The following is an excerpt from a recent issue of Private Wealth Advisory. We are reprinting it here because no one is addressing the real reason why Europe is such a huge problem for the financial system. You need to know this.

If you’ve looking for investment ideas on how to profit from this collapse (the gains will be even bigger than those produced during the 2008 Crash) Private Wealth Advisory can show you how. We already have a handful of EU Crisis Trades open, all of which are up.

To find out more about Private Wealth Advisory and how it can help you navigate the coming crisis… Click Here Now!!!

This is not going to be your usual investment newsletter.

This week I am going to devote this entire issue to explaining how the global financial system really works. Before we delve into things, I have to warn you in advance that what follows will be both extremely dense as well as extremely worrisome.

I am doing this because you need to know the real risks being posed to your wealth today. However, in order for you to understand this, you first need to understand how the financial system really works. Over 99% of people, including investment professionals do not understand what I am about to write. But I can assure you, that before this issue is done, everything that’s happened in the world since 2007 will make a lot more sense.

So let’s buckle up and get started.

Everything that has happened since 2007, every Central Bank move, ever major political decision regarding the big banks, every trend, have all been focused solely on one issue.

That issue is collateral.

What is collateral?

Collateral is an underlying asset that is pledged when a party enters into a financial arrangement. It is essentially a promise that should things go awry, you have some “thing” that is of value, which the other party can get access to in order to compensate them for their losses.

You no doubt are familiar with this concept on a personal level: any time you take out a bank loan the bank wants something pledged as collateral should you fail to pay the money back. In the case of property, the property itself is usually the collateral posted on the mortgage. So if you fail to pay your mortage, the bank can seize the home and sell it to recoup the losses on the mortgage loan (at least in theory).

In this sense, collateral is a kind of “insurance” for any financial transaction; it is a way that the parties involved mitigate the risk of their deal not working out.

As many of you know, our entire global financial system is based on leverage or borrowed money. Collateral is what allows this to work. Without collateral, there is no borrowed money. And without borrowed money, money does not enter the financial system.

In this sense, collateral is the “reality” underlying the “imaginary” or “borrowed” component of leverage: the asset is real and can be used to back-stop a proposed deal/ trade that has yet to come to fruition.

On a consumer level, our bank deposits (cash), homes, and other assets are the collateral pledged when we borrow money from a bank to finance something. This applies to everyone in the US all the way up to the multi-billionaire bracket.

How Larry Ellison Actually Funds His Lavish Lifestyle

One of the mysteries surrounding Larry Ellison is how he can afford so many mansions, islands, yachts and planes, all while retaining his shares in his company.

Yes, the Oracle CEO is one of the richest men in the world, worth over $30 billion. Yet he sells only small amounts of stock under a schedule stock-sale plan. And last I checked, yacht builders don’t take Oracle stock for payment.

Now we have some clues as to how Ellison funds his acquisitive lifestyle.

According to Oracle’s proxy, filed this month, Ellison has pledged 139 million shares “as collateral to secure certain personal indebtedness, including various lines of credit.” In other words, he’s got over $4.2 billion worth of stock pledged for personal loans.

http://www.cnbc.com/id/49194482/How_Larry_Ellison_Actually_Funds_His_Lavish_Lifestyle

On a corporate level, companies pledge various assets as collateral for their corporate loans. For manufacturing firms, this might be the actual steel inventory they own. For property companies, it’s portions of their real estate portfolios.

And for financial firms, at the top of the corporate food chain, it’s sovereign bonds.

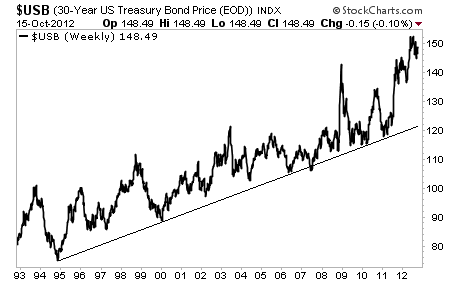

Modern financial theory dictates that sovereign bonds are the most “risk free” assets in the financial system (equity, municipal bond, corporate bonds, and the like are all below sovereign bonds in terms of risk profile). The reason for this is because it is far more likely for a company to go belly up than a country.

Because of this, the entire Western financial system has sovereign bonds (US Treasuries, German Bunds, Japanese sovereign bonds, etc) as the senior most asset pledged as collateral for hundreds of trillions of Dollars worth of trades.

The “hundreds” of trillions of Dollars of trades stems from a 2004 SEC ruling in which the SEC ruled that broker-dealers with capital bases above $5 billion (think Goldman, JP Morgan, etc) could increase their leverage above previously required levels while also abandoning market to market valuation methods (a methodology through which a security was priced at the value that a market participant would pay for it).

So, after the 2004 ruling, large broker dealers were permitted to increase their leverage levels dramatically. And because they could value their trades at whatever price their in-house models chose (what are the odds that these models were conservative?), the broker-dealers and large Wall Street banks are now sitting on over $700 trillion worth of derivatives trades.

Now, every large bank/ broker dealer knows that the other banks/dealers are overstating the value of their securities. As a result, these derivatives trades, like all financial instruments, require collateral to be pledged to insure that if the trades blow up, the other party has access to some asset to compensate it for the loss.

As a result, the ultimate backstop for the $700+ trillion derivatives market today is sovereign bonds.

When you realize this, the entire picture for the Central Banks’ actions over the last five years becomes clear: every move has been about accomplishing one of two things:

1) Giving the over-leveraged banks access to cash for immediate funding needs (QE 1, QE 2, LTRO 1, LTRO 2, etc)

2) Giving the banks a chance to swap out low grade collateral (Mortgage Backed Securities and other crap debts) for cash that they could use to purchase higher grade collateral (QE 1’s MBS component, Operation Twist 2 which lets bank their long-term Treasuries and buy short-term Treasuries, QE 3, etc).

By way of example, let’s first consider Greece.

Lost amidst the hub-bub about austerity measures and Debt to GDP ratio for Greece is the real issue that concerns the EU banks and the EU regulators: what happens to the trades that are backstopped by Greece sovereign bonds?

Remember:

1) Before the second Greek bailout, the ECB swapped out all of its Greek sovereign bonds for new bonds that would not take a haircut.

2) Some 80% of the bailout money went to EU banks that were Greek bondholders, not the Greek economy.

Regarding #1, the ECB had just permitted EU nations to dump over €1 trillion worth of sovereign bonds onto its balance sheet in exchange for immediate financing needs via its LTRO 1 and LTRO 2 schemes dated December 2011 and February 2012.

So, when the ECB swapped out its Greek bonds for new bonds that would not take a haircut during the second bailout, the ECB was making sure that the Greek bonds on its balance sheet remained untouchable and as a result could still stand as high grade collateral for the banks that had lent them to the ECB.

So the ECB effectively allowed those banks that had dumped Greek sovereign bonds onto its balance sheet to avoid taking a loss… and not having to put up new collateral on their trade portfolios.

Which brings us to the other issue surrounding the second Greek bailout: the fact that 80% of the money went to EU banks that were Greek bondholders instead of the Greek economy.

Here again, the issue was about giving money to the banks that were using Greek bonds as collateral, to insure that they had enough capital on hand.

Piecing this together, it’s clear that the Greek situation actually had nothing to do with helping Greece. Forget about Greece’s debt issues, or protests, or even the political decisions… the real story was that the bailouts were all about insuring that the EU banks that were using Greek bonds as collateral were kept whole by any means possible.

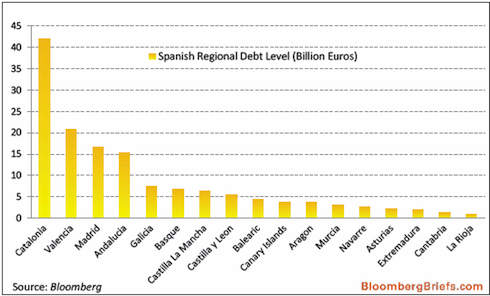

Now, Greece was always the small player in this mess. It’s entire sovereign bond market is a mere €300 billion.

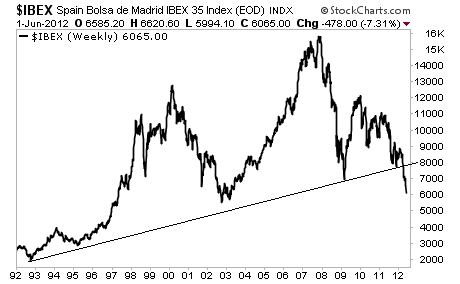

Spain and Italy, by comparison, have €1.78 trillion and €1.87 trillion in external debt respectively.

I do not have an exact figure for how much of the derivatives market uses Spanish and Italian sovereign bonds as collateral, but I can create an estimate using the US bank data I have available.

In the US, we know that the top four banks have over $222 trillion in derivatives exposure with just $7 trillion in total assets. So the leverage here is roughly 31 to 1.

Using this as a ballpark estimate for derivatives leverage, it is very possible that Spain and Italy’s sovereign bonds are pledged as collateral for well over $100 trillion worth of derivatives trades ($1.78 trillion X 31 + $1.87 trillion X 31).

This is why Spain is dragging its feet about asking for a bailout: the mess of trying to sort out the collateral issues for €1.78 trillion in collateral that is backstopping what is likely tens of TRILLIONS of Euros’ worth of trades is capable of causing systemic failure.

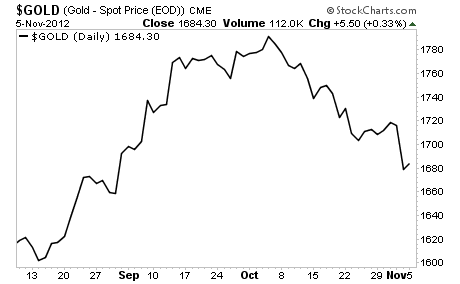

This is why I’ve been warning that 2008 was just the warm-up. What is coming will be far far worse.

If you’re looking for someone who can help you navigate and even profit from this mess, I’m your man. My clients made money in 2008. And we’ve been playing the Euro Crisis to perfection, with our portfolio returning 34% between July 31 2011 and July 31 2012 (compared to a 2% return for the S&P 500).

Indeed, during that entire time we saw 73 winning trades and only one single loser. We’re now positioning ourselves for the next round of the Crisis with several targeted investments that will explode higher as the EU crumbles. Already three of our picks are up more than 5% in the last week.

To find out what they are, and take steps to protect your portfolio from the inevitable collapse…

Click Here Now!

Graham Summers