Reports.

With a total of 20 pages, these reports outline:

1) how to prepare for bank holidays

2) which banks to avoid

3) how much bullion to own

4) how much cash is needed to get through systemic crises

5) how much food to stockpile, what kind to get, and where to get it

And more…

I can do the same for you. All you need to do is take out a subscription to my Private Wealth Advisory newsletter.

You’ll immediate be given access to the Private Wealth Advisory archives, including my Protect Your Family,Protect Your Savings, and Protect Your Portfolio reports.

You’ll also join my private client list in receive my bi-weekly market commentaries as well as my real time investment alerts, telling you exactly when to buy and sell an investment and what prices to pay.

So you get my hard hitting market insights, actionable investment recommendations, and real time trade alerts, for one full year, for just $299.99.

To take out an annual subscription to Private Wealth Advisory now and start taking steps to insure your loved ones and personal finances move through the coming storm safely…

Best Regards,

Graham Summers