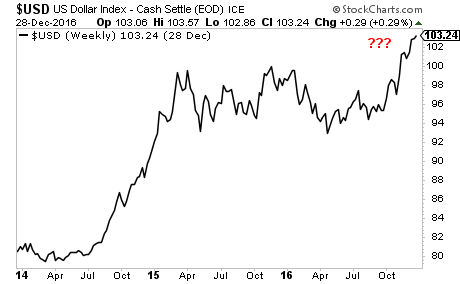

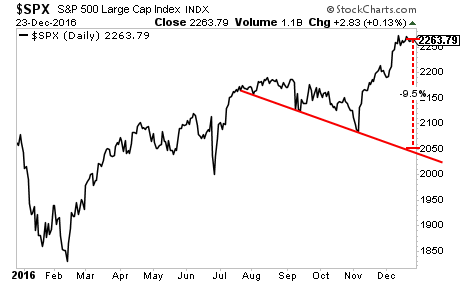

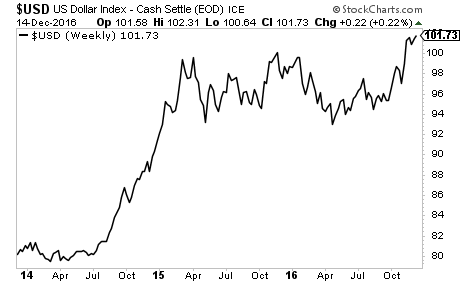

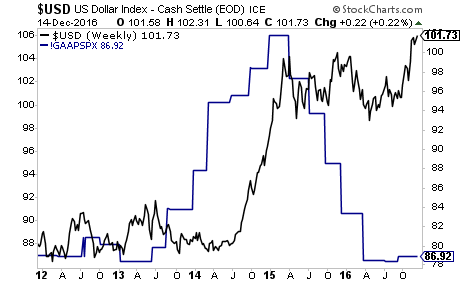

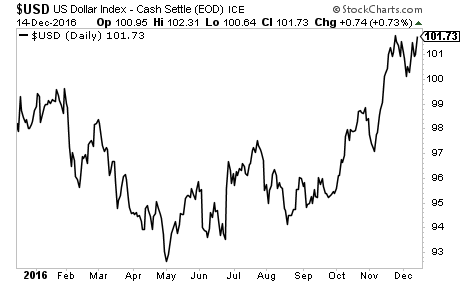

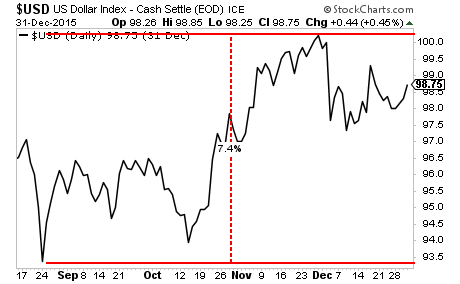

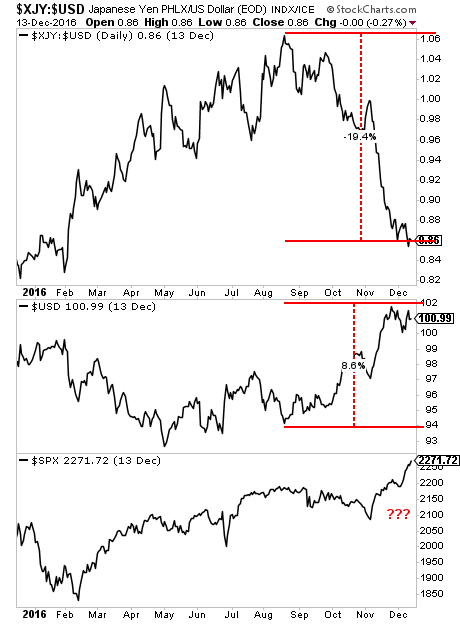

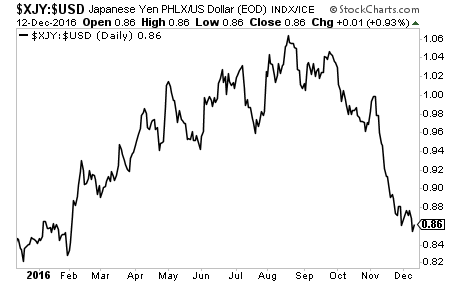

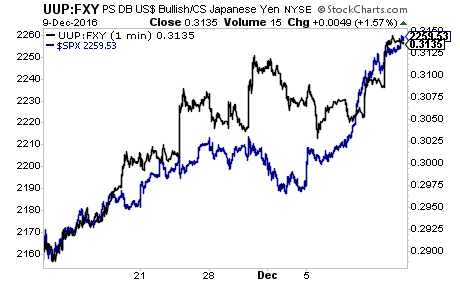

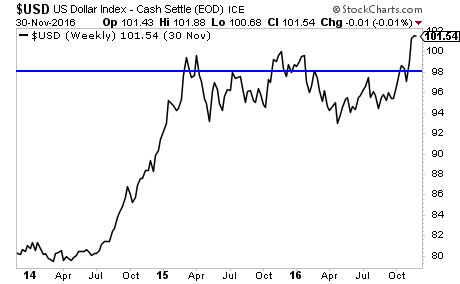

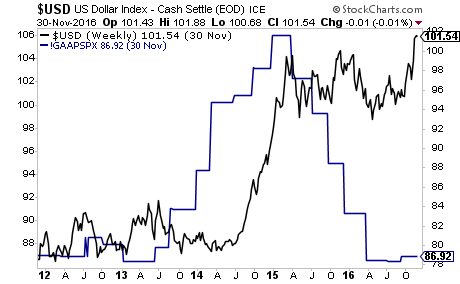

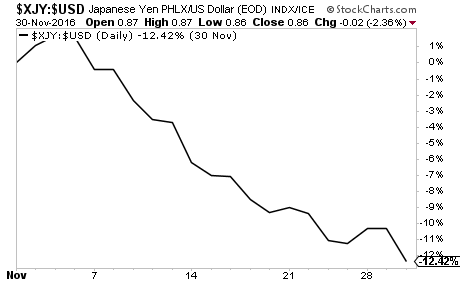

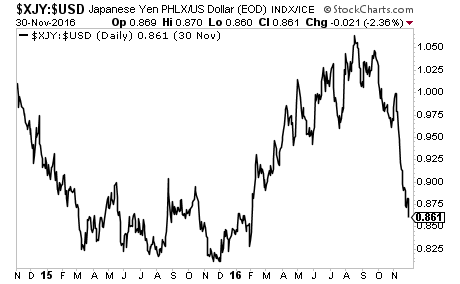

The momentum driven post election rally has ended. Next up is the US Dollar driven collapse in the markets.

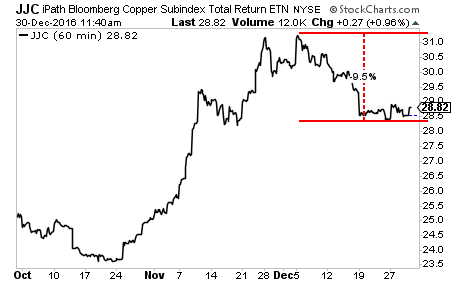

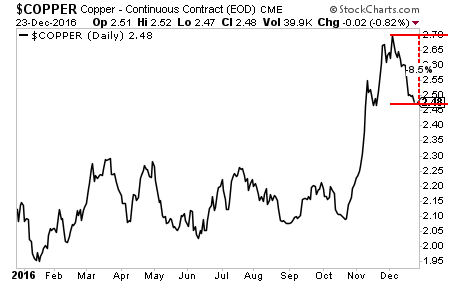

Copper called this weeks ago as we noted before. No one listed. It’s now down nearly 10% from its peak and clinging to support for dear life.

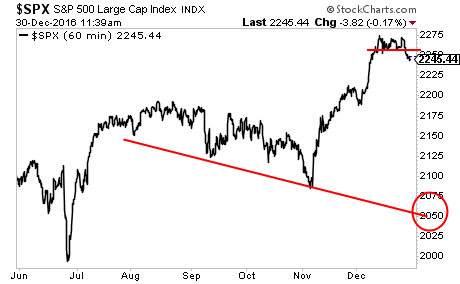

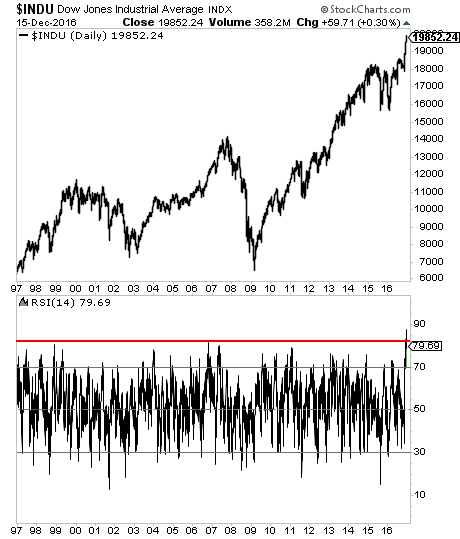

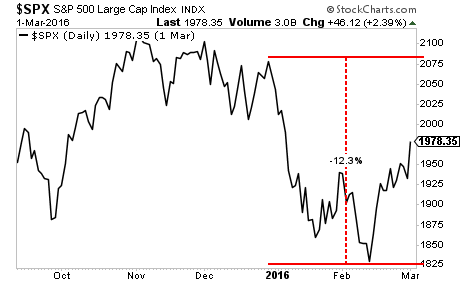

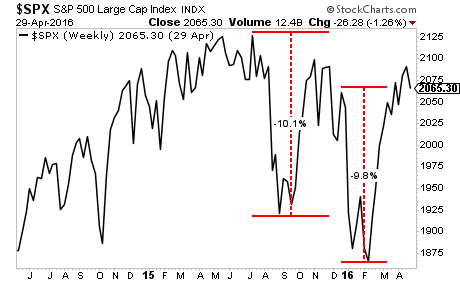

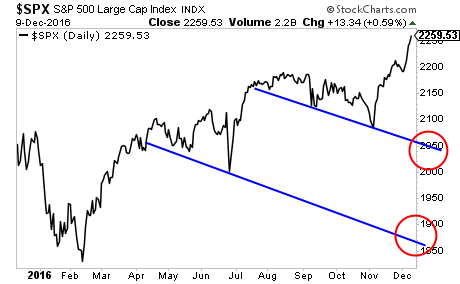

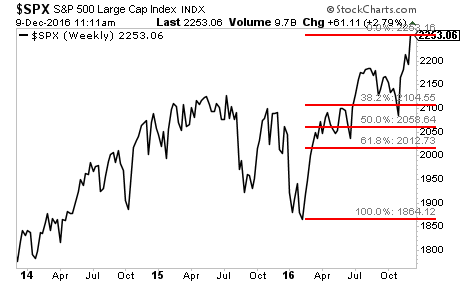

Stocks are now following. They’ve taken out support. The bulls will claim we’re going to hold at 2,200, but the reality is we’re going to unwind the entire election move and then some. 2,050 beckons.

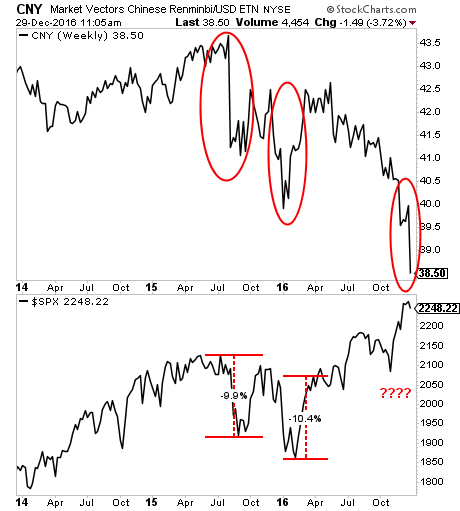

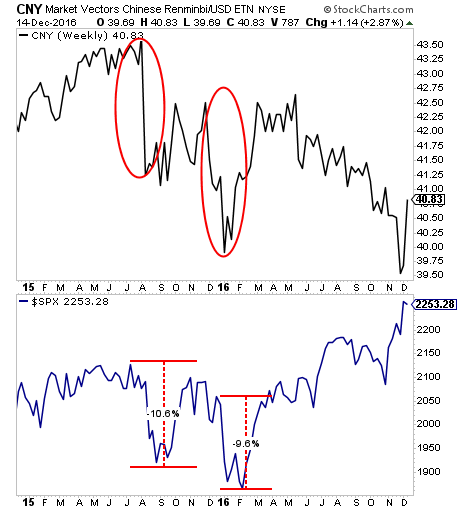

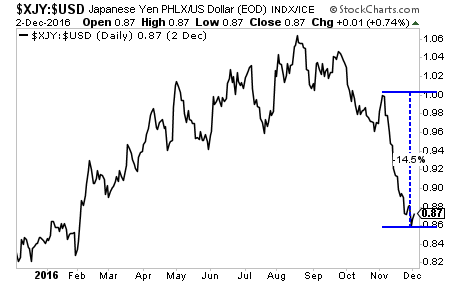

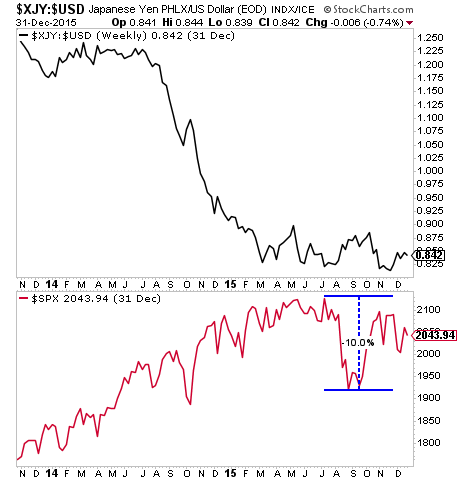

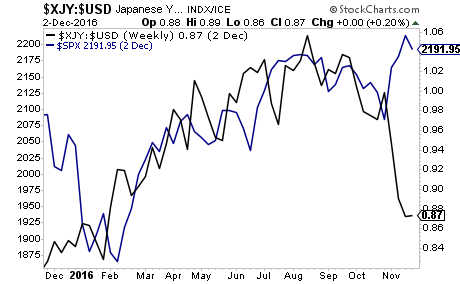

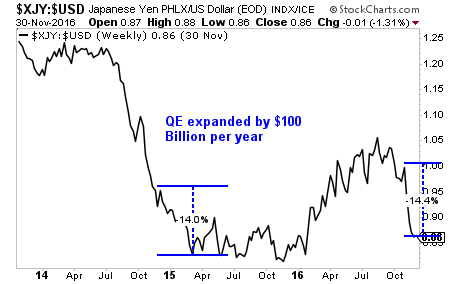

Indeed, stocks will be lucky if they don’t crash like they did in August ’15 based on what China’s doing with the Yuan.

While 99% of investors ignore this ticking time bomb, smart investors are already preparing.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Prepare and Profit From the Next Financial Crisis that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/Prepare1.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research